India doesn’t have an automotive marketing problem.

It has an automotive execution problem.

Most automobile accessory, tyre, lubricant, and battery brands already spend on:

- Digital campaigns

- Dealer schemes

- Distributor incentives

- Influencer collaborations

Yet market share movement at the retail level remains painfully slow—especially beyond the top 30 cities.

The reason is simple and uncomfortable:

Retail does not behave like dashboards. It behaves like people.

This is where Anaxee operates—not in theory, but in the messy, fragmented reality of India’s automotive retail ecosystem.

The Real Structure of India’s Automotive Retail Market

Before talking about solutions, it’s important to acknowledge a few ground truths that many brand teams avoid.

1. Decision Power Sits with Retailers, Not Brands

In Tier 2, 3, and 4 markets:

- Retailers push what gives them margin, credit comfort, and fast movement

- Brand recall helps, but daily sales behavior matters more

A battery or lubricant brand doesn’t “win” because of national advertising.

It wins because:

- The retailer trusts supply continuity

- The distributor resolves issues fast

- Someone shows up physically when things break

2. One India Does Not Exist

A GTM play that works in:

- Indore fails in Siliguri

- Coimbatore behaves differently from Jalandhar

Language, payment cycles, mechanic influence, seasonal demand—everything shifts every 200–300 km.

Most centralized marketing teams underestimate this.

3. Sales Teams Are Overstretched

Regional and area sales managers are expected to:

- Drive primary and secondary sales

- Manage distributors

- Activate retailers

- Report data

In reality, they can only prioritize fires.

This execution gap is exactly where Anaxee enters the system.

What Anaxee Actually Does (Beyond the Brochure)

Anaxee is often described as a “GTM” or “on-ground marketing” partner.

That description is incomplete.

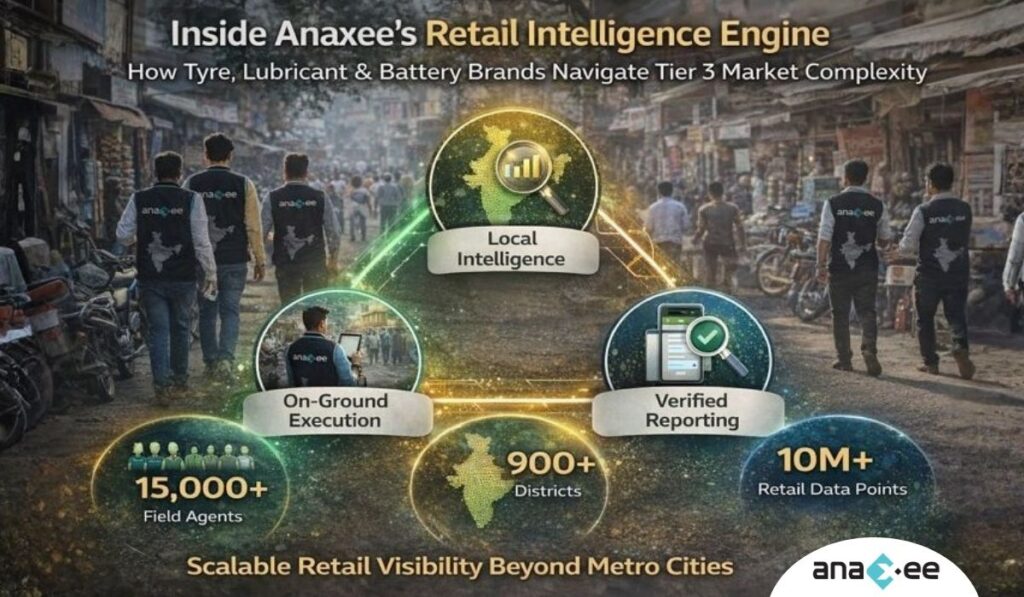

Anaxee builds distributed execution infrastructure for brands.

This includes:

- Physical presence at scale

- Local intelligence collection

- Retailer engagement workflows

- Verification and reporting layers

Instead of replacing sales teams, Anaxee extends them—district by district.

How Anaxee Supports Automobile Accessory Brands

Automobile accessories are impulse-driven, cluttered, and retailer-led.

Typical challenges accessory brands face:

- Low shelf visibility

- Poor in-store placement

- No control over retailer recommendation

- Scheme leakage

Anaxee’s Role in Accessory GTM

For accessory brands, Anaxee focuses on retail readiness and visibility discipline.

Key activities include:

- Retailer onboarding and mapping

- SKU presence audits

- Display and branding checks

- Mechanic and influencer identification

- Local competitor intelligence

Instead of relying on one-time activations, Anaxee creates repeatable retail touchpoints.

This ensures:

- New SKUs don’t die silently

- Visibility doesn’t fade after launch

- Brands get real feedback on pricing and packaging

How Tyre Brands Use Anaxee for Market Penetration

Tyres are high-value, low-frequency purchases.

Retailers don’t experiment easily.

The biggest barrier for tyre brands isn’t awareness—it’s retailer risk.

Retailers ask:

- Will this brand move?

- Will claims be handled?

- Will the distributor support me?

Anaxee’s Intervention in Tyre GTM

Anaxee works alongside tyre brands to:

- Identify high-potential retail clusters

- Support dealer onboarding drives

- Track conversion from onboarding to billing

- Capture retailer objections at scale

This ground feedback helps brands:

- Fix distributor-level issues early

- Redesign schemes that retailers actually understand

- Adjust regional pricing mismatches

Tyre GTM succeeds when trust compounds locally, not when ads scale nationally.

Lubricant Brands: Fighting Habit, Not Competition

Lubricants are habit-driven.

Mechanics, retailers, and fleet operators stick to what they know.

Most lubricant marketing fails because it focuses on:

- Brand superiority claims

- Technical features

But ignores behavioral inertia.

What Anaxee Changes in Lubricant Marketing

Anaxee’s lubricant programs focus on:

- Mechanic mapping and engagement

- Retailer-mechanic relationship tracking

- Local loyalty dynamics

- Consumption pattern audits

By placing feet on the ground, Anaxee helps brands:

- Identify switching barriers

- Track trial vs repeat usage

- Understand why incentives fail or work

This insight is difficult to get through surveys.

It requires presence.

Battery Brands: Scale Without Losing Control

Battery brands often expand faster than their systems can handle.

Common issues:

- Unverified retailer onboarding

- Fake visibility reports

- Scheme misuse

- Poor after-sales feedback loops

Anaxee’s Execution Layer for Battery Brands

For battery brands, Anaxee acts as:

- A verification layer

- A reporting engine

- A local problem resolver

Activities include:

- Retailer and distributor audits

- Stock and branding verification

- Replacement and complaint tracking

- Geo-tagged reporting

This gives brand leadership confidence in data, not just volume numbers.

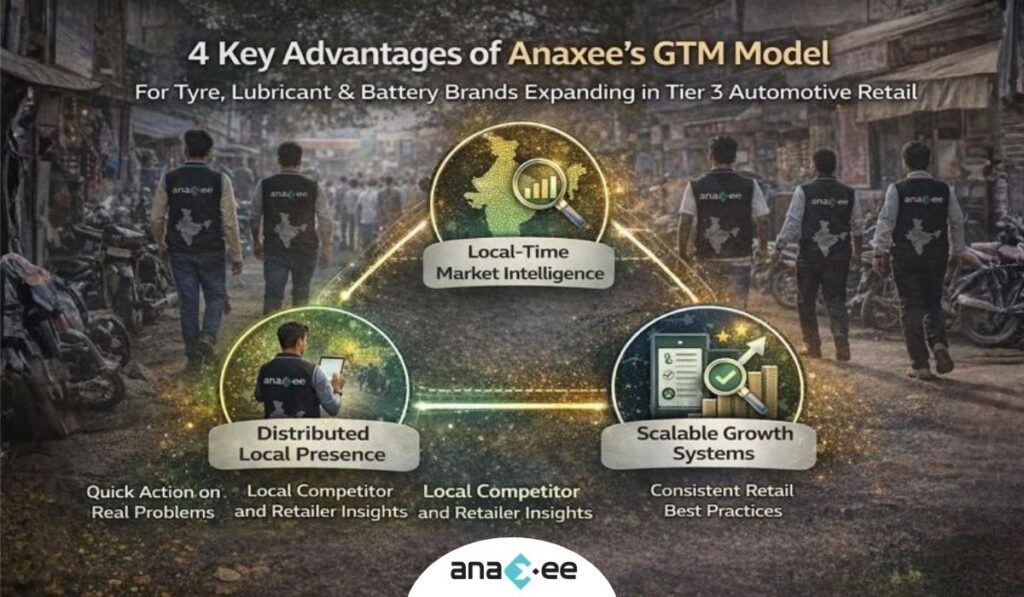

Why Anaxee’s Model Works Across Categories

Anaxee’s effectiveness comes from three structural advantages.

1. Distributed Local Presence

Anaxee operates with trained local representatives embedded in districts.

This allows:

- Faster response times

- Cultural and language alignment

- Trust-based retailer interactions

2. Standardized Execution, Flexible Playbooks

While execution is local, workflows are standardized.

Brands get:

- Comparable data across regions

- Clear execution benchmarks

- Reduced chaos during scale

3. Built-in Verification

Every activity is:

- Documented

- Geo-tagged

- Time-stamped

This reduces:

- False reporting

- Rework

- Decision delays

What Brands Actually Gain (Beyond “Reach”)

Brands working with Anaxee typically see improvements in:

- Retailer activation velocity

- Scheme effectiveness

- Distributor accountability

- Market intelligence depth

More importantly, leadership teams gain clarity:

- What’s working

- What’s failing

- Where to intervene

This clarity is rare in fragmented retail markets.

Who This Model Is Not For

To be direct:

Anaxee is not for brands looking for:

- One-off activations

- Vanity metrics

- Short-term optics

It works for brands that:

- Want repeatable GTM systems

- Care about execution quality

- Are serious about Tier 2–4 growth

Closing Thought

Automotive retail growth in India doesn’t come from louder marketing.

It comes from better execution density.

Anaxee helps brands build that density—district by district, retailer by retailer.