For a long time, carbon action sat on the fringes of corporate decision-making. It lived in sustainability reports, annual disclosures, and carefully worded press releases—important, but rarely decisive. That era is over.

Today, decarbonisation is no longer a communications exercise. It is a performance issue, tied directly to cost structures, supply-chain resilience, regulatory exposure, and long-term competitiveness. As climate targets move off strategy decks and into delivery plans, companies are discovering a simple truth: internal emission reductions alone are not enough.

This is where carbon solutions—used correctly—become a strategic tool rather than a reputational risk.

Decarbonisation Has Moved From Intent to Execution

Across sectors, businesses are facing the same structural pressures. Energy price volatility is no longer episodic. Climate-linked disruptions—floods, heat stress, water scarcity—are now recurring operational risks. Regulators and investors are asking sharper questions, not just about ambition, but about how targets will be met year after year.

In response, many organisations have done the right first thing: measure their emissions and commit to reducing them. Energy efficiency upgrades, renewable procurement, supplier engagement, and product redesign are all essential. But even the most aggressive decarbonisation pathways leave residual emissions, especially in hard-to-abate areas like heavy industry, logistics, agriculture, and long-lived infrastructure.

Carbon solutions are not a detour from this work. They are a complement to it—one that allows companies to deliver measurable climate impact today while longer-term reductions and innovations are still underway Carbon_Markets_Buyers_Guide (1).

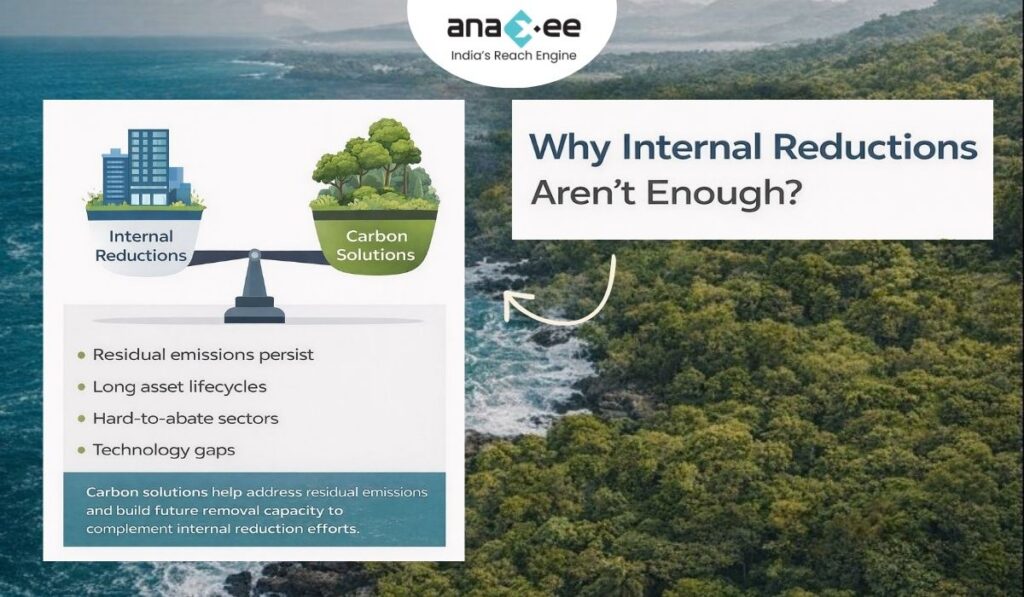

Why Internal Reductions Alone Don’t Solve the Problem

It is tempting to frame climate strategy as a simple hierarchy: reduce first, offset later. In theory, that is sound. In practice, it ignores the realities of how businesses operate.

Some emissions cannot be eliminated quickly without destabilising operations or supply chains. Others depend on technologies that are not yet commercially viable at scale. Waiting for a perfect future solution creates a dangerous gap between climate commitments and real-world impact.

High-quality carbon solutions help close that gap by addressing three challenges simultaneously:

- Residual emissions that remain despite best-effort reductions

- Timing mismatches between near-term climate impact and long-term transformation

- Systemic underinvestment in the natural and engineered systems required for net zero

Used with discipline, carbon credits do not replace internal action. They make credible action possible in the present.

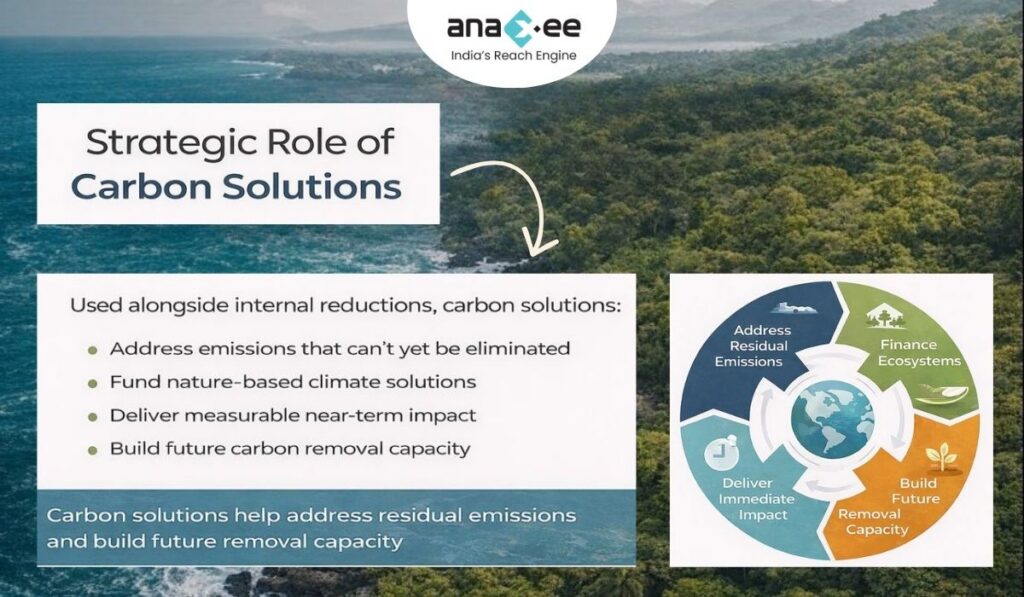

The Strategic Role of Carbon Solutions

When stripped of jargon, carbon solutions do four things for businesses.

First, they address emissions that cannot yet be eliminated. This is not an excuse for inaction; it is an acknowledgement of physical and economic constraints.

Second, they channel capital into natural systems the real economy depends on. Forests regulate water cycles and temperature. Wetlands buffer floods. Healthy soils underpin agricultural productivity. These benefits rarely appear on balance sheets, but their loss shows up quickly in operational risk.

Third, carbon solutions deliver immediate, verifiable climate impact. While product redesigns and supplier transitions take years, carbon finance can reduce or remove emissions now.

Fourth, they help build future removal capacity. Durable carbon removal—whether through nature-based systems or engineered solutions—requires early demand signals. Without committed buyers, these projects do not get financed, and future supply remains constrained.

Together, these functions make carbon solutions a strategic lever rather than a symbolic gesture Carbon_Markets_Buyers_Guide (1).

Understanding the Voluntary Carbon Market’s Real Purpose

The voluntary carbon market (VCM) has often been misunderstood. At its best, it is not about “neutralising guilt” or achieving simplistic carbon-neutral claims. Its core function is far more practical: directing private capital to activities that reduce or remove greenhouse gases while strengthening ecological and social systems.

Over the past decade, the VCM has matured significantly. Methodologies have tightened. Monitoring, reporting, and verification (MRV) has become more data-rich. Independent ratings agencies and integrity frameworks have emerged to provide additional scrutiny. Buyers, developers, investors, and standards bodies are converging on what “good” looks like.

This convergence matters. It means companies no longer need to navigate the market blindly. Clearer benchmarks around additionality, durability, safeguards, and transparency now exist—and ignoring them is increasingly difficult to justify.

Why Quality Matters More Than Ever

Not all carbon credits serve the same purpose. As the market has evolved, a clear split has emerged between lower-quality, price-driven credits and a higher-integrity tier that prioritises long-term climate value.

High-quality projects are characterised by:

- Demonstrable additionality

- Conservative accounting and frequent verification

- Strong community safeguards and grievance mechanisms

- Transparent data and long-term monitoring

- A clear approach to permanence and reversal risk

This “flight to quality” is not driven by idealism. It is driven by risk management. Poor-quality credits expose companies to reputational damage, regulatory scrutiny, and internal credibility loss. High-integrity credits, by contrast, align with emerging disclosure standards and investor expectations.

Increasingly, companies are choosing to retire fewer tonnes at higher quality, rather than maximising volume at minimal cost. This shift reflects a broader move away from simplistic compensation claims toward contribution-based approaches that emphasise long-term impact.

Carbon Solutions Strengthen Internal Climate Action]

One of the most persistent myths about carbon credits is that they discourage internal reductions. Evidence suggests the opposite.

Companies active in the voluntary carbon market are significantly more likely to have approved science-based targets and to invest more heavily in reducing emissions within their own value chains. Engagement with carbon markets often sharpens internal accountability rather than diluting it.

Why? Because credible carbon strategies require:

- Clear emissions baselines

- Robust data systems

- Governance structures that withstand audit and scrutiny

These same capabilities strengthen internal decarbonisation efforts. In effect, disciplined participation in carbon markets reinforces operational climate maturity.

Nature-Based Solutions and Business Resilience

For many companies, the most immediate climate risks are not abstract temperature targets but physical disruptions: water shortages, crop failures, supply interruptions, and infrastructure damage.

Nature-based solutions—such as forest restoration, improved land management, and agroforestry—address these risks while delivering carbon benefits. They are not just climate tools; they are risk mitigation assets.

However, nature-based projects only deliver durable value when implemented and monitored properly. Poorly designed projects fail communities, ecosystems, and buyers alike. High-integrity nature solutions require long-term engagement, local participation, transparent data, and continuous monitoring—elements that cannot be retrofitted after credits are issued.

Carbon Solutions as a Market Signal

Beyond their direct climate impact, carbon solutions send powerful economic signals. When companies align around shared quality criteria and commit to multi-year purchases, they reshape supply.

Developers design projects to meet buyer expectations from day one. Investors gain confidence to provide upfront capital. Monitoring systems improve. Community safeguards deepen. Over time, quality and scale begin to move in the same direction rather than competing with each other.

This demand-led dynamic is one of the most important—and least discussed—functions of the voluntary carbon market. Business demand does not merely consume credits; it actively shapes the kind of climate solutions that get built.

Where Most Companies Still Get It Wrong

Despite progress, many organisations continue to approach carbon solutions tactically rather than strategically. Common mistakes include:

- Treating credits as a year-end procurement exercise

- Lacking a written carbon-credit policy

- Focusing on price over integrity

- Making vague or misleading claims

- Failing to disclose project details, vintages, or methodologies

These approaches may reduce short-term costs, but they create long-term liabilities. As standards tighten and scrutiny increases, poorly governed carbon programs become increasingly difficult to defend.

What a Credible Carbon Strategy Looks Like

A credible approach to carbon solutions is not complicated, but it is disciplined.

It starts with a clear policy that defines why credits are used, which project types qualify, and how the portfolio will evolve over time. It aligns near-term action with long-term net-zero goals, gradually shifting toward higher-durability removals as capacity scales.

It treats procurement as an ongoing process, not a one-off transaction. Portfolios are diversified across geographies, project types, and delivery years. Data is actively managed. Claims are precise and evidence-based.

Most importantly, carbon solutions are integrated into broader climate governance rather than isolated as a sustainability side project.

From Strategy to Execution

Carbon solutions are no longer about optics. They are about execution—about making climate commitments real in a world that cannot afford to wait.

Used well, they help businesses manage risk, accelerate impact, and invest in the systems that will define a net-zero economy. Used poorly, they undermine trust and delay progress.

The difference lies not in intent, but in how seriously companies treat carbon solutions as a core business strategy rather than a CSR afterthought.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.