If you’re a National Sales Head, CEO, or Business Leader in tractors, automotive batteries, tyres, lubricants, home appliances, or agri-inputs, this sentence will make you uncomfortable:

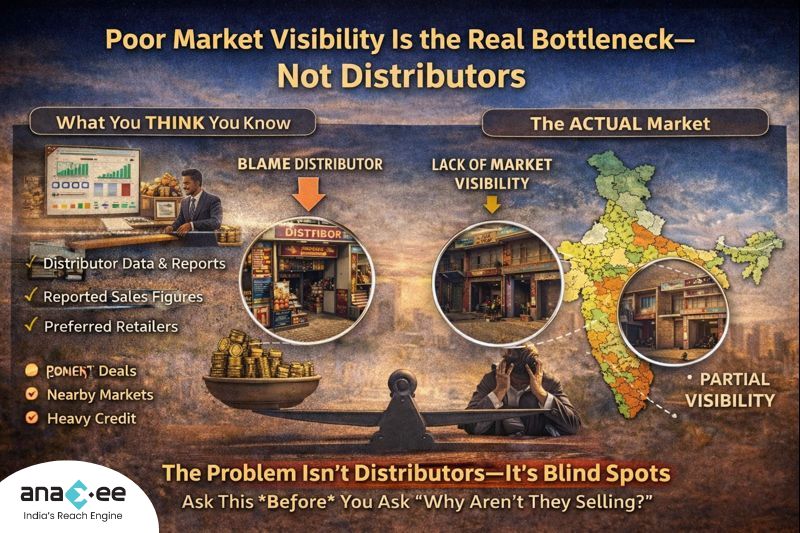

Most brands that blame distributors don’t actually know their own market.

Not approximately.

Not strategically.

Actually.

And that blind spot quietly costs you growth every single month.

The Default Scapegoat in Indian Sales Reviews

When sales numbers stall, the conversation almost always follows a familiar script:

- “Distributor is not active enough.”

- “They are pushing competing brands.”

- “They’re focusing only on easy retailers.”

- “Coverage is weak in interior markets.”

None of this is entirely wrong.

But it’s also not the root cause.

Because distributors don’t control the market.

They only operate inside the slice of the market you’ve made visible.

The Question No One Asks (But Should)

Before asking why a distributor isn’t performing, leadership should ask:

Do we actually know how many retailers exist in this district?

Most brands don’t.

They know:

- How many retailers place orders

- How many retailers does the distributor prefer

- How many retailers appear in reports

They don’t know:

- How many retailers exist but were never approached

- How many competitors sell exclusively

- How many dropped off quietly

- How many are invisible because no one tracks them

So performance reviews are conducted on partial reality.

The Distributor Visibility Trap

Let’s be brutally honest.

Most distributor MIS and secondary sales reports show only:

- Active accounts

- Billing history

- Order values

They do not show:

- Non-selling outlets

- Lost retailers

- Competitor-locked shops

- Missed micro-markets

Which means leadership is making decisions based on a filtered view of the market.

And when growth slows, the only visible lever left to pull is:

“Push the distributor harder.”

That never works for long.

Why Distributors Behave the Way They Do (And Why That’s Rational)

This isn’t a loyalty issue.

It’s an incentive issue.

Distributors naturally prioritize:

- Faster-paying retailers

- Nearby markets

- Higher-margin SKUs

- Lower operational friction

From their perspective, this is good business.

From the brand’s perspective, this creates:

- Patchy coverage

- Weak presence in long-tail markets

- Over-dependence on a few high-volume outlets

The misalignment is structural—not personal.

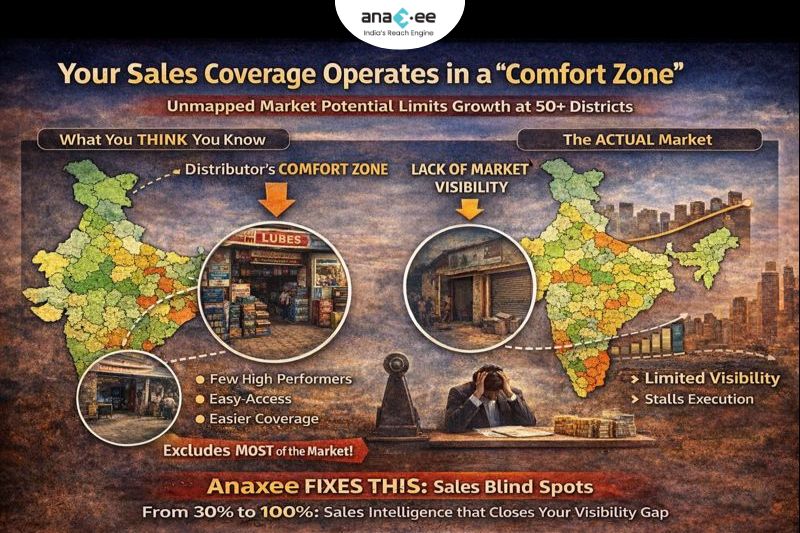

The Hidden Cost of “Comfort Coverage”

Most brands unknowingly operate inside what we can call comfort coverage.

This includes:

- 20–30% of retailers

- The easiest routes

- The most responsive accounts

Sales numbers look acceptable.

Dashboards look reassuring.

Leadership assumes the district is “covered.”

But the real market lies outside this comfort zone.

And because it’s invisible, it’s never addressed.

Why Hiring More Salespeople Doesn’t Fix This

At this point, brands usually try one of two things:

- Hire more feet-on-street

- Increase distributor pressure

Both fail for the same reason.

They increase activity, not visibility.

Without knowing:

- Who to visit

- Why to visit

- What opportunity exists

More people simply mean:

- More cost

- More noise

- Same blind spots

The problem isn’t effort.

It’s market intelligence.

What “True Market Visibility” Actually Means

Real visibility is not a PowerPoint estimate.

It means knowing, district by district:

- Every addressable retailer

- What they sell today

- Which brands dominate shelf space

- Where your brand is absent

- Where reactivation is possible

Until you have this, distributors will always appear to be the problem—because they’re the only visible variable.

This Is Where Anaxee Changes the Game

Anaxee doesn’t replace distributors.

It doesn’t compete with sales teams.

It fixes the invisible layer between strategy and execution.

1. Full Market Mapping (Not Sampling)

Anaxee maps every relevant retail outlet in a district—not just those already selling your brand.

This immediately answers:

- Actual market size

- Real penetration

- Untapped zones

Suddenly, conversations shift from blame to clarity.

2. Retailer Profiling That Goes Beyond Billing

Each retailer is profiled for:

- Brands sold

- Product mix

- Purchase source

- Business potential

This turns “shops” into actionable sales units, not just names on a list.

3. Structured Order-Taking via Digital Runners

Anaxee’s Digital Runners:

- Visit uncovered and under-served retailers

- Reactivate lapsed accounts

- Improve pitch quality using data

- Feed real-time insights back to dashboards

This creates a neutral execution layer that benefits both brand and distributor.

4. Distributor Empowerment (Not Surveillance)

When distributors see:

- Clear opportunity maps

- Identified white spaces

- Data-backed visit plans

They sell more.

Because now effort is targeted, not exploratory.

What Brands Usually Discover (And Don’t Expect)

Once visibility improves, leadership often realizes:

- “Our distributor wasn’t underperforming—we were under-seeing.”

- “We were fighting for depth when width was missing.”

- “Growth didn’t stall; it was never fully accessed.”

This is the moment when sales conversations mature.

From:

“Why aren’t they selling?”

To:

“Where exactly should growth come from next?”

The Real Bottleneck Is Invisible—Until You Fix It

Distributors don’t limit growth.

Blind spots do.

Sales teams don’t fail execution.

Unmapped markets do.

Strategy doesn’t break at scale.

Visibility does.

Fix that—and distributors stop looking like the enemy.

If your brand is:

- Dependent on distributor reports

- Unsure about real retail coverage

- Expanding districts but not depth

It’s time to see your market clearly.

Write to sales@anaxee.com

Tell us your category and current footprint.

We’ll help you identify what’s missing—not who to blame.

🔹 FAQs:

1. Are distributors responsible for slow sales growth?

Distributors optimize for efficiency and margin. Slow growth usually comes from poor market visibility and incomplete retail coverage.

2. Why do brands struggle to see their full market?

Most brands rely on distributor reports, which only show active retailers and hide untapped or lapsed outlets.

3. How does market visibility impact sales execution?

Without knowing where opportunities exist, sales teams and distributors focus on comfort zones, limiting growth.

4. Can brands grow without changing distributors?

Yes. Improving market mapping, retailer profiling, and execution systems often unlocks growth without distributor changes.

5. How does Anaxee improve distributor performance?

By providing full market visibility, structured visits, and data-backed insights that help distributors sell more effectively.