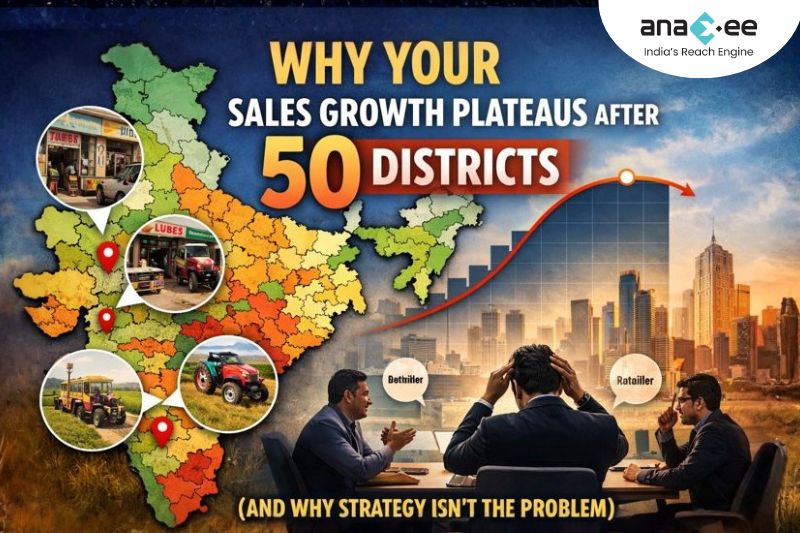

Why Your Sales Growth Plateaus After 50 Districts (And Why Strategy Isn’t the Problem)

If you are a National Sales Head, CEO, or Growth Leader in a tractor, auto battery, tyre, lubricant, home appliance, or agri-input brand, this situation will sound painfully familiar.

You had a great run.

The first 10–15 districts delivered strong numbers.

The next 20 followed with momentum.

By the time you crossed 40–50 districts, revenue looked impressive on paper.

Then something strange happened.

Growth slowed.

Sales became inconsistent.

Some districts performed brilliantly, others flatlined.

Forecast accuracy dropped.

And every review meeting started sounding the same.

“The distributor is not active.”

“Retailers are not pushing our brand.”

“Competition is discounting aggressively.”

“We need better schemes.”

Here’s the uncomfortable truth most leadership teams avoid:

Your growth didn’t plateau because your strategy failed.

It plateaued because your execution model stopped scaling.

The Illusion of Scale: Why 50 Districts Feels Like a Wall

At 10 districts, execution is manageable.

At 25 districts, control starts weakening.

At 50+ districts, most non-FMCG brands quietly lose visibility.

Not because people are incompetent.

But because the system was never designed to scale uniformly.

What worked early on relied on:

- Personal distributor relationships

- A few high-performing sales managers

- Gut feel about “important” retailers

- Sample-based reporting

This works when leadership can “feel” the market.

It breaks when the market becomes too large to feel.

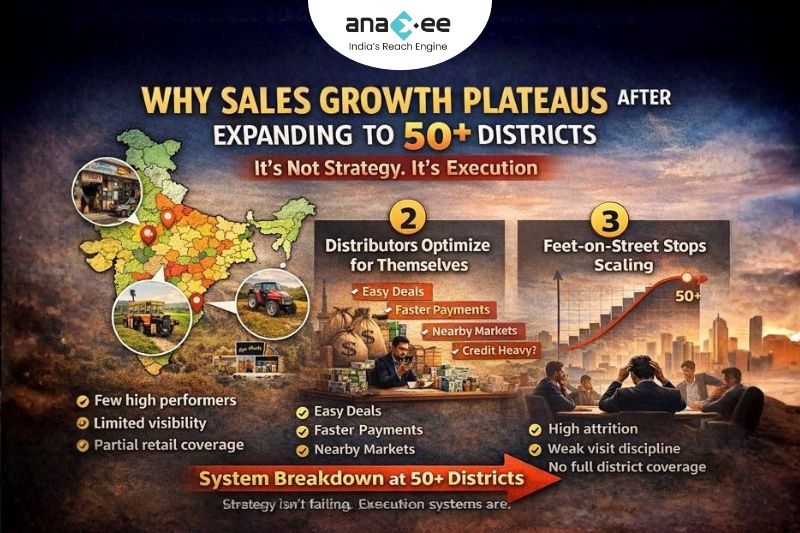

By the time you reach 50 districts, three silent problems emerge.

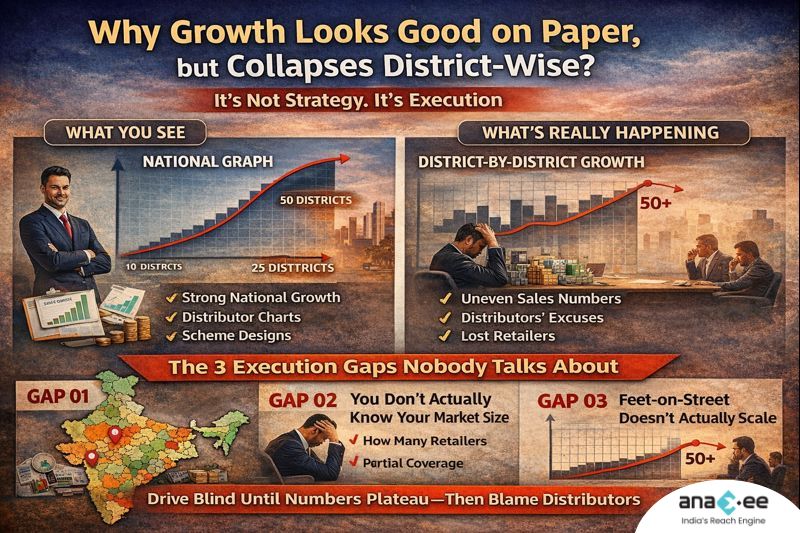

Problem #1: You Don’t Actually Know Your Market Size

Most brands believe they know their market.

In reality, they know:

- How many distributors they have

- How many retailers their distributors deal with

- How much secondary sales gets reported

What they don’t know:

- How many retailers actually exist in the district

- How many sell competitor brands exclusively

- How many were never approached

- How many stopped ordering months ago

So leadership decisions are made on partial visibility.

You think penetration is 60%.

In reality, it’s often 25–30%.

This gap is where growth disappears.

Problem #2: Distributors Optimize for Themselves (Not for You)

This is not distributor bashing.

It’s economic reality.

Distributors:

- Prioritize retailers who pay faster

- Push brands with better margins

- Focus on nearby markets

- Avoid difficult or credit-heavy outlets

As a brand, you want:

- Maximum retail coverage

- Uniform district-level sales

- Consistent visibility

- Long-term market creation

These incentives are not naturally aligned.

So distributors end up serving:

- Their comfort zone

- Their preferred retailers

- Their easiest routes

Meanwhile, hundreds of potential retailers remain untouched.

From your dashboard, everything looks “covered.”

On the ground, opportunity is leaking every day.

Problem #3: Feet-on-Street Doesn’t Scale the Way You Think

Most leadership teams respond with the same solution:

“Let’s hire more salespeople.”

That works—until it doesn’t.

Because traditional feet-on-street models suffer from:

- High attrition

- Uneven visit discipline

- Relationship-based reporting

- Limited data capture

- Zero scalability beyond a point

You add people.

You add cost.

But you don’t add visibility or control.

The result?

- Activity without intelligence

- Visits without conversion logic

- Sales without repeatability

Why FMCG Solved This—And Non-FMCG Still Struggles

There’s a reason FMCG companies dominate Indian distribution.

They learned early that:

- Distribution is a system, not a relationship

- Visibility must reach every outlet, not samples

- Sales execution needs process discipline

- Decisions must be data-backed, not anecdotal

They invested in:

- Market mapping

- Retailer classification

- Visit frequency norms

- SKU-level visibility

- Central dashboards

Most non-FMCG brands didn’t.

They assumed distributors would do the heavy lifting.

That assumption works at 10 districts.

It collapses at 50.

The Real Reason Growth Plateaus: Loss of Uniformity

The biggest myth in sales leadership is that average growth matters.

It doesn’t.

What actually matters is uniformity.

- Uniform distributor activity

- Uniform retail coverage

- Uniform visit frequency

- Uniform SKU presence

Most plateaued brands have:

- A few star districts

- Many mediocre ones

- Several invisible ones

Growth doesn’t stall because demand disappears.

It stalls because execution becomes uneven.

What Changes When You Fix the Execution Layer

This is where most brands go wrong.

They tweak:

- Pricing

- Schemes

- Marketing spends

But ignore the execution architecture underneath.

When execution is fixed, something powerful happens.

1. The Market Becomes Visible

You know:

- Exactly how many retailers exist

- Who sells you, who doesn’t

- Where competitors dominate

- Where white spaces exist

No more guessing.

2. Distributors Get Empowered, Not Replaced

Instead of blaming distributors, you:

- Enable them with intelligence

- Expand their reach beyond comfort zones

- Increase their throughput

They sell more—because the system supports them.

3. Sales Teams Stop Firefighting

With structure in place:

- Visits become purposeful

- Follow-ups become systematic

- Order-taking becomes predictable

Sales leadership moves from chasing numbers to managing levers.

How Anaxee Solves the 50-District Plateau

Anaxee was built specifically to solve this invisible execution gap Anaxee- GTM deck-Sep 2024.

Not by replacing distributors.

Not by bloating payrolls.

But by creating a tech-enabled execution layer between strategy and sales.

Step 1: Market Mapping (No Sampling)

Anaxee maps every relevant retail outlet in a district—not samples.

You finally know:

- True market size

- True penetration

- True opportunity

Step 2: Retailer Profiling (Know Your Retailer)

Each retailer is profiled for:

- Brands sold

- Purchase source

- Product mix

- Potential value

This turns a “shop” into a revenue unit.

Step 3: Structured Order Taking

Using Anaxee’s Digital Runners:

- Regular visits are ensured

- Pitches improve with data

- Lost retailers are reactivated

- New ones are unlocked

All activity is tracked.

Nothing is anecdotal.

Step 4: Distributor Empowerment

Distributors gain:

- Wider reach

- Better planning inputs

- Higher secondary sales

- Reduced dependence on gut feel

This is why distributor resistance drops quickly.

What Brands Usually Discover (And It’s Uncomfortable)

Once visibility improves, leadership often realizes:

- “We overestimated our coverage.”

- “Our best districts were masking weak ones.”

- “Some competitors are everywhere—we weren’t.”

This realization is uncomfortable.

But it’s also where growth restarts.

Because now decisions are based on reality, not assumptions.

The CEO-Level Question You Should Be Asking

Not:

“Why isn’t my distributor performing?”

But:

“Do I have a system that makes performance inevitable?”

If your growth depends on:

- Individual distributor motivation

- Individual sales manager effort

- Individual relationships

You will always hit a ceiling.

Systems scale.

Heroics don’t.

Final Thought: Plateaus Are Signals, Not Failures

A 50-district plateau is not a warning sign.

It’s a signal that your brand is ready for its next execution upgrade.

The companies that break through are not the ones with better products or louder marketing.

They are the ones that fix the last mile.

If your brand is:

- Growing unevenly across districts

- Too dependent on distributor reports

- Struggling to scale sales execution without ballooning costs

It’s time to look beneath strategy and schemes.

Write to sales@anaxee.com

Tell us your category and current district count.

We’ll show you—clearly—where your growth is hiding and why it stalled.

Uniform growth is not a dream.

It’s an execution choice.

FAQs:

Q1. Why does sales growth slow down after expanding to multiple districts?

Because execution systems don’t scale uniformly. Visibility drops, distributor focus narrows, and retail coverage becomes uneven.

Q2. Is the distributor the main reason for poor district-level sales?

No. The real issue is lack of market visibility and structured execution beyond distributor comfort zones.

Q3. How can brands achieve uniform sales growth across districts in India?

By combining full market mapping, retailer profiling, disciplined visits, and data-backed order taking.

Q4. Which industries face this problem most in India?

Tractors, automotive batteries, tyres, lubricants, home appliances, and agri-input brands.