Artificial intelligence has finally crashed into the world of carbon markets.

On one side, there is huge excitement: faster MRV, better baselines, smarter risk assessment, and lower transaction costs. On the other side, there is a quiet fear: what if AI just automates bad assumptions faster?

Both feelings are valid.

Let’s strip away the hype and look at what actually matters: data integrity.

If that piece is weak, AI doesn’t fix anything. It just makes the mess more efficient.

1. Carbon Markets Are a Data Business (Most People Don’t Act Like It)

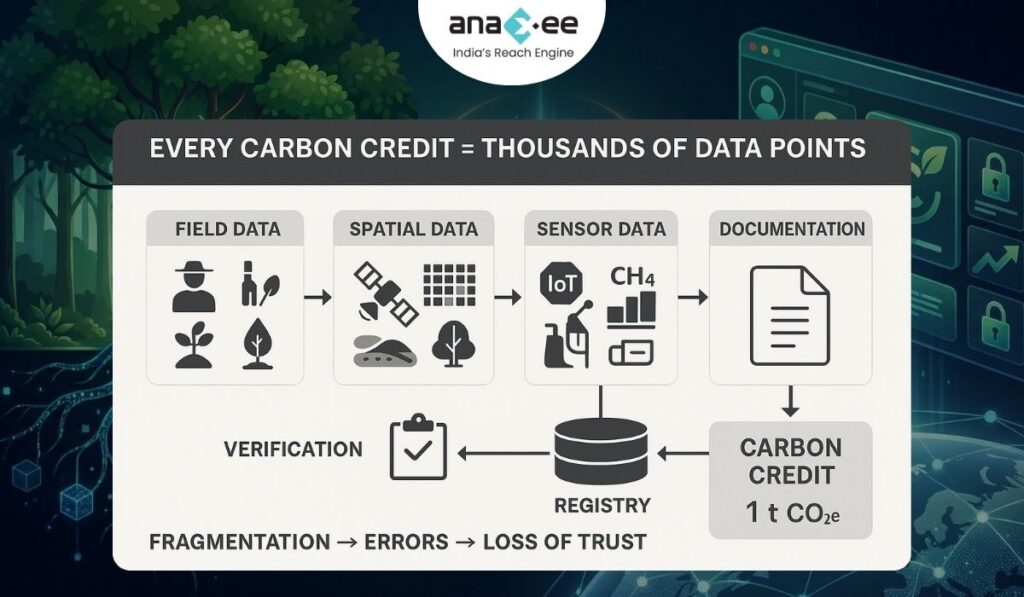

Everyone talks about “credits,” “offsets,” and “tons.” But every carbon credit rests on a chain of claims:

- How much carbon was emitted or removed?

- Compared to what baseline?

- Over what period?

- With what leakage?

- Verified by whom? Using what evidence?

Underneath all that are thousands of data points:

- Farmer-level surveys

- Forest inventories

- Satellite pixels

- Sensor readings

- Financial flows

- Activity logs

Right now, the reality is uncomfortable:

- Data is fragmented across PDFs, spreadsheets, registries, emails.

- Some data is self-reported with little independent verification.

- Field photos and measurements often sit in offline folders.

- Registries were never designed as AI-ready databases.

Into this chaos, we are now dropping AI tools and expecting clean, objective answers. That’s not how this works.

2. “AI is Only as Good as the Inputs” Is Not a Cliché Here – It’s a Warning

Companies like Carbon AI keep repeating the same point:

AI is only as strong as the data integrity behind it.

Why are they so obsessed with this?

Because in carbon markets, bad data is not an academic problem. It leads to:

- Overcrediting

- Double counting

- Misallocated finance

- Greenwashing accusations

- Reputational damage for everyone involved

AI increases the stakes. Once AI systems are embedded in MRV, baselines, and risk scoring, errors propagate faster and more widely.

Let’s break down the main risks.

3. The Dark Side: When AI Makes Things Worse

a) AI Hallucinations

Language models (like the ones used for document extraction or summarisation) are predictive systems, not “thinking machines.” They predict the next best word based on patterns in their training data.

If they hit gaps, they improvise. That “improvisation” can look very confident and very wrong.

In a carbon context, hallucinations could:

- Misread a key emission factor from a PDF

- Invent a missing baseline detail

- Misclassify a project type

- Summarise a risk in a misleading way

That’s not a theoretical risk. It’s already happening in many domains. Carbon is just a higher-stakes version of it.

b) Black Box AI

If a model spits out:

“Project quality score: 82/100”

and you cannot explain how it reached that number, the score is useless for serious decisions.

Regulators, auditors, and buyers need:

- Transparent inputs

- Traceable logic

- Clear assumptions

- Audit trails

“Black box” AI is fine for recommending movies. It’s not fine for allocating millions of dollars in climate finance.

c) Market Manipulation and Distorted Pricing

If models are trained on biased, incomplete, or outdated data, their outputs can:

- Overvalue weak projects

- Undervalue strong ones

- Misjudge geographic risks

- Misinterpret policy changes

Bad actors could also game AI-driven systems by feeding them misleading or selective data.

If AI becomes deeply embedded in marketplaces, these distortions could affect prices, liquidity, and even market trust.

d) Regulatory Lag

AI is moving faster than regulation.

That gap creates confusion:

- Which AI outputs are “evidence”?

- What counts as acceptable digital MRV?

- How much can be automated before an auditor must step in?

- Are AI-based baselines methodology-compliant?

Without clear standards, we risk fragmented interpretations across countries, registries, and buyers. That fragmentation itself is a risk.

4. So Why Bother With AI At All?

Because when the data foundation is strong, AI is the only realistic way to scale carbon markets without drowning in manual work.

Let’s be blunt:

We cannot get from millions of credits to billions of high-integrity credits using spreadsheets and PDF-heavy workflows.

AI is useful in three big ways:

- Speed – rapidly processing large volumes of data

- Pattern detection – catching things humans would miss or take months to see

- Consistency – applying the same logic across thousands of projects

The question is not “AI or no AI”.

The real question is: What kind of AI, built on what kind of data, under what kind of governance?

5. Where AI Is Already Adding Real Value

a) Digital MRV (Monitoring, Reporting, Verification)

AI can:

- Clean and harmonise field data

- Cross-check sensor readings

- Flag anomalies in satellite time series

- Auto-generate draft monitoring reports

This doesn’t eliminate auditors. It makes them more efficient and less dependent on messy, manual inputs.

b) Predictive Performance Modeling

Models are already being used to forecast:

- Tree growth and biomass

- Methane reduction in waste projects

- Fuel consumption shifts in cookstove programs

- Risk of reversal (fire, pest, encroachment)

For investors, this clarity reduces perceived risk and makes climate assets more “investable.”

c) Automated Document Understanding

A single PDD can run 200+ pages.

Now multiply that across 1,000+ projects.

AI helps by:

- Pulling out key values (EFs, FNRB, buffers, discount rates)

- Flagging inconsistent numbers

- Comparing methodologies and parameters across a portfolio

- Generating structured data tables from messy PDFs

Abatable, for example, uses OCR + vector search + LLMs to extract and organise project-level info. That kind of work would take humans days; AI cuts it to minutes.

d) News, Policy & Counterparty Risk

AI models can scan:

- News articles

- Policy updates

- ESG controversies

- Legal filings

…and highlight signals like:

- Political risk around a project country

- Litigation risk attached to a developer

- Sudden policy changes affecting baseline logic

Again, not a replacement for expert judgement, but a powerful filter.

6. Governance: What “Responsible AI” Actually Means in Carbon Markets

“Responsible AI” is a vague phrase until you spell it out.

In the context of carbon, it should mean:

- Explainable models – Inputs, assumptions, and logic are traceable.

- Role-based governance – Only authorised entities can push data into a project’s core record.

- Immutable traceability – Using hashing or ledger-like systems so records can’t be quietly altered.

- Human-in-the-loop – AI supports decision-makers; it never fully replaces them.

- Standardised data schemas – So data from different sources can be combined without guesswork.

In other words:

AI must be built on auditable, role-governed, traceable datasets, not on a random pile of registry PDFs and marketing decks.

7. The Hard Part No One Can Automate Away: Getting Good Primary Data

Everyone talks about satellites, models, APIs, and dashboards.

All of that is worthless if the primary data is weak.

You still need:

- Someone to verify that trees actually exist where polygons are drawn

- Someone to measure survival and spacing properly

- Someone to confirm land tenure

- Someone to talk to farmers and communities

- Someone to gather photographic evidence in a standardised way

AI cannot climb a bund, measure a tree, talk to a farmer, or negotiate community participation.

That’s the uncomfortable truth:

The future of AI in carbon markets depends on very old-fashioned, on-the-ground work.

8. Where Anaxee Fits In — Turning AI From Liability Into Asset

This is where Anaxee’s Tech for Climate model matters.

The industry is largely building top-down: satellites, fancy MRV tools, dashboards, AI analytics.

Anaxee works from the bottom up.

a) National-Scale Human Infrastructure

Anaxee has:

- A 125+ member internal climate and operations team

- A large network of local Digital Runners across India

They do the unglamorous, essential work:

- Farmer enrolment

- Geo-tagged plantation mapping

- Survival surveys

- Soil and practice data

- Activity logging (weeding, watering, thinning, harvesting)

This is the kind of primary data that AI systems desperately need but rarely get.

b) AI-Ready dMRV

Anaxee’s digital MRV stack focuses on:

- Standardised data formats

- GPS-tagged photos and surveys

- Time-stamped activity records

- Structured tree and plot data

This makes it easy for AI tools — whether from Planet, Pachama, Carbon AI, or others — to plug in and work with reliable ground truth.

c) Traceability and Transparency

With Anaxee:

- Every plantation is backed by verifiable evidence

- Every farmer interaction can be traced

- Data flows from field → app → database → dashboard

- Buyers see more than just “claims”; they see the underlying story with proof

That’s exactly what’s needed to avoid AI becoming just another black box.

d) Execution at Scale

AI can tell you:

- Where to plant

- What to plant

- How much impact is possible

But someone still has to:

- Procure seedlings

- Train farmers

- Supervise planting

- Monitor survival

- Fix failures

Anaxee specialises in that implementation layer, which most AI-native climate companies don’t touch.

Final Point: AI Won’t Save Carbon Markets. Good Data Will. AI Just Makes It Useful.

If the sector gets data integrity right — especially primary data and traceability — AI can help:

- Reduce verification time

- Increase investor confidence

- Allocate capital to real impact

- Detect fraud and weak claims early

If we get data wrong, AI will just accelerate distrust.

Anaxee’s proposition is simple:

We build the human and data foundation that makes AI in carbon markets actually work.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.