Introduction: The Big Promise vs The Quiet Doubt

Carbon markets frequently promote a compelling narrative:

🌱 Farmers adopt regenerative practices

🌱 Soil captures carbon

🌱 Credits are issued

🌱 Farmers earn new revenue

It sounds elegant.

But beneath that promise lies a persistent doubt:

Is carbon income meaningful, reliable, and worth the effort for farmers?

This question matters because:

✔ Farmer participation drives supply

✔ Supply credibility drives buyers

✔ Buyer trust sustains markets

If farmer economics don’t work, projects stall regardless of climate ambition.

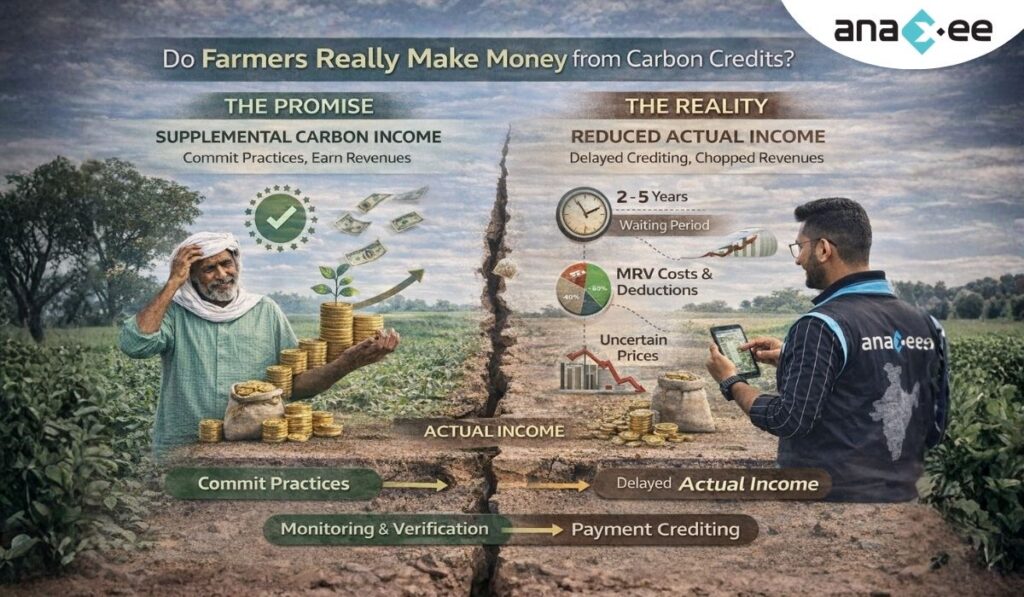

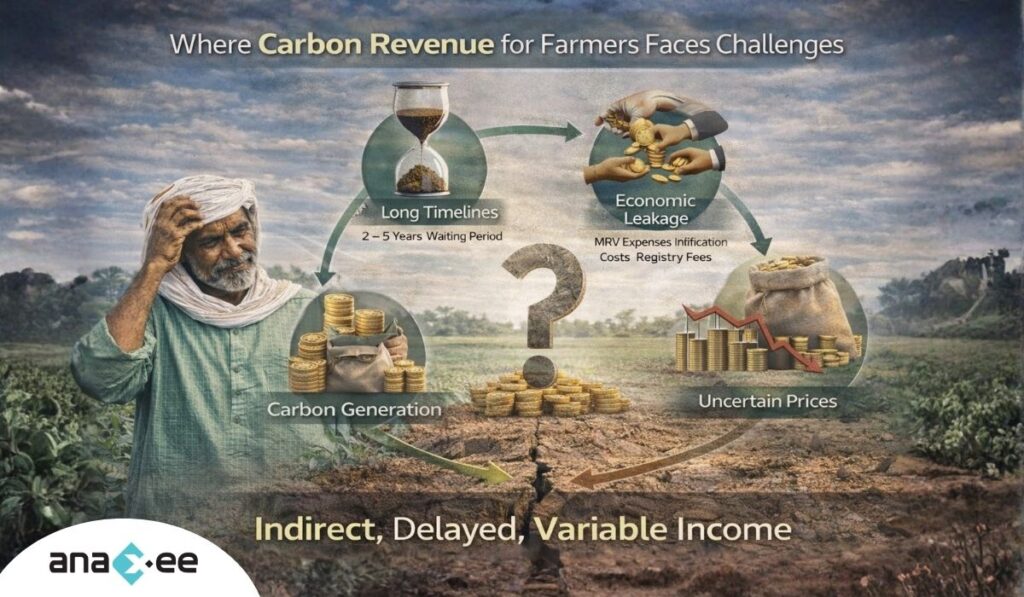

1️⃣ Where Farmer Revenue Actually Comes From

Farmers do not get paid for practices directly.

They get paid for verified carbon outcomes, influenced by:

✔ Soil carbon sequestration

✔ Emissions reductions

✔ Avoided emissions

✔ Project credit issuance

Revenue flow:

Carbon credit sale → Project developer → Revenue share → Farmer

Key implication:

👉 Farmer income is indirect, delayed, and variable

2️⃣ The Economic Reality Most Discussions Skip

Let’s break the mechanics honestly.

📉 Revenue Is Not Immediate

Agriculture carbon projects typically involve:

⏳ Baseline establishment

⏳ Adoption period

⏳ Monitoring cycles

⏳ Verification

⏳ Credit issuance

Farmers often wait:

👉 2–5 years before first payment

Mismatch:

Short-term farm economics vs long-term carbon timelines

📉 Revenue Per Farmer Can Be Modest

Carbon generation per hectare depends on:

🌱 Soil type

🌱 Climate

🌱 Practice intensity

🌱 Baseline carbon levels

Typical ranges (varies widely):

Smallholder farms may generate:

👉 Fractional credits annually

Which translates to:

💰 Modest per-year payouts unless aggregated at scale

📉 Costs Eat into Gross Revenue

Project economics must absorb:

✔ MRV costs

✔ Soil sampling / modeling

✔ Data collection

✔ Verification expenses

✔ Registry fees

✔ Buffer reserves

What looks like attractive gross revenue often shrinks after deductions.

3️⃣ Why Some Farmers Feel Disappointed

Disappointment rarely stems from carbon science.

It stems from expectation misalignment.

Common friction points:

❌ Overpromised income projections

❌ Poor explanation of timelines

❌ Unclear revenue-sharing terms

❌ Delayed issuance

❌ Verification setbacks

Result:

👉 Farmer disengagement

👉 Trust erosion

👉 Adoption decline

Carbon projects are fragile if farmer trust breaks.

4️⃣ When Carbon Income Works for Farmers

Carbon revenue becomes meaningful when projects ensure:

✔ Realistic Income Framing

Instead of:

🚫 “Carbon will transform your income”

Projects must communicate:

✔ Supplemental revenue

✔ Long-term benefit

✔ Variability acknowledgment

Expectation management = retention strategy

✔ Low Farmer Friction

Farmers resist projects that add:

⚠️ Complex paperwork

⚠️ Frequent disruptions

⚠️ Unclear requirements

Successful projects integrate into:

🌾 Existing farm routines

🌾 Local advisory systems

✔ Strong Aggregation Models

Individual smallholder economics are limited.

Aggregation unlocks:

📈 Scale efficiencies

📈 Lower per-unit MRV costs

📈 Better buyer access

✔ Reliable Monitoring & Payments

Nothing destroys credibility faster than:

❌ Missed payments

❌ Long unexplained delays

Predictability matters more than peak payout.

🚀 Where Anaxee Changes the Economic Equation

Agriculture carbon economics often fail at execution, not theory.

Anaxee’s value directly influences farmer viability.

🔹 Reducing MRV Cost Burden

MRV is one of the largest cost centers.

Anaxee’s:

✔ Distributed field network

✔ Digital workflows

✔ Geo-tagged evidence

Help lower:

📉 Monitoring inefficiencies

📉 Repeated verification errors

Improving net revenue potential.

🔹 Improving Farmer Retention

Farmer dropout = economic leakage.

Anaxee strengthens:

✔ Continuous engagement

✔ Local communication

✔ Data-backed follow-ups

Which protects:

📈 Adoption continuity

📈 Credit generation stability

🔹 Enabling Smallholder Aggregation

Fragmented farms = fragmented economics.

Anaxee supports:

✔ Farmer clustering

✔ Standardized onboarding

✔ Field validation

Making scale financially feasible.

🔹 Accelerating Verification Readiness

Verification delays postpone revenue.

Anaxee’s structured data systems improve:

✔ Audit readiness

✔ Documentation reliability

✔ Evidence traceability

Reducing issuance bottlenecks.

🔹 Bridging Trust Gaps

Farmers trust:

👤 People → not platforms

Anaxee’s last-mile presence builds:

✔ Relationship continuity

✔ Expectation clarity

✔ Engagement stability

5️⃣ The Most Important Insight

Carbon income alone rarely justifies adoption.

But combined benefits often do:

✔ Soil health improvement

✔ Input cost reduction

✔ Yield stability

✔ Water retention

✔ Risk diversification

✔ Supplemental carbon revenue

Smart projects frame carbon as:

👉 Part of a resilience strategy

Not a miracle income stream.

6️⃣ Risks That Still Need Acknowledgment

Even well-designed projects face:

⚠️ Credit price volatility

⚠️ Methodology revisions

⚠️ Reversal risks

⚠️ Climate variability

⚠️ Policy shifts

Ignoring risks weakens farmer confidence later.

Transparency builds durability.

7️⃣ Strategic Implication for Carbon Developers

If farmer economics are weak:

❌ Adoption stalls

❌ Data quality declines

❌ Credits underperform

❌ Buyers hesitate

Projects must design for:

✔ Farmer experience

✔ Cash flow timing

✔ Engagement simplicity

✔ MRV efficiency

✔ Trust continuity

Conclusion: Carbon Income Is Real — But Conditional

Yes.

Farmers can earn from carbon credits.

But outcomes depend on:

✔ Realistic projections

✔ Strong MRV systems

✔ Efficient execution

✔ Transparent revenue sharing

✔ Long-term engagement

Carbon finance is not automatic income.

It is engineered income.

And execution-focused partners like Anaxee help ensure:

🌱 Lower friction

🌱 Stronger data

🌱 Faster verification

🌱 Higher credit integrity

🌱 Better economic sustainability

Because ultimately:

If farmers don’t benefit, carbon markets don’t scale.