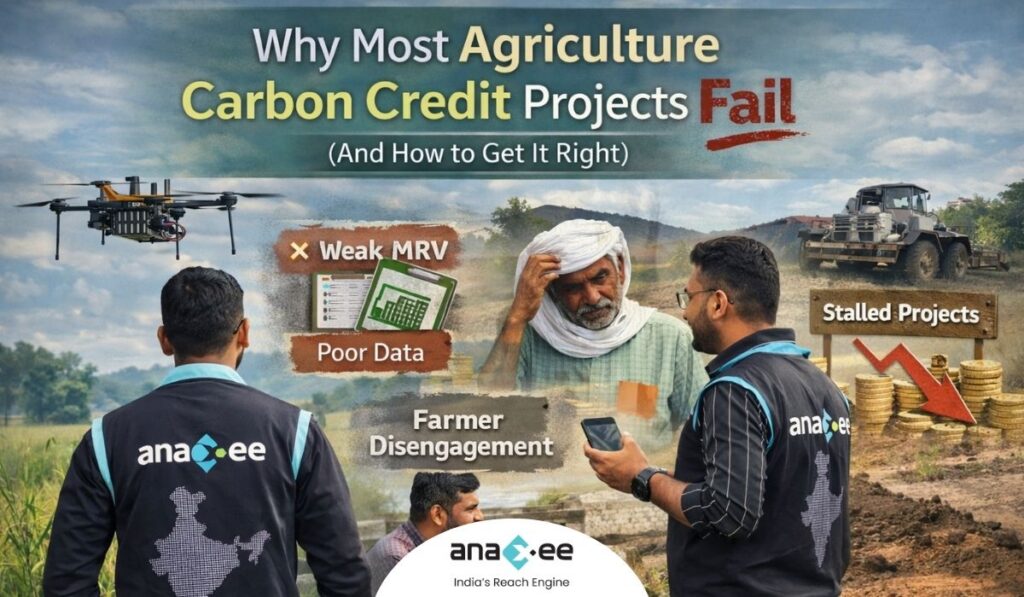

Introduction: The Uncomfortable Reality

Agriculture is widely promoted as the next frontier of carbon credit generation. The narrative is compelling: farmers adopt regenerative practices, carbon is sequestered in soils, credits are issued, incomes rise, and corporations meet climate goals.

Yet behind the optimism lies a harder truth:

A significant number of agriculture carbon credit projects underperform, stall, or fail entirely.

Not because the science is invalid.

Not because farmers are unwilling.

But because execution, measurement, and incentives are often misaligned.

Carbon markets reward outcomes — not intentions.

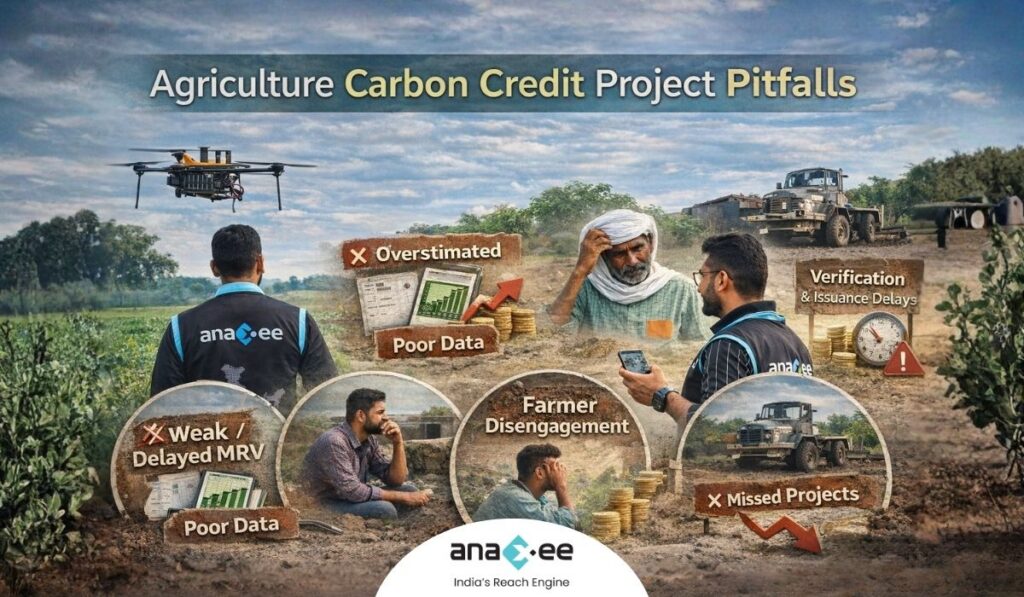

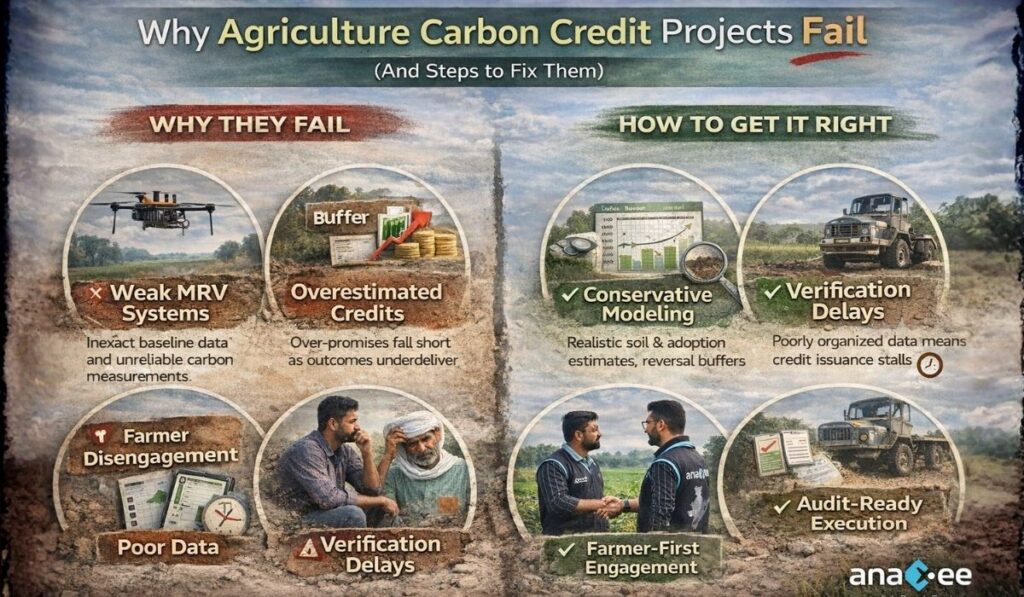

1️⃣ Weak Measurement, Reporting & Verification (MRV)

The most common failure point is MRV fragility.

Agricultural carbon is inherently complex:

- Soil carbon fluctuates naturally

- Weather variability distorts outcomes

- Farming practices differ widely

- Sampling is expensive and inconsistent

Projects frequently collapse under:

❌ Inadequate baseline data

❌ Poor sampling design

❌ Inconsistent monitoring cycles

❌ Lack of digital traceability

Without defensible MRV:

- Credits are delayed

- Verification bodies raise objections

- Buyers discount pricing

- Project economics deteriorate

Reality check:

If carbon cannot be measured credibly, it cannot be monetized reliably.

2️⃣ Overestimated Carbon Projections

Early project models often rely on optimistic sequestration assumptions.

Typical issues:

- Uniform sequestration rates applied across diverse geographies

- Ignoring soil saturation limits

- Underestimating reversal risks

- Treating adoption as guaranteed

The result:

📉 Actual carbon outcomes < projected outcomes

📉 Credit issuance < financial expectations

📉 Investor confidence erodes

Carbon accounting is unforgiving.

Exaggeration today becomes a liability tomorrow.

3️⃣ Poor Farmer Engagement & Incentive Design

Many projects underestimate the human dimension.

From a farmer’s perspective:

- Carbon revenue is uncertain

- Payments are delayed

- Practice changes involve risk

- Benefits are intangible initially

Common engagement failures:

❌ Complex onboarding processes

❌ Weak training & education

❌ Delayed incentives

❌ No local trust network

❌ Misaligned expectations

Farmers don’t abandon projects because they reject sustainability.

They disengage when:

👉 Economic value is unclear

👉 Processes are confusing

👉 Promises feel distant

4️⃣ Fragmented Smallholder Landscapes

Agriculture carbon projects often target smallholder farmers, especially in India.

Challenges include:

- Landholding fragmentation

- Diverse crop systems

- Variable documentation

- Dispersed geographies

- Inconsistent practice adoption

Without aggregation capability:

⚠️ Monitoring costs escalate

⚠️ Data quality drops

⚠️ Leakage risks increase

⚠️ Verification complexity multiplies

Scaling smallholder carbon projects is logistics-heavy, not spreadsheet-heavy.

5️⃣ Verification & Methodology Misalignment

Projects sometimes fail due to methodological mismatches.

Examples:

- Activities not fully aligned with chosen standard

- Inadequate permanence safeguards

- Insufficient leakage mitigation

- Data gaps during audit

Verification bodies are increasingly stringent.

If documentation, field data, and evidence chains are weak:

🚫 Credits are rejected

🚫 Issuance is delayed

🚫 Reputation risk increases

Carbon markets are moving from volume-driven to integrity-driven.

6️⃣ Delayed Financial Flows

Carbon projects are long-cycle investments.

But projects falter when:

❌ Farmers wait years for returns

❌ Upfront costs are unsupported

❌ Revenue timelines are unrealistic

❌ Cash flow gaps appear

Without structured financial planning:

💸 Adoption slows

💸 Drop-outs increase

💸 Project viability weakens

✅ How to Get It Right

Understanding failure points is only useful if it informs better design and execution.

✔️ Build MRV Before Scaling

Strong projects treat MRV as infrastructure, not an afterthought.

This means:

✔️ Defensible baselines

✔️ Hybrid measurement (field + remote sensing)

✔️ Repeatable monitoring cycles

✔️ Digital audit trails

✔️ Transparent reporting systems

MRV robustness directly influences:

📈 Credit acceptance

📈 Buyer confidence

📈 Pricing premium

✔️ Use Conservative Carbon Estimates

Credible projects avoid inflated projections.

Better approach:

✔️ Region-specific models

✔️ Soil-type differentiation

✔️ Reversal buffers

✔️ Realistic adoption curves

Underpromise. Overdeliver.

Markets reward reliability.

✔️ Design Farmer-First Incentives

Successful projects align with farmer economics:

✔️ Clear value communication

✔️ Early benefit visibility

✔️ Simplified participation

✔️ Local training & trust building

✔️ Predictable payment structures

Carbon projects succeed when farmers see:

👉 Practical benefits

👉 Reduced risk

👉 Tangible income potential

✔️ Solve Aggregation & Last-Mile Execution

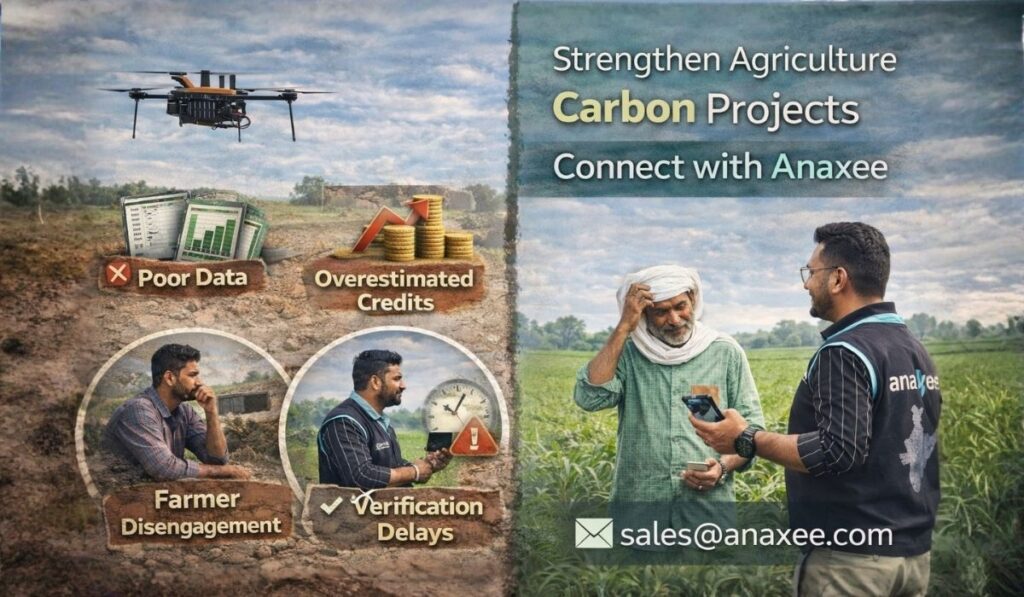

This is where many models break — and where Anaxee becomes critical.

🚀 Where Anaxee Changes the Equation

Agriculture carbon projects don’t fail at strategy level.

They fail at execution level.

Anaxee addresses precisely that gap.

🔹 Last-Mile Data & Monitoring

Anaxee’s distributed field force enables:

✔️ On-ground data capture

✔️ Geo-tagged evidence

✔️ Practice verification

✔️ Farmer-level traceability

This strengthens:

📊 MRV credibility

📊 Audit readiness

📊 Credit defensibility

🔹 Farmer Engagement Infrastructure

Carbon adoption is behavioural change.

Anaxee provides:

✔️ Local presence

✔️ Training workflows

✔️ Continuous follow-up

✔️ Trust-based relationships

Turning:

“Sustainability initiative” → “Farmer opportunity”

🔹 Aggregation & Scale Management

Fragmented landscapes demand structured aggregation.

Anaxee enables:

✔️ Farmer clustering

✔️ Standardized workflows

✔️ Monitoring consistency

✔️ Cost efficiency at scale

🔹 Verification-Ready Execution

Anaxee’s systems ensure:

✔️ Evidence chains

✔️ Digital documentation

✔️ Process discipline

✔️ Compliance alignment

Reducing:

🚫 Credit rejection risk

🚫 Audit friction

🚫 Revenue delays

📌 The Strategic Insight

Agriculture carbon credits are not:

❌ A pure climate initiative

❌ A simple financial product

❌ A technology-only solution

They are a multi-layer execution challenge involving:

🌱 Science

📊 Measurement

👨🌾 Human behaviour

📍 Logistics

💰 Incentives

📑 Compliance

Projects succeed when these layers are integrated — not isolated.

Conclusion: Quality Credits Require Quality Execution

Carbon markets are evolving fast.

Buyers increasingly demand:

✔️ Integrity

✔️ Transparency

✔️ Verifiable impact

✔️ Low reversal risk

Which means:

Only well-designed and well-executed agriculture carbon projects will survive.

Anaxee’s value is not theoretical.

It sits where projects actually struggle:

📍 Field execution

📍 Farmer engagement

📍 Data reliability

📍 Monitoring discipline

📍 Scalable operations

Because in carbon markets:

👉 Strategy attracts attention

👉 Execution generates credits

👉 Integrity commands premium pricing