The Automotive Battery Market Is Growing — But Brands Aren’t Capturing It Evenly

India’s automotive battery market is not short on demand. Vehicle parc is expanding, replacement cycles are predictable, and electrification is creating new product categories. Yet, most battery brands face erratic growth across districts, inconsistent retailer penetration, and an overdependence on distributors’ personal networks.

The problem isn’t the product.

The problem is retail execution.

Between OEM dominance, fragmented aftermarket channels, and limited on-ground visibility, battery brands often operate blind beyond their top-performing cities. As we approach 2026, the winners in automotive batteries will not be those with the loudest campaigns—but those with disciplined, data-backed Go-To-Market (GTM) execution at the retail level.

1. India’s Automotive Battery Aftermarket: What’s Actually Changing

1.1 A Replacement-Driven Market

Over 70% of automotive battery demand in India comes from replacements—not new vehicles. This creates:

- Predictable demand cycles (18–36 months)

- Strong dependence on local mechanics and retailers

- High sensitivity to availability and credit terms

Despite this, many brands still operate with OEM-style thinking, ignoring the complexity of the aftermarket.

1.2 Rise of Multi-Brand Retailers & Service Points

Battery retailers today are:

- Selling 4–7 competing brands

- Bundling batteries with tyres, lubricants, and services

- Influenced more by availability and relationship than brand advertising

This means brand loyalty is fragile—and earned only through presence and consistency.

1.3 The EV Transition Is Reshaping Expectations

While EV batteries are still OEM-dominated, they are already changing how retailers think:

- Higher technical knowledge

- Faster inventory turns

- Demand for training and support

Brands that build retailer education and visibility today will own mindshare tomorrow.

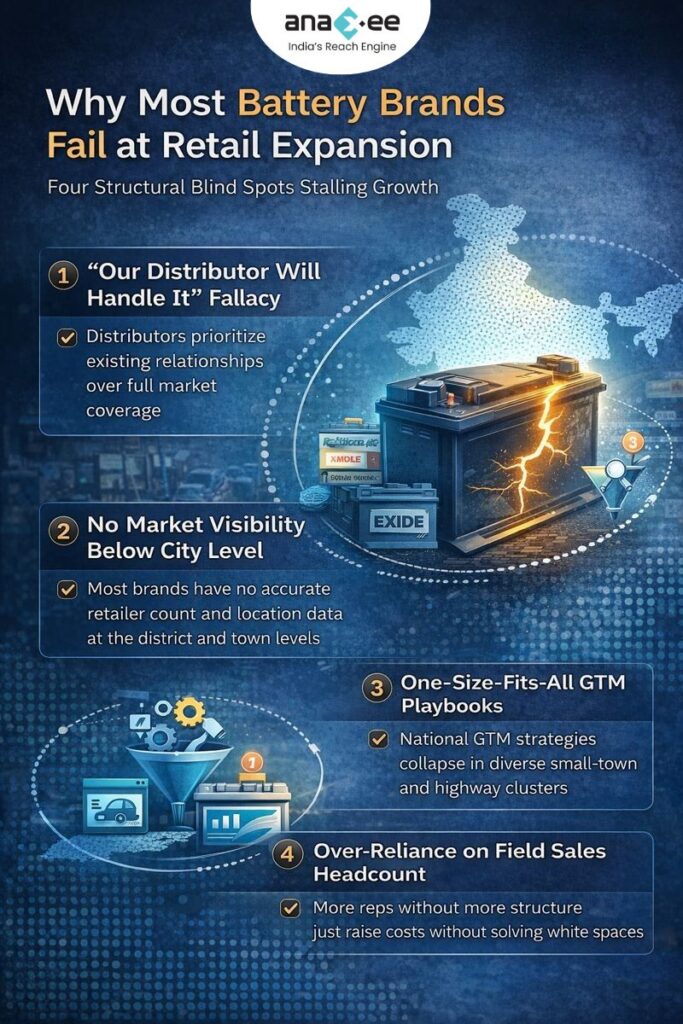

2. Why Most Battery Brands Fail at Retail Expansion

Let’s be blunt. Most failures come from four structural blind spots.

2.1 “Our Distributor Will Handle It” Fallacy

Distributors optimize for:

- Their comfort zones

- Existing relationships

- Credit risk minimization

They do not optimize for:

- Full market coverage

- New retailer discovery

- Brand-first prioritization

Result: Large white spaces within the same district.

2.2 No Real Market Visibility Below City Level

Ask most sales heads:

- How many battery retailers exist in District X?

- Which ones don’t stock your brand but stock competitors?

- Where exactly is your sales leaking?

You’ll get estimates. Not data.

2.3 One-Size-Fits-All GTM Playbooks

Urban GTM logic fails in:

- Tier 2, 3, and 4 towns

- Highway clusters

- Rural mobility hubs

Without localised execution, national strategies collapse at the last mile.

2.4 Over-Reliance on Field Sales Headcount

Hiring more feet-on-street without structure:

- Increases cost

- Reduces accountability

- Still doesn’t solve visibility gaps

Execution ≠ headcount. Execution = system.

3. The Winning Lens: GTM as a Retail Infrastructure Problem

The brands winning the automotive battery aftermarket are treating GTM as infrastructure, not campaigns.

This is where Anaxee’s FMCG-inspired GTM model becomes relevant.

4. The Anaxee GTM Framework for Automotive Batteries

Step 1: Market Mapping — Discover the Full Battery Retail Universe

Objective: Know every relevant retailer before trying to sell.

What this looks like on ground:

- Every battery shop, mechanic, inverter store mapped

- GPS-tagged, photographed, classified

- District-wise, town-wise coverage dashboards

Why it matters:

You cannot grow what you haven’t discovered.

Most brands are surprised to find 30–50% more retailers than their distributor lists show.

Step 2: Retailer Profiling — Understand Who Is Worth Winning

Not all retailers are equal.

Profiling captures:

- Brands currently sold

- Monthly battery volumes

- Replacement vs OEM mix

- Credit behaviour

- Openness to switching brands

This enables:

- Revenue potential estimation per retailer

- Priority targeting

- Smarter incentive design

Result: Sales teams stop guessing. Decisions become data-backed.

Step 3: Structured Order Taking — Convert Presence into Revenue

Once mapped and profiled:

- Trained field runners visit target retailers

- Product pitches are contextual, not generic

- Follow-ups are systematic, not random

Orders are:

- Digitally captured

- Tracked by SKU

- Linked to retailer profiles

This is where GTM becomes measurable.

5. Why This Approach Works Better Than Traditional Sales Models

| Traditional Model | Field-First GTM Model |

|---|---|

| Distributor-driven | Brand-driven |

| Relationship-based | Data-backed |

| City-focused | District-deep |

| Gut-feel expansion | White-space discovery |

| High attrition risk | System-led continuity |

6. What CMOs & CEOs Should Care About (Beyond Sales)

6.1 Predictable Expansion

You know:

- Which districts to enter next

- How much revenue they can deliver

- What resources are required

No more blind launches.

6.2 Brand Control in Fragmented Markets

Your brand presence is no longer hostage to:

- Distributor priorities

- Sales team churn

- Informal networks

6.3 Lower Cost of Growth

By replacing random field activity with structured execution:

- CAC drops

- Sales cycles shorten

- Retail stickiness improves

7. What Winning Battery Brands Will Do by 2026

- Build district-level retail intelligence

- Invest in retailer education, not just schemes

- Treat GTM as a repeatable system

- Measure success by coverage depth, not just topline growth

Conclusion:

The Aftermarket Is Won on the Ground — Not in Boardrooms

Automotive battery demand will continue to grow. But growth without control is not strategy—it’s luck.

Brands that win in the next phase will be those that:

- See their market clearly

- Execute locally

- Scale systematically

A field-first, data-backed GTM approach isn’t optional anymore.

It’s the difference between being available—and being chosen.