Biochar is gaining attention as one of the most credible forms of carbon dioxide removal. It is durable, low-tech, and has immediate co-benefits for soil, crops, and land. Yet despite increasing global awareness, biochar sits in a strange and temporary limbo — fully embraced by the voluntary carbon market but still locked out of compliance markets.

That reality shapes everything about how biochar is financed, contracted, sold, and scaled today.

The voluntary carbon market (VCM) has become the proving ground for engineered carbon removals. But it is a marketplace operating under incomplete rules, asymmetric power dynamics, emerging standards, and an unusual concentration of buyers. In the middle of this sits biochar — a climate solution that needs massive scale but must first survive a volatile, undercapitalized market where its strongest demand is still voluntary.

This is both an opportunity and a risk. And developers who misunderstand the nature of this market often struggle — not because the science is uncertain, but because the market mechanics are unforgiving.

This blog explores why the VCM matters, how it works for biochar, why supply is still limited despite high enthusiasm, and what it will take to break through the current structural barriers.

The Voluntary Carbon Market: A Parallel System

The global carbon economy is split into two worlds.

One is mandatory and regulated — the compliance markets. These are enormous, government-enforced cap-and-trade systems that require companies to buy credits to comply with emissions laws.

The other is completely optional — the voluntary carbon market. Here, companies purchase carbon credits not because they are forced to, but because they want to claim carbon neutrality, net-zero alignment, or climate leadership.

Biochar, for now, exists only in the voluntary space.

That distinction matters. The size of the voluntary market is still small — about US$1 billion, compared to compliance systems worth over US$800 billion. The compliance side is backed by legislation, sovereignty, and enforcement frameworks. The voluntary side is powered by reputation, marketing goals, sustainability reporting — and to some extent, genuine climate responsibility.

For biochar developers, that means every buyer is optional. Every purchase is discretionary. Every agreement is subject to the buyer’s internal policies, budgets, and shifting priorities.

This creates a unique tension:

Biochar is permanent, durable, and scientifically strong.

But it is trapped in a temporary, unstable marketplace.

The Supply-Demand Paradox

Biochar demand is rising. The largest corporations in the world have already committed to carbon removal, not just avoidance. They are no longer satisfied with offsets tied to forest protection or avoided emissions. They want removals — and biochar is one of the first removals technologies that is both real and affordable.

But here is the paradox:

Biochar is in high demand.

Yet biochar credits are still scarce.

By mid-2025, research showed that only 11% of industrial biochar credits for 2025 were still unclaimed. That’s how quickly forward contracts are snapped up — often years in advance.

The shortage is real, but it is not because biochar cannot grow. It is because:

Developers lack financing.

Financing requires contracts.

Contracts require scale.

Scale requires financing.

This is the classic chicken-and-egg cycle of climate tech. No one wants to pay for scale, but everyone wants large-scale supply.

The Buyer Monopoly

In most markets, early buyers stimulate growth and then fade into a broader customer base. But in biochar, something unusual has happened: a handful of ultra-large companies dominate the entire space.

Microsoft

Google

Meta

Shopify

Stripe

McKinsey

Alphabet

Frontier Coalition (collective)

These companies account for nearly 90% of all purchased biochar removal credits.

That much concentration comes with consequences.

Smaller buyers struggle to enter because large corporations buy almost all available supply through multi-year forward commitments. Mid-market buyers often cannot purchase in quantities small enough to be meaningful. And developers end up relying heavily on a very small group of customers — giving those customers enormous pricing leverage.

This is not a healthy market. It is a mature bottleneck.

Why Most Biochar Contracts Are Too Short

A typical biochar offtake agreement runs for about three to five years. On paper, that looks fine. But in reality, it is a structural problem.

Carbon removal infrastructure needs long-term capital — 7, 10, even 12 years.

Banks will not finance a project with only three years of revenue certainty. Investors want payback periods that line up with the capital time horizon. A short contract weakens the unit economics and increases the discount rate on forward payments, making projects look less viable even when they are technically sound.

This explains why many developers are still stuck at sub-industrial scale. Their contract horizons are too short to support debt, and too risky to support equity.

In contrast, look at renewable energy. Wind and solar projects became bankable only when PPAs (Power Purchase Agreements) stretched into 10–15 year horizons.

Biochar needs that same evolution.

Pre-Payment Isn’t a Perfect Solution

Many biochar developers try to solve this financing gap by selling credits in advance. This is understandable — it helps fund construction, equipment, certification, and operations.

But buyers know this. And they negotiate accordingly.

Forward agreements often come with discounts ranging from 15% to 30% below spot price. That discount is meant to compensate for risk, uncertainty, and capital being locked up early instead of used elsewhere. But for developers, it can cripple future economics.

The project may become operational, only to discover that revenue is locked in at a level that doesn’t justify scale.

Once again, the market structure punishes early developers for the same reason it claims to support them.

Certification: The Quiet Gatekeeper of Value

Every credit must be certified. And for biochar, the certification standard matters.

Today, the most respected include:

- Puro.earth

- Isometric

- Carbon Standards International

- Carbonfuture (MRV layer)

These bodies act as trust authorities. Without them, biochar credits would not sell at premium prices, nor would they qualify for carbon removal categories instead of carbon avoidance.

But certification does more than authenticate climate value.

It signals quality.

It supports insurance.

It enables pricing power.

It attracts better buyers.

It anchors investor due diligence.

Developers who delay certification or choose low-integrity pathways usually find themselves shut out of serious capital.

The Microsoft–Exomad Deal: A Turning Point

One of the most significant deals in the biochar market happened quietly in 2025. Microsoft signed a multi-year, million-ton removal agreement with Exomad Green.

This is important not just because of volume, but structure.

The deal:

- Spans 10 years

- Uses Puro.earth standard

- Relies on trusted MRV via Carbonfuture

- Includes feedstock traceability

- Integrates environmental safeguards

- Provides revenue security

It shows what a mature biochar agreement looks like.

A contract that doesn’t just buy credits —

it enables scale.

The Future: Will Biochar Enter Compliance Markets?

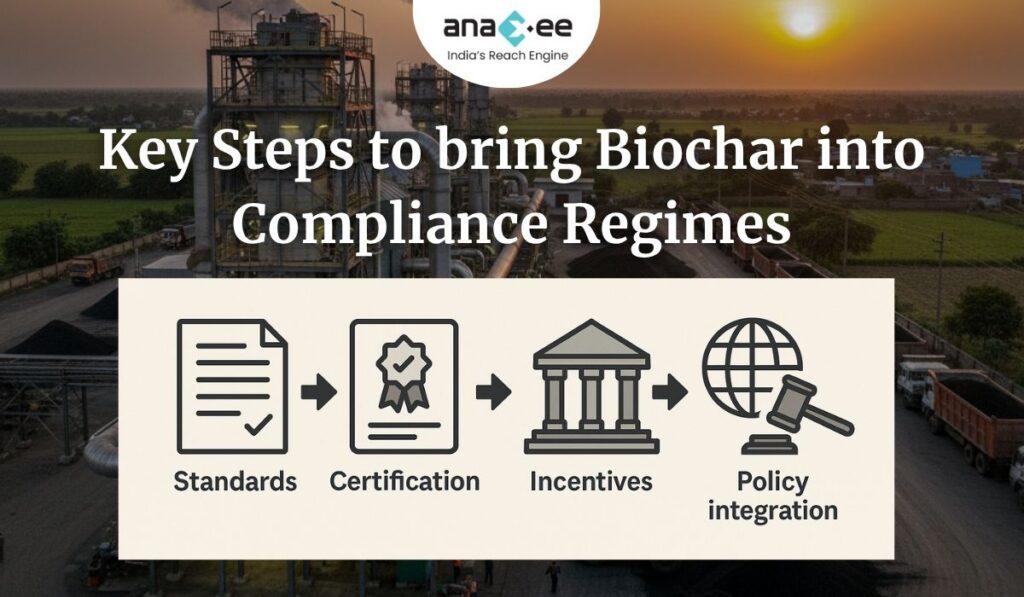

Today, compliance systems do not accept engineered removals like biochar. The rules simply aren’t written for it — yet.

But governments are now under pressure to:

- expand allowable credits

- include durable carbon removal

- integrate with national carbon accounting

The EU is already considering CDR pathways.

The UK has released GGR frameworks.

North America is preparing policy models.

Sooner or later, compliance markets will open — at least partially — to removal pathways like biochar.

And when they do, the shift will be enormous.

Instead of optional climate spending, biochar will become a mandatory emissions tool. Instead of niche climate budgets, national compliance budgets will apply. Instead of voluntary demand hoping for permanence, legal demand will enforce it.

Developers who survive the voluntary era will thrive in the compliance era.

How Developers Can Position Themselves Now

There is no point waiting for the policy shift. By the time it arrives, the market will already be structured around the winners of today.

Developers who want to scale must:

- build long-term buyer confidence

- standardize contracts

- over-invest in MRV and certification

- use insurance as a credibility lever

- aggregate projects to diversify risk

- negotiate offtake agreements that match project lifespans

- find buyers beyond the “Big 8”

- diversify revenue streams beyond credits

In other words:

Act like a future compliance market participant — now.

Conclusion

Biochar is not just competing with other carbon credits. It is competing with every future pathway for how the world removes carbon.

It is competing for capital.

It is competing for trust.

It is competing for regulatory acceptance.

The voluntary carbon market has given biochar a launchpad. But it is not a destination. It is a stepping stone — messy, imperfect, unstable, yet absolutely necessary.

Developers who understand the market’s asymmetry, anticipate its evolution, and build accordingly will be the ones who convert supply constraints into scale advantages.

The next phase of biochar growth will not be about proving the science.

It will be about proving readiness for the carbon economy that is coming next.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations. Connect with Anaxee atsales@anaxee.com