Biochar is one of the few carbon removal solutions that has managed to achieve scientific credibility, operational feasibility, and commercial traction at the same time. Unlike many emerging carbon removal technologies that still depend on laboratory breakthroughs or billion-dollar pilot plants, biochar is already delivering measurable removals today. Yet the economics of biochar remain widely misunderstood, even among investors and project developers who follow the climate sector closely.

The price of biochar carbon removal credits—typically ranging from $130 to $200 per ton of CO₂ removed—often appears expensive when compared with traditional carbon offsets. But the comparison is misleading. Biochar is not an avoidance credit; it is a genuine removal pathway with durability measured in centuries. Its economics reflect real permanence, real sequestration, real measurement, and real operational costs.

This blog explores the underlying dynamics that shape biochar pricing: feedstock considerations, technology choices, certification frameworks, co-product economics, market demand, insurance costs, and the early-stage nature of the carbon removal market. To understand why biochar costs what it does—and why it will likely stay within this range for the near future—you need to understand the deeper logic of the carbon removal marketplace.

The First Misunderstanding: Biochar Isn’t Competing with Forestry

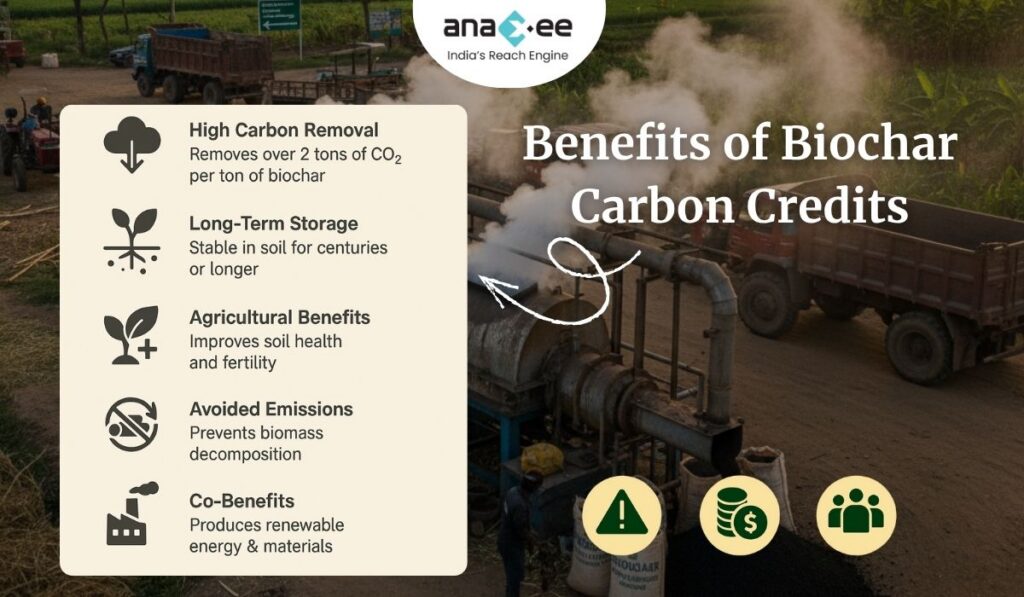

Forestry offsets are often priced between $3 and $20 per ton. From the outside, it looks irrational that biochar should command a price more than 10x or even 20x that amount. But biochar is not competing with avoided deforestation or forest restoration programs. It competes with engineered removals, not biological avoidance.

This matters because the market has begun to sharply differentiate between two categories of climate action:

- Avoidance – Preventing emissions that would have occurred.

- Removal – Actively taking CO₂ out of the air and storing it long-term.

Biochar falls squarely into the removal category. And in that category, it is one of the cheapest options available.

Direct Air Capture: $500+ per ton

BECCS: $389 per ton

Enhanced Weathering: $200 per ton

Biochar: $130–$200 per ton

Biochar, in other words, sits in the “accessible middle.” It provides high-integrity carbon removal without the extremely high operational costs of DAC or the infrastructural complexity of BECCS. That makes it one of the most investable options—but still significantly more expensive than cheap, low-permanence avoidance offsets that offer questionable climate value.

If a buyer wants removal, they must pay removal prices. Biochar, for now, is one of the most cost-effective ways to do it.

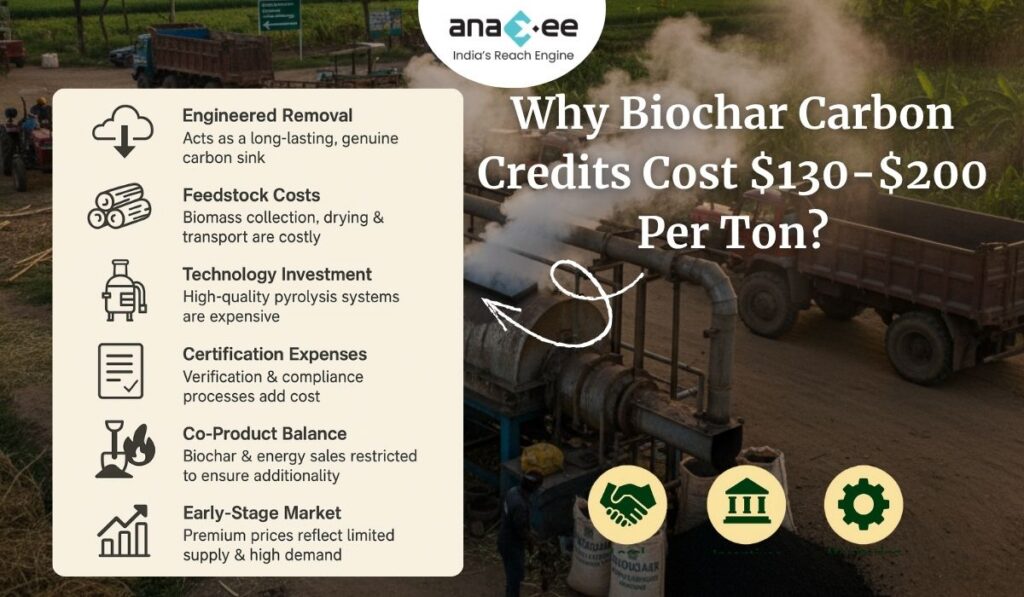

Feedstock Economics: The Cornerstone of Pricing

Every biochar project depends on biomass. However, not all biomass sources are equal. The feedstock determines:

- carbon content

- moisture level

- ash content

- transport cost

- processing cost

- emission factor

- MRV complexity

In many developing economies, biomass is abundant, but not always accessible. Collection, aggregation, sorting, drying, and transporting add significant costs. Raw feedstock may be free, but preparing it for pyrolysis is not.

Furthermore, different feedstocks create different types of biochar with varying carbon content and stability. A highly stable char justifies a higher carbon credit price because it delivers more durable sequestration. But this often requires better technology and better feedstock preparation.

Biochar pricing is thus shaped by agricultural economics as much as by climate science.

The Technology Variable: Cheap Equipment Is Never Cheap

Many new developers assume that lowering capital expenditure is the best way to reduce credit prices. They search for low-cost pyrolysis kilns, modular units with minimal automation, or small-scale equipment that promises quick deployment.

This strategy almost always backfires.

Cheap systems fail more often. They have higher downtime. They produce inconsistent char. They require more manual intervention. They lack data logging. They are harder to certify. And they rarely meet the strict quality expectations of premium removal buyers such as Microsoft or Frontier Climate.

The most efficient systems today involve controlled pyrolysis, automated feeding, process monitoring, and high thermal efficiency. But these systems are expensive—not because of unnecessary add-ons, but because precision and reliability matter when permanence is at stake.

Biochar pricing reflects these technological demands. Lower capex equipment often results in higher operational costs, weaker certification outcomes, and lower credit prices. Paradoxically, premium technology ends up reducing long-term costs and raising credit revenue.

Certification Costs: High Integrity Is Expensive

Certification is a quiet but powerful force shaping biochar pricing.

The most respected standards—Puro.earth, Isometric, Carbon Standards International—require:

- independent testing

- feedstock documentation

- process audits

- sampling & lab analysis

- permanence modeling

- MRV integration

- third-party verification

This level of rigor builds trust among buyers. But it also adds cost.

Developers must maintain meticulous records, run consistent operations, and work with auditors. For small developers, certification costs can be disproportionately high. But without certification, credits cannot be sold at premium removal prices, forcing the developer into the low-integrity segment of the market where prices are far lower and demand is fragile.

In other words, paying more for certification is not optional—it’s essential.

Co-Product Economics: The Double Revenue Model

One of biochar’s great advantages is that it can produce multiple revenue streams:

- Carbon Credits

- Biochar for soil and agriculture

- Heat or energy generation

However, this advantage comes with a regulatory nuance. If a project is too profitable through co-products alone, it may lose eligibility for carbon credits. Standards insist that carbon crediting must be essential for project viability, not merely a bonus.

This creates a tricky balance:

Developers must monetize co-products—but not so aggressively that they erase additionality.

The pricing of carbon credits must reflect this balance. If a project underprices credits, it might appear profitable without them and risk disqualification. If it overprices them, it might lose market demand.

This balancing act is a key reason why the market has converged around the $130–$200 range. Investors see this pricing band as sufficient to anchor viability without undermining integrity.

Buyer Dynamics: The Market Is Not Fairly Distributed

Another force shaping biochar pricing is the unusual buyer concentration. A small group of companies—Microsoft, Stripe, Shopify, Google, Meta, Frontier Climate—dominate demand. They are not price-sensitive in the way traditional buyers are. They prioritize:

- quality

- permanence

- traceability

- MRV accuracy

- supplier credibility

They are willing to pay a premium for reliable carbon removal. But this also means the market has not yet “normalized.” Prices reflect early adopters who value leadership, not mass-market buyers who seek cost efficiencies.

When the buyer landscape widens—especially into compliance markets—pricing will stabilize further. But for now, premium demand drives premium pricing.

Forward Selling: Discounting the Future

In the early phase of a project’s life, developers often sell credits forward. Buyers pay today for deliveries in future years. This provides capital for construction and operations, but it also demands a discount. Buyers assume risk, so they expect lower prices.

These discounts usually fall in the 15–30% range depending on:

- risk profile

- delivery horizon

- technology reliability

- certification plan

- developer track record

Forward selling does not necessarily lower the market price; it simply shifts pricing power toward buyers during early-stage development.

Insurance: The New Cost Driver

Insurance has recently emerged as a critical layer in biochar project economics. High-integrity buyers demand protection against:

- non-delivery

- disasters

- methodology changes

- operational failure

Specialized insurance—led by companies like Kita—is helping biochar projects become more bankable. But insurance premiums add to project cost, and thus are reflected in the final carbon credit price.

The industry is still accumulating risk data. Over time, as risk pools grow, insurance costs should fall. But for now, they remain a meaningful economic factor.

Will Biochar Prices Fall Over Time?

There is a common expectation that carbon removal prices will drop as technologies mature. That is true for DAC and synthetic processes with economies of scale. But biochar is different. It is anchored in:

- biomass availability

- rural logistics

- labor costs

- energy inputs

- certification cycles

These factors do not drop in cost dramatically. Biochar may get more efficient, but not radically cheaper. The future price floor will likely stabilize around $110–$150 per ton—not because companies want higher margins, but because the inputs will never mimic silicon-based cost curves like solar and batteries.

In short, biochar pricing will mature, but not collapse.

Conclusion: Biochar Pricing Reflects Reality, Not Hype

The price of biochar removal credits signals something important: real carbon removal has real costs. It does not rely on speculative forest accounting or questionable baselines. It requires equipment, feedstock, certification, MRV, insurance, and reliable operations.

Those costs are built into the price—not because the industry wants to be expensive, but because the climate challenge demands durable solutions.

Biochar sits today where solar sat two decades ago—proven, credible, and ready to scale, but constrained by early-stage economics. As technology standardizes, as insurance reduces risk premiums, and as compliance markets absorb removal pathways, pricing will stabilize.

But biochar will not become “cheap.” Nor should it. What it offers is too valuable to be sold as a commodity offset. It is a tool for real, verifiable, permanent carbon removal.

The world needs that, and biochar developers must build business models that embrace the true cost of integrity.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations. Connect with Anaxee atsales@anaxee.com