In Lubricants, the Product Rarely Loses — Execution Does

India’s automotive lubricants market is one of the most competitive categories in the aftermarket. Dozens of brands compete with similar formulations, overlapping price points, and near-identical claims.

Yet some brands scale consistently across districts, while others remain stuck in pockets—despite comparable products.

The difference isn’t chemistry.

It’s Go-To-Market execution at the retail and mechanic layer.

Lubricants are a habit-driven category. Once a mechanic or retailer trusts a brand, switching is rare. Which means early, disciplined retail execution matters more here than almost any other automotive category.

1. India’s Automotive Lubricants Market: What’s Really Changing

1.1 A Frequency-Driven Aftermarket

Unlike tyres or batteries, lubricants are:

- High-frequency purchases

- Strongly influenced by recommendations

- Sensitive to availability and margin, not brand recall alone

This makes lubricants retail-heavy and relationship-intensive.

1.2 Shift from Product Push to Portfolio Selling

Retailers and mechanics now expect:

- Clear product segmentation (2W, 3W, PV, CV, tractor)

- Faster-moving SKUs

- Training support, not just schemes

Brands that treat lubricants as a single SKU business are already behind.

1.3 EVs Are Changing the Narrative—but Not Yet the Volumes

While EVs reduce engine oil demand:

- ICE vehicles will dominate Indian roads for the next decade

- Hybrid servicing still needs fluids

- Workshops are expanding service portfolios, not shrinking them

The opportunity remains large—but only for brands that lock in retail behaviour early.

2. Why Lubricant Brands Struggle Despite Strong Demand

2.1 Distribution ≠ Retail Presence

Most lubricant companies measure success by:

- Distributor billing

- Scheme uptake

- Monthly volume targets

What they don’t see:

- Which retailers actually push the brand

- Which mechanics recommend competitors

- Where availability breaks down at taluka level

This creates false confidence at HQ.

2.2 Overcrowded Shelves, Under-managed Relationships

A typical lubricant retailer:

- Stocks 6–10 brands

- Pushes whichever brand offers better margin that week

- Switches recommendations easily

Without structured retail engagement, brand preference decays fast.

2.3 Sales Teams Spread Thin, Focused on Firefighting

Field sales teams spend time:

- Chasing outstanding payments

- Resolving stock issues

- Managing distributor friction

Very little time is spent on:

- New outlet discovery

- Mechanic engagement

- Portfolio education

3. Lubricants Are a Behavioural GTM Problem

Lubricant GTM is not about:

- One-time conversion

- Heavy ATL spending

- Aggressive trade schemes

It’s about:

- Repeated visibility

- Consistent engagement

- Behaviour shaping at the last mile

This is where a field-first, data-backed GTM model becomes critical.

4. The Field-First GTM Framework for Lubricant Brands

Step 1: Market Mapping — Discover Where Lubricants Are Actually Sold

Objective: Build the true lubricant retail universe.

This includes:

- Auto spare shops

- Multi-brand garages

- Service centres

- Highway workshops

- Rural mechanics

Each outlet is:

- GPS-tagged

- Classified by type

- Mapped district-wise

Reality check:

Most lubricant brands underestimate market size by 30–50% at district level.

Step 2: Retailer & Mechanic Profiling — Understand Influence, Not Just Volume

Profiling focuses on:

- Brands currently recommended

- Vehicle segments serviced

- Monthly oil change frequency

- Willingness to trial new SKUs

This enables:

- Targeted outreach

- Better scheme allocation

- Higher ROI per visit

Step 3: Structured Engagement & Conversion

Instead of random visits:

- Field teams follow a fixed cadence

- Conversations are tailored to outlet profile

- Orders and feedback are digitally tracked

Over time, this builds:

- Habit formation

- Brand stickiness

- Predictable offtake

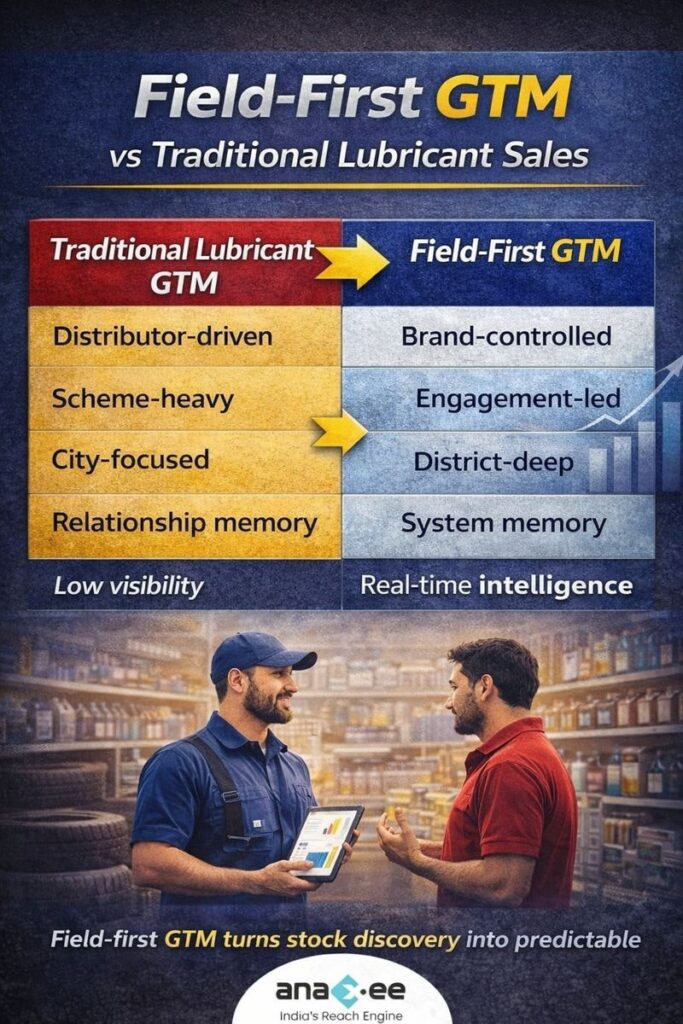

5. Why Traditional Lubricant GTM Models Break at Scale

| Traditional Lubricant GTM | Field-First GTM |

|---|---|

| Distributor-driven | Brand-controlled |

| Scheme-heavy | Engagement-led |

| City-focused | District-deep |

| Relationship memory | System memory |

| Low visibility | Real-time intelligence |

6. What CMOs, CEOs, and Sales Heads Should Care About

6.1 Behavioural Lock-In Beats Short-Term Volume

In lubricants, who recommends today controls tomorrow’s volume.

Field-first GTM helps brands:

- Identify influencers early

- Shape recommendations

- Defend share against price wars

6.2 Lower Churn, Higher Lifetime Value

Once a mechanic adopts a lubricant brand:

- Switching costs increase

- Repeat purchase stabilises

- Portfolio expansion becomes easier

6.3 GTM as an Asset, Not an Expense

With data-backed execution:

- Sales predictability improves

- Territory planning becomes scientific

- Expansion decisions stop being reactive

7. Growth Levers Lubricant Brands Must Pull by 2026

Winning lubricant brands will:

- Build district-level retail intelligence

- Invest in mechanic education, not just incentives

- Track recommendation behaviour, not just billing

- Treat GTM as infrastructure, not campaigns

Conclusion:

In Lubricants, Visibility Creates Preference — Preference Creates Volume

The Indian automotive lubricants market will remain crowded.

Margins will fluctuate.

Products will look increasingly similar.

The brands that win will not be the loudest—but the most present, consistent, and disciplined on the ground.

A field-first GTM strategy gives lubricant brands what they actually need:

- Control over retail behaviour

- Predictable growth

- Long-term defensibility

In a habit-driven category, execution is the real formulation.

Retail growth in India doesn’t fail because of demand—it fails because of poor reach, weak visibility, and zero ground intelligence.

Anaxee fixes this by putting tech-enabled feet-on-street across districts, mapping every retailer, profiling demand at SKU level, and converting data into orders.

We help brands move beyond distributor bias, uncover untapped shops, and generate uniform, predictable retail sales—district by district. Connect with us a sales@anaxee.com