ESG Implementation in India: Turning Strategy into Measurable Action

Over the last few years, ESG has moved from being a “nice-to-have” concept to a boardroom priority. Annual reports are filled with sustainability commitments. Investor presentations highlight climate targets. Policies, frameworks, and declarations are everywhere.

Yet a stubborn gap remains.

Many organisations are strong on ESG strategy, but struggle with ESG execution.

And that gap is where most ESG risks quietly live.

Because ESG is not built in PowerPoint decks. It is built in villages, factories, supply chains, retail networks, warehouses, farms, and communities. It is built through thousands — sometimes millions — of micro-actions that must be captured, verified, measured, and improved.

This is particularly true in India.

Why ESG Execution is Harder Than It Looks

Designing an ESG roadmap is intellectually demanding. But implementing it across dispersed geographies is operationally brutal.

Consider what ESG execution actually requires:

- Identifying beneficiaries or stakeholders

- Conducting baseline assessments

- Deploying interventions

- Monitoring progress

- Collecting field data

- Ensuring compliance

- Generating auditable evidence

- Reporting outcomes

Now multiply that across:

- Multiple states

- Rural and urban areas

- Different languages

- Different socio-economic contexts

- Fragmented infrastructure

Suddenly ESG becomes less of a reporting exercise and more of a large-scale operations challenge.

The friction usually appears in three areas:

1. Last-Mile Visibility

What is actually happening on the ground? Are activities being carried out as planned? Are beneficiaries real? Are outcomes measurable?

Without reliable last-mile visibility, ESG programs drift into assumption-based reporting.

2. Data Integrity

Manual surveys, Excel sheets, delayed updates, inconsistent formats — these weaken ESG credibility. Inaccurate data doesn’t just distort impact; it exposes organisations to reputational and regulatory risks.

3. Monitoring & Control

Field teams, NGOs, partners, vendors — ESG delivery often involves multiple actors. Tracking performance, compliance, and quality becomes complex without a structured system.

The Cost of Weak ESG Execution

When ESG execution falters, the consequences are rarely immediate — but they accumulate.

- Inflated impact claims

- Audit failures

- Investor scepticism

- Greenwashing allegations

- Regulatory exposure

- Wasted budgets

In capital markets, credibility is everything. ESG without verifiable evidence is increasingly viewed as risk rather than value.

From ESG Intent to ESG Evidence

The shift organisations must make is simple but demanding:

Move from ESG storytelling to ESG evidence.

Evidence requires:

✔ Structured workflows

✔ Standardised data capture

✔ Real-time monitoring

✔ Geo-tagged proof

✔ Beneficiary validation

✔ Audit trails

This is where technology-enabled execution partners play a decisive role.

Where Anaxee Fits into the ESG Ecosystem

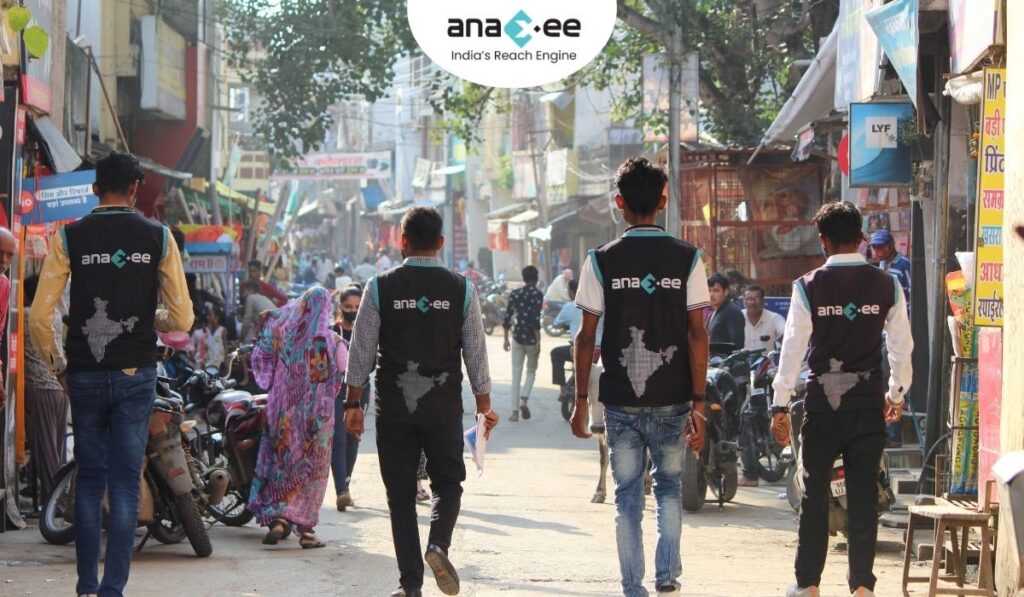

Anaxee operates at a layer many ESG strategies underestimate — the execution layer.

Rather than focusing only on consulting or reporting, Anaxee specialises in:

- Last-mile field operations

- Digital data collection

- Real-time monitoring

- Impact measurement

- Large-scale distributed workforce management

In practical terms, this means organisations gain:

✔ Last-Mile Visibility

Every field activity is digitally captured. Stakeholder interactions are traceable. Progress is observable.

✔ High-Integrity Data

Data is collected via mobile applications with:

- GPS tagging

- Photographic evidence

- Structured questionnaires

- Offline functionality

- Time stamps

This dramatically reduces data manipulation, duplication, and post-fact reconstruction.

✔ Monitoring of Field Personnel

Distributed field teams are not just deployed — they are monitored. Routes, tasks, completion status, and productivity are measurable.

✔ Real-Time Dashboards

Decision-makers see progress without waiting for monthly summaries.

✔ Impact Measurement

Outcomes are not inferred. They are quantified.

Why This Matters for ESG Programs

1. Environmental Projects

Tree plantations, regenerative agriculture, water conservation, renewable adoption — these require continuous monitoring and survival verification, not one-time reporting.

2. Social Impact Initiatives

Livelihood programs, health interventions, financial inclusion, skill development — success depends on authentic beneficiary tracking and engagement evidence.

3. Governance & Compliance

Auditability, traceability, documentation — governance demands structured digital trails.

India’s Unique ESG Execution Reality

India presents extraordinary scale and diversity:

- 600,000+ villages

- Complex supply chains

- Informal economies

- Regional variations

- Infrastructure gaps

ESG programs designed without operational grounding often collapse under logistical realities.

Execution partners with:

✔ Field networks

✔ Technology infrastructure

✔ Local workforce models

✔ Process discipline

become not optional — but essential.

Technology is Not a Tool. It is the Backbone.

Many organisations treat ESG technology as an accessory. In reality, it is the backbone of credible implementation.

Because ESG without:

- Verified data

- Live monitoring

- Digital documentation

is vulnerable.

Anaxee’s model integrates:

📍 Feet-on-street teams

📱 Digital workflows

📊 Dashboards

🧭 GPS-enabled tracking

🗂 Structured evidence capture

bridging the gap between intent and proof.

Beyond Reporting: Building ESG Confidence

Strong ESG execution delivers more than compliance.

It builds:

✔ Investor confidence

✔ Audit readiness

✔ Program efficiency

✔ Resource optimisation

✔ Reputation resilience

It also exposes underperformance early — allowing course correction instead of post-mortem explanations.

A Practical Reframe for ESG Leaders

Instead of asking:

❌ “What should we report?”

Progressive organisations ask:

✅ “What can we prove?”

And that proof depends on execution quality.

Final Thought

ESG success is not defined by ambition alone. It is defined by measurable, verifiable, repeatable action.

Strategy defines direction.

Execution defines credibility.

And in India’s complex operating environment, execution requires more than intent — it requires infrastructure.

That is where partners like Anaxee become a structural advantage rather than a vendor choice.