India is betting big on its climate transition—renewables, electric mobility, regenerative agriculture, circular economy systems, and climate-smart supply chains.

But there’s a silent bottleneck that almost every sector runs into: the cost of credit.

The panel discussion on blended finance made this painfully clear.

Whether the topic was textile circularity, climate-smart agriculture, green MSMEs, or smallholder livelihoods, everyone kept coming back to the same point:

“Capital exists. But the cost of that capital—and the risk allocation—are completely misaligned with India’s climate goals.”

This blog unpacks the problem in detail:

- Why access to credit is still broken for farmers, agri-startups, and MSMEs

- Why NBFCs face structural cost disadvantages

- Why banks hesitate—even with guarantees

- Why India needs a climate credit architecture that spreads risk fairly

- What blended finance can do (and cannot do)

- How to build a functioning system over the next decade

Let’s start with the basics.

1. India’s Climate Ambitions Clash With Its Credit Reality

India needs around USD 170 billion every year for climate action.

Actual flows? Roughly USD 44 billion.

This gap isn’t due to lack of interest from investors.

It’s because climate-positive activities—like green machinery adoption, regenerative practices, circularity projects, decarbonizing MSMEs—are stuck in an outdated credit ecosystem.

1.1 Farmers still rely on informal moneylenders

Despite heavy government intervention, a large share of India’s smallholder farmers continue to borrow from:

- local arhtiyas

- traders

- input retailers

- village moneylenders

Interest rates often exceed 36–60% annually.

The formal credit penetration problem still hasn’t been solved, partly because:

- Banks consider smallholder agriculture “high risk”

- Paperwork is heavy

- Land ownership is fragmented

- Banks cannot verify real repayment capacity

- Field monitoring is expensive

This pushes farmers into a debt cycle that directly blocks climate transition investments—like solar pumps, precision irrigation, climate-smart inputs, low-emission machinery, or improved rice practices.

1.2 NBFCs lend at double-digit rates because their own cost of capital is high

NBFCs are the real last-mile lenders in rural India.

They do the hard work banks won’t do:

- On-ground verification

- Lending without collateral

- Serving remote villages

- Building trust with farmer groups

But NBFCs themselves borrow at 11–16%, sometimes higher.

By the time they:

- cover OPEX

- cover NPAs

- add a risk margin

…the interest rate to a farmer or FPO often becomes 18–24%.

This is not greed.

It is pure math.

The panel discussion nailed the point:

“If we solve the cost of capital for the lender, we automatically reduce the rates for the borrower.”

But India does not yet have a system that lowers cost of capital for climate-positive NBFCs.

1.3 Banks meet priority sector norms on paper, not on quality

Banks must lend 18% to agriculture.

But most of this is:

- safe, collateral-backed lending

- indirect lending to NBFCs

- big-ticket corporate agri loans

- gold loans counted under agriculture

The capital hardly reaches high-risk, high-impact segments:

- tenant farmers

- rainfed regions

- transitioning MSMEs

- climate-smart practices

- regenerative agriculture

- circular farming models

This is why India’s climate credit architecture needs a redesign—not a patchwork fix.

2. Why India’s Credit Transmission Fails (Even When Money Is Available)

Even when concessional money exists—grants, guarantees, DFIs—lenders rarely pass the benefits down to borrowers.

Reason 1: Risk is not correctly priced

A guarantee does not change:

- repayment behavior

- weather risk

- commodity cycles

- market linkage volatility

- quality of borrower information

So lenders continue to behave cautiously—sometimes overly so.

Reason 2: Regulatory rules restrict structuring flexibility

The panel was blunt:

“You basically cannot do blended finance in India under current regulations.”

Why?

- SEBI constraints on tranching

- FEMA rules on concessional lending

- FCRA restrictions on NGO capital flows

- Grey zones around guarantees

- Tight rules around preferred distribution

Result?

Capital cannot be creatively structured where it is most needed.

Reason 3: Banks want total security—even with guarantees

Banks routinely ask for:

- 100% guarantee

- collateral

- personal guarantees

- additional guarantee fees

That defeats the purpose.

The moment the guarantee program ends, banks exit the sector.

Reason 4: Technical Assistance (TA) does not change lender behavior

TA is valuable, but insufficient.

Training a credit officer on “climate-smart lending” does nothing unless:

- incentives change

- risk sharing improves

- monitoring is affordable

- repayments are predictable

TA cannot override institutional DNA.

This is why India needs something more fundamental: a climate credit architecture that changes risk economics at the system level.

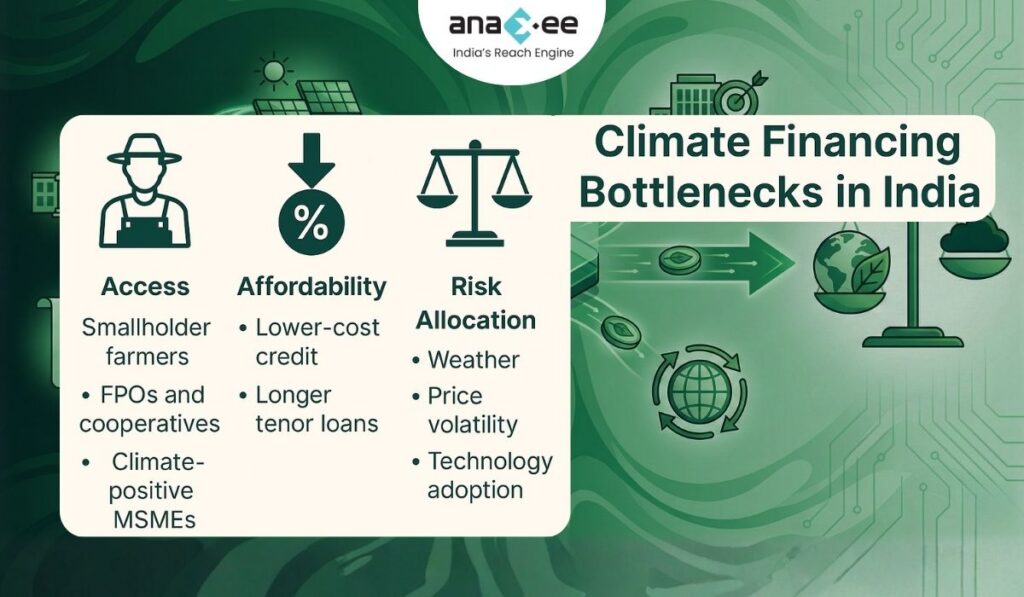

3. What India Needs: A Climate Credit Architecture that Fixes Three Things

India’s climate-finance bottleneck boils down to three issues:

- Access

- Affordability

- Risk allocation

Let’s break these down.

3.1 Access: Who can actually borrow?

A functioning climate credit architecture must widen access for:

A. Smallholder farmers

With solutions like:

- low-cost working capital

- risk-shared loans

- micro-capex financing for pumps, power units, machinery

- credit for regenerative practices

- equipment leasing backed by guarantees

B. FPOs and cooperatives

They need:

- capex lines

- procurement financing

- post-harvest working capital

- risk mitigation tools

C. Climate-positive MSMEs

If India wants green supply chains, MSMEs need:

- financing for energy-efficient machinery

- pollution control upgrades

- renewable energy adoption

- waste-to-value systems

- alternative materials

Currently, these MSMEs face some of the worst credit access barriers.

3.2 Affordability: The interest rates must actually make sense

You cannot expect a farmer to adopt climate-smart practices with a 22% loan.

You cannot expect a mill to adopt new cellulose technology at 16% borrowing cost.

A national climate credit architecture must:

- lower wholesale cost of capital

- create a concessional layer for climate sectors

- pool philanthropic money to absorb risk

- create longer-tenor, patient debt products

- reward verified climate outcomes with interest rebates

Without affordability, the climate transition will remain an elite exercise.

3.3 Risk Allocation: Spread risk to those best able to handle it

Climate lending involves multiple types of risk:

- weather

- price volatility

- technology adoption

- aggregation failures

- tenant farming dynamics

- repayment uncertainty

- small-ticket economics

Lenders cannot carry all of this alone.

Philanthropies cannot carry everything either.

Governments shouldn’t over-guarantee without monitoring.

A functioning architecture distributes risk rationally:

- Farmers carry behavior risk

- Lenders carry credit risk

- Philanthropies carry early-stage risk

- Government carries systemic risk

- Outcome-based mechanisms carry performance risk

This balance is missing today.

4. Why Blended Finance Is Part of the Solution (But Only If Designed Correctly)

Blended finance is not a magic wand.

The panelists repeatedly warned against overselling it.

But used correctly, it can:

- unlock private lending

- reduce cost of capital

- derisk new business models

- give lenders confidence to enter new sectors

- fund early-stage innovations

- convert pilots into investable assets

However, three conditions must be met.

4.1 Condition 1: It must not subsidize doomed projects

Philanthropic money should not become “good money thrown after bad.”

It should:

- accelerate viable enterprises

- unlock market failures

- reduce technology or adoption risk

- help enterprises reach investability

Upaya’s textile recycling case is the example to emulate.

4.2 Condition 2: It must be standardized, not bespoke every time

India cannot scale blended finance if:

- every deal is handcrafted

- structuring costs exceed ticket sizes

- legal complexity kills speed

India needs:

- standardized, approved templates

- a national guarantee facility

- a uniform KPI measurement system

- pre-validated outcome-based financing models

This is how scale happens—not by inventing a new model for every borrower.

4.3 Condition 3: It must eventually exit

The panel got this right:

Blended finance should be a bridge, not a permanent crutch.

Its purpose is to:

- Prove viability

- Reduce early-stage uncertainty

- Attract commercial lenders

- Exit when the asset class is mature

Unfortunately, today most blended-finance initiatives in India remain stuck in pilot phase.

A national climate credit architecture would fix that.

5. What a Climate Credit Architecture for India Could Look Like

Here’s a concrete, practical, implementable architecture.

5.1 Component 1: Climate Guarantee Facility (CGF-India)

A government-backed guarantee pool that:

- shares first-loss risk for climate loans

- covers 15–30% of the principal

- supports NBFCs, small banks, and FPOs

- does not demand collateral from borrowers

- repays lenders on time (unlike past state guarantees)

Think of it as a CGTMSE for green lending, but with clearer rules and climate KPIs.

5.2 Component 2: Climate Concessional Debt Window

A pooled fund from:

- philanthropies

- multilaterals

- green investors

This fund provides:

- low-cost wholesale credit to NBFCs

- interest-rate buy-downs

- climate-linked interest rebates

The condition:

NBFCs must pass lower rates to end borrowers.

5.3 Component 3: Outcome-Based Incentives

Borrowers (farmers, MSMEs, mills) receive:

- interest rate rebates

- top-up payments

- performance-linked reductions

…but only when climate KPIs are independently verified.

This aligns incentives properly.

5.4 Component 4: Digital MRV Infrastructure

Without reliable measurement, none of this works.

India needs:

- geotagged farm data

- automated monitoring

- clean supply chain traceability

- emissions calculators

- verified outcome certificates

This is where Anaxee’s Climate Infrastructure (dMRV, last-mile workforce, QA/QC, dashboards) becomes central.

5.5 Component 5: A Green MSME Upgrade Line

Since MSMEs account for:

- 30% of emissions in key supply chains

- majority of energy inefficiencies

- most of the machinery that needs upgrading

India needs a dedicated:

- green machinery loan

- with blended risk cover

- subsidized interest

- rapid digital underwriting

- pre-approved vendor lists

This solves the MSME credit block in one shot.

6. How This Architecture Will Fix the Credit Bottleneck

Let’s connect the dots.

6.1 Farmers get cheaper loans and better practices

With guarantees and concessional wholesale capital:

- NBFCs reduce rates

- farmers get affordable loans

- adoption of climate-smart agri scales

- repayment improves (lower stress)

Everyone wins.

6.2 MSMEs become bankable

Green MSMEs today are excluded due to:

- outdated technology

- limited collateral

- unpredictable cash flows

With risk-sharing + concessional capital:

- lenders enter the segment

- emissions-intensive clusters modernize

- supply chain compliance improves

- export competitiveness rises

6.3 Lenders feel protected, not exposed

Banks and NBFCs get:

- partial guarantee

- verified outcomes

- lower risk weights

- standardized underwriting

- predictable recoveries

This changes the economics of rural and climate lending.

6.4 Philanthropies fund leverage, not subsidy

Instead of giving grants that disappear, philanthropies:

- crowd-in commercial capital

- derisk high-impact markets

- support only catalytic segments

- measure impact transparently

This is smarter philanthropy.

6.5 The government does not carry all the burden

Government’s role becomes:

- providing systemic risk cover

- setting clear rules

- enabling climate finance markets

Not trying to do everything itself.

7. Roadmap: How India Can Build This System in 5–8 Years

Breaking it down into practical phases.

Phase 1 (0–12 months): Foundation

- Create a regulatory sandbox

- Set up a Climate Credit Task Force

- Standardize measurement protocols

- Pilot 3 blended finance models (agri, MSME, circularity)

Phase 2 (1–3 years): Scaling

- Launch the Climate Guarantee Facility

- Expand concessional wholesale credit

- Digitize monitoring across sectors

- Integrate outcome payments

Phase 3 (3–5 years): Mainstreaming

- Banks adopt green risk-adjusted underwriting

- NBFC ecosystem matures

- MSME green loan products become standard

- FPOs integrate into formal credit systems

Phase 4 (5–8 years): Maturity

- Commercial lenders dominate

- Concessional layers begin withdrawing

- Green outcomes become creditworthy signals

- Climate lending becomes a mainstream asset class

This is what a functioning climate credit architecture looks like—not a patchwork of pilots.

Conclusion: India Needs a System, Not More Pilot Projects

India’s climate transition cannot be financed by:

- high-interest rural loans

- fragmented NBFC cost structures

- bank hesitation

- slow-moving guarantees

- technical assistance without incentives

- regulatory restrictions on blended structures

It needs an architecture that gets three things right:

- Access

- Affordability

- Risk allocation

Once these pillars are in place, India can unlock:

- climate-smart agriculture at scale

- decarbonized MSMEs

- circular textile ecosystems

- resilient rural livelihoods

- new green industries

- a climate economy built on credit, not charity

The money exists.

The intent exists.

The risk appetite can be engineered.

What India needs now is the architecture that makes climate credit flow where it actually matters.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.