Distributors are the backbone of India’s automotive market.

They move stock, extend credit, and keep supply chains running.

But here’s the uncomfortable question most leadership teams avoid:

Have distributors become your only window into the market?

For many tyre, battery, lubricant, and accessory brands, the answer is yes.

And that overdependence quietly limits growth.

The Silent Shift: From Channel Partner to Information Gatekeeper

Over time, distributors often take on a second role—market narrator.

Leadership hears:

- “Retailers are price sensitive”

- “Schemes didn’t work in this region”

- “Competitor push is aggressive”

All valid inputs.

But also filtered.

Not maliciously—structurally.

Distributors optimise for:

- Cash flow

- Inventory movement

- Relationship stability

Not for deep execution diagnostics.

Why This Is Risky for Automotive Categories

Batteries: When Claim Reality Gets Softened

Battery brands rely heavily on distributors for:

- Replacement coordination

- Warranty feedback

But:

- Claim friction rarely travels upward cleanly

- Retailer frustration is diluted

- Early warning signs are missed

By the time leadership notices, trust has already eroded.

Tyres: When Risk Perception Is Misread

Tyre distributors may say:

- “Retailers are hesitant”

But hesitation can stem from:

- SKU mismatch

- Credit cycles

- Past claim issues

Without independent insight, brands treat symptoms—not causes.

Lubricants: When Habit Is Blamed on Competition

Lubricant underperformance is often explained as:

- “Mechanic loyalty”

- “Price wars”

But brands rarely see:

- Where trial failed

- Where switching stalled

- Where education never reached

Distributor-level summaries hide behavioural nuance.

Accessories: When Visibility Is Assumed, Not Verified

Accessory brands trust:

- Stock placement claims

- Display compliance updates

But without verification:

- New SKUs get buried

- Schemes leak

- Competitors occupy prime space

The Core Issue: Distribution ≠ Execution Control

Distributors are essential.

But they are not designed to provide:

- Continuous execution visibility

- Product-level diagnostic insight

- Independent verification

When brands confuse distribution strength with execution control, blind spots multiply.

How Anaxee Complements (Not Replaces) Distributors

Anaxee does not compete with distributors.

It supports the system distributors operate in.

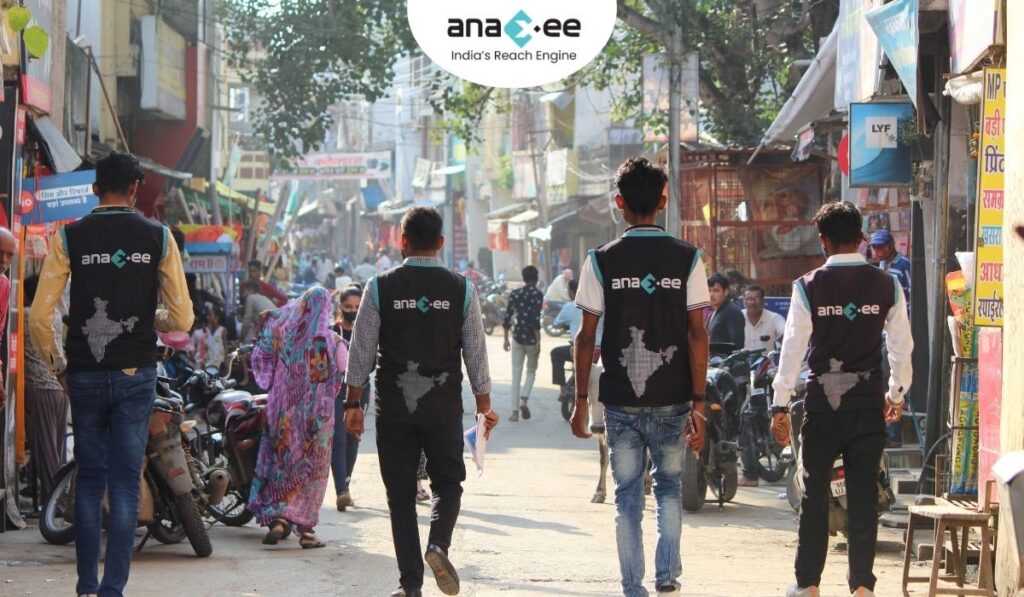

1. Independent Market Visibility

Anaxee places trained field teams at:

- Retail counters

- Mechanic clusters

- Local markets

This gives brands:

- Unfiltered retailer feedback

- Product-level resistance signals

- Competitor activity intelligence

2. Verified Execution on the Ground

Every activity is:

- Geo-tagged

- Time-stamped

- Workflow-driven

This allows leadership to:

- Validate distributor claims

- Identify gaps early

- Reduce guesswork

3. Product-Specific GTM Intelligence

Anaxee differentiates execution by product type:

- Tyres → risk & confidence building

- Lubricants → mechanic behaviour mapping

- Batteries → claim and availability validation

- Accessories → visibility and margin audits

Distributors rarely operate at this granularity.

4. Better Use of Distributor Relationships

With independent data:

- Conversations with distributors improve

- Issues become specific, not emotional

- Trust increases through clarity

Anaxee strengthens distributor ecosystems by removing ambiguity.

The Leadership Question That Matters

Ask yourself:

- Do you know what’s happening at retail this week?

- Can you identify why a district underperformed without waiting for month-end?

- Can you intervene locally without launching a national scheme?

If not, the issue isn’t distributors.

It’s overdependence.

What Brands Gain with Anaxee in the System

Brands working with Anaxee gain:

- Execution visibility beyond reports

- Faster correction cycles

- Reduced scheme leakage

- Product-level GTM clarity

Most importantly, leadership regains control without adding headcount.

Closing Thought

Distributors move your products.

But they cannot be your only lens into the market.

In India’s fragmented automotive retail landscape,

independent execution visibility is no longer optional.

Anaxee helps brands move from distributor dependence to GTM control—without breaking the ecosystem.

CTA

If your automotive brand spans batteries, tyres, lubricants, or accessories—and you want visibility beyond distributor reports,

write to sales@anaxee.com.