Most automotive brands don’t suffer from a lack of data.

They suffer from data that arrives too late, too filtered, and too disconnected from execution.

Sales reports look healthy.

Dashboards are full.

But market behavior doesn’t move.

This gap between what leadership sees and what the market does is where GTM control is lost.

Anaxee’s retail intelligence engine was built specifically to close this gap.

The Core Problem: Visibility Without Control

Traditional GTM models create visibility through:

- Distributor reports

- Sales team updates

- Monthly reviews

But visibility is not control.

Control requires:

- Knowing what is happening now

- Knowing why it is happening

- Having the ability to intervene locally

Most automotive brands lack all three once they scale beyond metro cities.

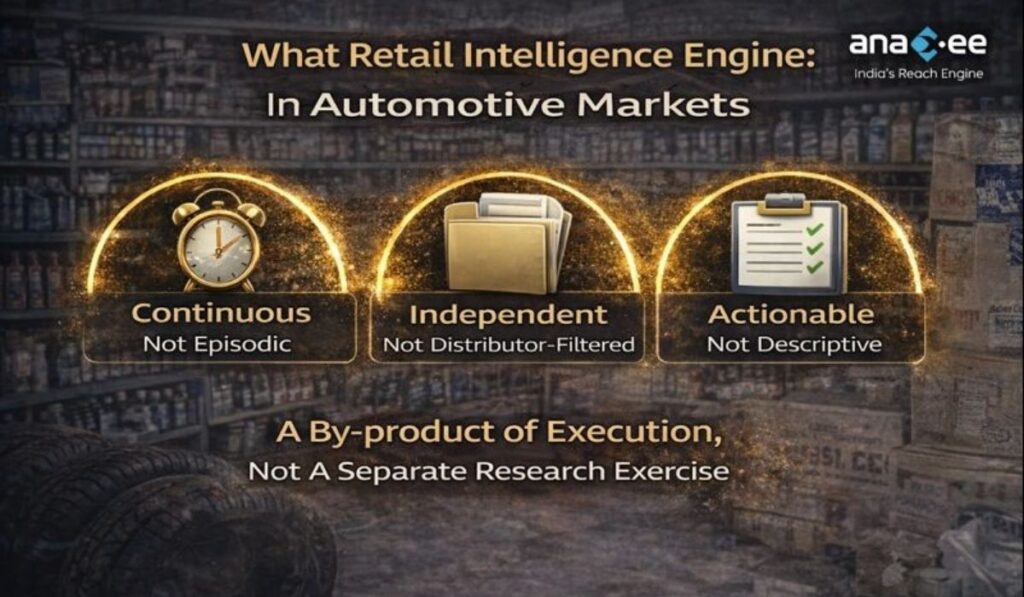

What “Retail Intelligence” Actually Means in Automotive Markets

Retail intelligence is often misunderstood as:

- Surveys

- Market studies

- Feedback forms

In fragmented automotive retail, intelligence must be:

- Continuous, not episodic

- Independent, not distributor-filtered

- Actionable, not descriptive

Anaxee’s engine treats intelligence as a by-product of execution, not a separate research exercise.

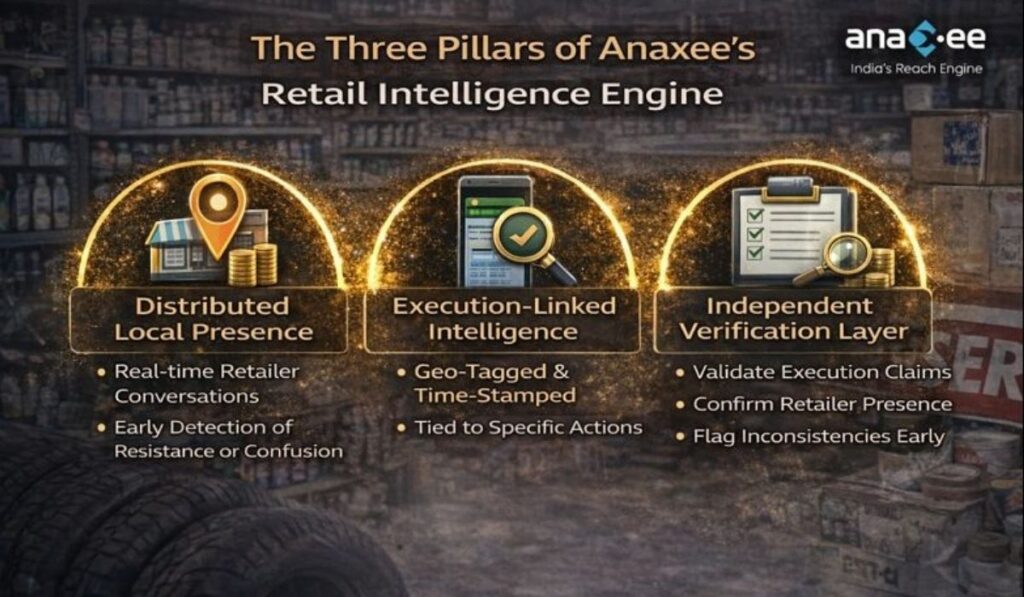

The Three Pillars of Anaxee’s Retail Intelligence Engine

1. Distributed Local Presence

At the core of Anaxee’s model is persistent local presence.

Not:

- Quarterly visits

- Campaign-based activations

But trained field representatives embedded across districts.

This enables:

- Real-time retailer conversations

- Early detection of resistance or confusion

- Faster issue escalation

For tyre, lubricant, and battery brands, this presence replaces assumptions with observation.

2. Execution-Linked Intelligence

Most brands collect intelligence after execution.

Anaxee flips this.

Every activity—whether:

- Retailer onboarding

- SKU presence checks

- Scheme communication

- Mechanic engagement

is captured as:

- Geo-tagged

- Time-stamped

- Workflow-bound data

This ensures intelligence is:

- Verifiable

- Comparable across regions

- Linked to specific actions

No anecdotal reporting. No guesswork.

3. Independent Verification Layer

One of the biggest weaknesses in traditional GTM is self-reporting.

When the same channel:

- Executes

- Reports

- Evaluates

Bias is inevitable.

Anaxee introduces an independent verification layer that:

- Validates execution claims

- Confirms retailer presence

- Flags inconsistencies early

For leadership teams, this creates confidence in decisions, not just numbers.

How This Engine Changes Decision-Making for Brands

From Lagging Indicators to Leading Signals

Instead of waiting for:

- Monthly secondary sales

- Quarter-end performance

Brands can see:

- Retailer hesitation patterns

- Scheme misinterpretation

- Competitor push intensity

early enough to act.

From Firefighting to Structured Intervention

With localized intelligence, brands can:

- Adjust schemes regionally

- Support specific distributors

- Re-train sales teams surgically

Not everything needs a national fix.

From Sales Bandwidth Drain to Sales Leverage

Sales teams stop being:

- Messengers

- Report collectors

And focus on:

- Closing

- Relationship-building

- Strategic expansion

Execution burden moves to a system, not individuals.

Why This Matters More for Tyre, Lubricant & Battery Brands

These categories share three characteristics:

- Retailer-driven recommendation

- Mechanic influence

- High brand substitutability

Small execution failures compound fast.

Without a retail intelligence engine:

- Schemes leak

- Trial doesn’t convert

- Distribution investments underperform

Anaxee’s system doesn’t eliminate competition.

It eliminates blindness.

GTM as a System, Not a Hierarchy

Traditional GTM looks like a pyramid:

- Leadership

- Sales teams

- Distributors

- Retailers

Anaxee’s GTM works like a network:

- Local nodes

- Central intelligence

- Continuous feedback loops

This shift—from hierarchy to system—is what enables scale without chaos.

The Real Outcome: GTM Control

When brands work with Anaxee, the biggest outcome is not reach.

It is control.

Control over:

- What is happening in each district

- Why certain regions underperform

- Where to invest next

This control is what separates brands that grow steadily from those that stall after expansion.

Closing Thought

In India’s automotive retail markets,

growth doesn’t fail because of ambition—it fails because of opacity.

Anaxee’s retail intelligence engine replaces opacity with clarity, and clarity with control.

CTA

If you’re responsible for GTM performance across tyres, lubricants, or batteries—and want execution visibility without adding headcount—

write to sales@anaxee.com.