For years, the voluntary carbon market operated on a simple assumption: a tonne is a tonne. If a credit claimed to represent one tonne of CO₂ reduced or removed, the price became the deciding factor. Buyers optimised for volume. Developers optimised for speed. And the market scaled—fast.

That assumption no longer holds.

In 2025, the voluntary carbon market is undergoing a decisive shift. Quality has stopped being a “nice to have” and become a structural dividing line. High-integrity credits are attracting long-term buyers, institutional capital, and premium pricing. Low-quality credits are increasingly stranded—harder to defend, harder to use, and harder to justify.

This is not a moral argument. It is a risk argument.

What “Flight to Quality” Actually Means

The phrase “flight to quality” is often used loosely, but in carbon markets it has a very specific meaning.

It describes the separation of the market into tiers, driven by buyer behaviour, integrity standards, and scrutiny. On one side sits a higher-integrity segment: credits with conservative accounting, strong safeguards, transparent data, and credible durability. On the other sits a legacy segment: cheaper credits with weaker oversight, limited monitoring, and higher reversal or over-crediting risk.

This split did not happen overnight. It is the result of more than a decade of learning—sometimes the hard way.

As methodologies tightened, MRV improved, and independent scrutiny increased, it became clear that not all credits deliver the same climate value, even if they carry the same nominal unit.

Why the Old “Cheap Credits” Model Is Breaking Down

Low-priced carbon credits were once attractive for three reasons:

- They were abundant

- They were easy to procure

- They supported simple claims

All three advantages are eroding.

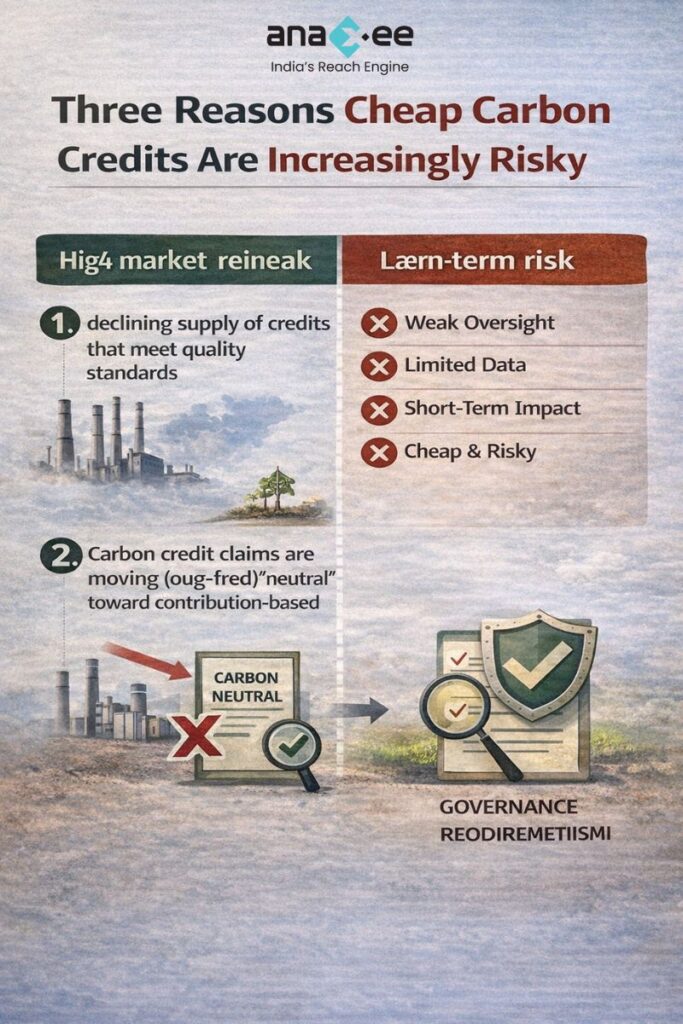

First, abundance is no longer guaranteed. Many project types that dominated early supply—especially those with weak additionality—are facing tighter eligibility rules or declining buyer demand.

Second, ease of procurement has become a liability. Credits that cannot withstand third-party scrutiny now create internal friction with auditors, legal teams, and sustainability committees.

Third, simple claims are disappearing. As companies move away from blanket “carbon-neutral” statements toward contribution-based or hybrid claims, the quality of underlying credits matters more than the headline number.

In short, cheap credits are no longer cheap once reputational, regulatory, and governance risks are accounted for.

What Defines a High-Quality Carbon Credit in 2025

The market’s convergence around quality has produced a clearer consensus on what good looks like. While definitions vary by project type, high-quality credits consistently share five characteristics.

1. Additionality That Holds Up Under Scrutiny

Additionality asks a basic question: would this outcome have happened without carbon finance?

In early market phases, additionality assessments were often binary and superficial. Today, they are more nuanced and conservative. Buyers expect clear evidence that carbon revenue is a decisive factor—not a marginal bonus layered onto business-as-usual activity.

Projects that rely on outdated assumptions or weak financial barriers are increasingly challenged, regardless of how inexpensive their credits appear.

2. Robust Monitoring, Reporting, and Verification (MRV)

MRV has moved from periodic paperwork to continuous evidence generation.

High-quality projects now combine:

- Field-level data collection

- Remote sensing and satellite imagery

- Digital reporting systems

- Independent third-party verification

This reduces uncertainty, improves transparency, and limits the risk of over-crediting. Credits without strong MRV are increasingly treated as unverifiable claims rather than credible climate instruments.

3. Durability and Management of Reversal Risk

Not all climate benefits last equally long. This is particularly important for removal projects, where the risk of reversal—carbon being released back into the atmosphere—varies widely.

High-integrity credits are explicit about:

- Storage duration

- Buffer mechanisms or insurance

- Monitoring periods

- Risk mitigation strategies

Credits that gloss over durability or rely on vague assurances are now viewed as structurally weaker, even if they come from familiar project categories.

4. Community Safeguards and Biodiversity Outcomes

Quality is not just about carbon accounting. It is also about how projects interact with people and ecosystems.

Projects that lack:

- Free, prior, and informed consent (FPIC)

- Grievance mechanisms

- Transparent benefit-sharing

- Biodiversity safeguards

are increasingly excluded from serious buyer portfolios. The reason is simple: social and ecological failures eventually become financial and reputational failures.

5. Transparency Across the Entire Lifecycle

High-quality credits are easy to explain.

They disclose:

- Project location and type

- Methodology used

- Verification status

- Vintage and volume

- Retirement records

Opacity, once tolerated, is now a red flag.

Why Buyers Are Willing to Pay More for Fewer Tonnes

One of the clearest signals of the flight to quality is buyer behaviour.

Leading companies are deliberately choosing to retire fewer credits if it means higher integrity. This runs counter to early market logic but aligns with modern governance expectations.

The shift reflects three realities:

- Boards and investors care more about credibility than volume

- Sustainability teams are accountable for claims, not just spend

- Regulators and civil society are paying closer attention

In this context, a smaller number of defensible credits delivers more strategic value than a large volume of questionable ones.

How Buyer Demand Is Reshaping Supply

The flight to quality is not only changing what buyers purchase—it is changing what gets built.

When early large buyers could not find enough credits that met their standards, they did not lower the bar. They coordinated.

Buyer coalitions, shared quality frameworks, and joint RFPs sent clear signals to developers: build to this specification, or do not expect long-term demand. In response, new project pipelines emerged—designed from day one around stronger safeguards, deeper monitoring, and longer-term durability.

This demand-led feedback loop is one of the most important—and underappreciated—developments in the voluntary carbon market.

Quality is no longer retrofitted. It is increasingly designed in.

The Role of Independent Frameworks and Ratings

Another force accelerating the flight to quality is the rise of independent integrity frameworks and ratings.

Guidance such as the Oxford Principles and the IC-VCM’s Core Carbon Principles has provided common reference points for:

- Portfolio construction

- Claims language

- Disclosure practices

At the same time, third-party ratings offer additional perspectives on project risk, governance, and robustness.

While no framework or rating is perfect, together they have raised the cost of poor-quality supply and reduced information asymmetry for buyers.

Why Low-Quality Credits Are Becoming Harder to Use

Low-quality credits face three compounding problems.

First, they are increasingly hard to defend internally. Legal, audit, and risk teams are more involved in carbon decisions than ever before.

Second, they are harder to explain externally. NGOs, journalists, and investors now expect evidence, not assurances.

Third, they are less future-proof. As standards tighten and disclosure requirements expand, credits that barely meet today’s thresholds are unlikely to survive tomorrow’s.

This does not mean low-quality credits disappear overnight. It means they lose relevance for companies with serious, long-term climate strategies.

The Strategic Implications for Companies

The flight to quality forces companies to confront uncomfortable questions.

- Are we buying credits to minimise cost—or to deliver credible impact?

- Can we explain our portfolio choices five years from now?

- Do our credits align with where standards are going, or where they used to be?

Answering these questions honestly often leads to fewer purchases, longer timelines, and more structured procurement. It also leads to stronger alignment between climate strategy and business risk management.

Quality Is No Longer a Preference — It’s the Market Direction

The most important thing to understand about the flight to quality is that it is not reversible.

Once buyers, standards bodies, and capital providers align around higher integrity, the market does not drift back to looser rules. It moves forward—sometimes unevenly, but decisively.

In 2025, the voluntary carbon market is no longer asking whether quality matters. It is asking how quickly companies are willing to adapt.

Those that treat quality as optional will find themselves with stranded credits and fragile claims. Those that treat it as foundational will help shape the next phase of the market—and benefit from it.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.

Connect with us at sales@anaxee.com