1. Why Agriculture Is Poised for High-Value Carbon Credits

Agriculture contributes significantly to global greenhouse gas emissions but also holds tremendous potential as a carbon sink. By adopting sustainable and regenerative practices that reduce emissions and sequester carbon, farms can transform their operations into climate solutions — and earn carbon credits that have real monetary value in voluntary and compliance markets.

A high-value carbon credit in this context is not just about earning revenue — it’s about generating credits that are verified, robust, permanent, and impactful, meeting buyer expectations for quality and corporate sustainability commitments.

2. Understanding Agricultural Carbon Credits

At its core, a carbon credit represents one tonne of CO₂e reduced or removed through an activity that would not have occurred otherwise. In agricultural contexts, credits are typically associated with practices that:

- Increase soil organic carbon (SOC) through conservation or regenerative methods

- Reduce methane emissions from rice paddies or livestock management

- Enhance biomass carbon via agroforestry or cover cropping

Once these activities are implemented, monitored, and verified, credits can be sold into the carbon markets.

These credits are increasingly attractive because they both help climate mitigation and support broader sustainable development outcomes — for soil health, water retention, biodiversity, and farmer livelihoods.

3. What Makes a Carbon Credit “High-Value”?

Not all carbon credits are created equal. A high-value credit is typically characterised by:

• Additionality: The carbon benefits must stem from practices that wouldn’t have occurred without carbon finance.

• Robust MRV: Measurement, Reporting & Verification must be rigorous and transparent, relying on credible data and independent assessment.

• Permanence: Carbon sequestration should endure over time, avoiding reversal.

• Sustainable Co-Benefits: Practices should deliver social, environmental and economic value beyond carbon alone.

From buyers’ perspectives, credits that score high on these dimensions command a premium price because they reliably support climate targets and corporate net-zero commitments.

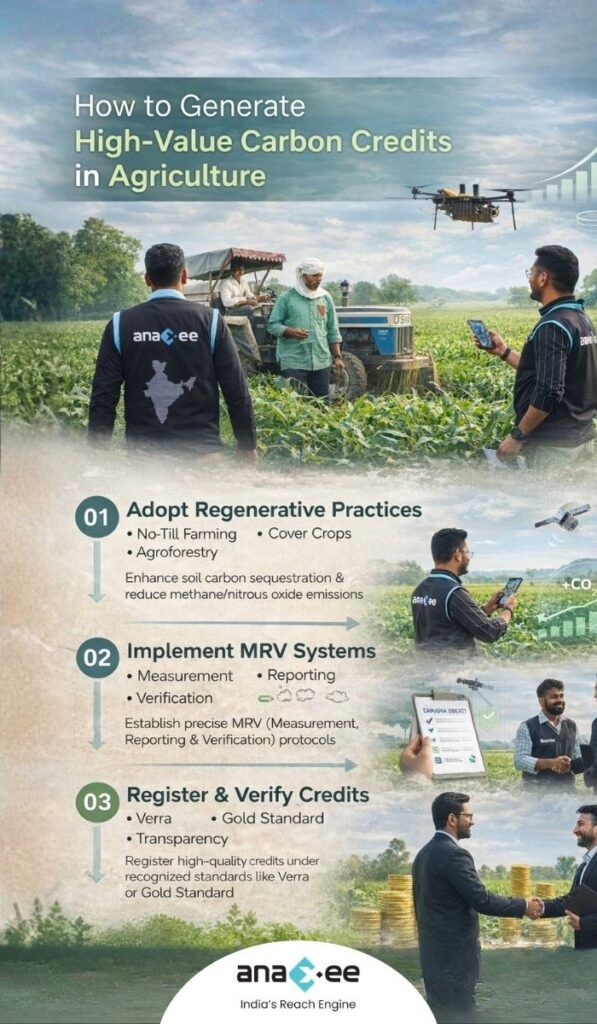

4. Pathways to Generate High-Value Carbon Credits in Agriculture

a. Soil Carbon Sequestration (No-Till, Cover Crops)

Soil organic carbon can be significantly increased through practices like no-till farming, diverse crop rotations, and cover cropping. These methods minimize soil disturbance, enhance carbon uptake, and improve long-term soil health — creating measurable sequestration that can be translated into credits.

b. Agroforestry & On-Farm Tree Integration

Agroforestry integrates trees with crop or livestock systems, boosting carbon stored both above and below ground. This strategy adds permanence and biodiversity co-benefits that enhance credit value and market appeal.

c. Methane & Nitrous Oxide Reductions

Cultivation methods such as optimized rice water management or improved manure handling can reduce potent greenhouse gases like methane or nitrous oxide, opening additional streams for generating tradable credits.

d. Innovative Soil Amendments (e.g., Biochar)

Emerging practices like incorporating biochar into soil hold promise for durable carbon storage — often beyond what traditional soil carbon methods achieve — and are increasingly sought after in carbon markets because of their permanence and high-potential pricing.

5. The Role of Measurement, Reporting & Verification (MRV)

MRV is the backbone of credible carbon credit generation. Whether using field sampling, remote sensing, digital farming tools, or a mix of methods, rigorous MRV ensures that credits reflect real climate action and builds trust with buyers. Without strong MRV, credits are often discounted or rejected by informed buyers.

Leading standards like Verra’s VCS or Gold Standard define robust MRV protocols, helping quality credits command higher market prices and wider corporate uptake.

6. Market Dynamics: Where High-Value Credits Sell Best

Agricultural carbon credits are increasingly part of the voluntary carbon market where corporations buy credits to meet net-zero pledges, sustainability goals, or ESG targets. Premium buyers look for credits that signal transparency, co-benefits, and long-term impact, often paying well above the market average because the credits reflect meaningful climate outcomes.

Factors that influence price include:

- Rigour of verification

- Duration and permanence of sequestration

- Co-benefits (soil health, livelihoods)

- Standard used (e.g., Gold Standard, Verra)

As markets mature, high-quality agricultural carbon credits can command significant premiums relative to lower-integrity offsets.

7. Challenges & Risks in Agriculture Carbon Markets

Despite opportunity, barriers remain:

- Smallholder farmers may lack data or resources for rigorous MRV.

- Policy uncertainty and measurement gaps can delay credit issuance.

- Climate variability (droughts, floods) can impact actual sequestration outcomes.

These challenges underline the importance of project facilitation, digital tools, and structured support for farmers and project developers alike.

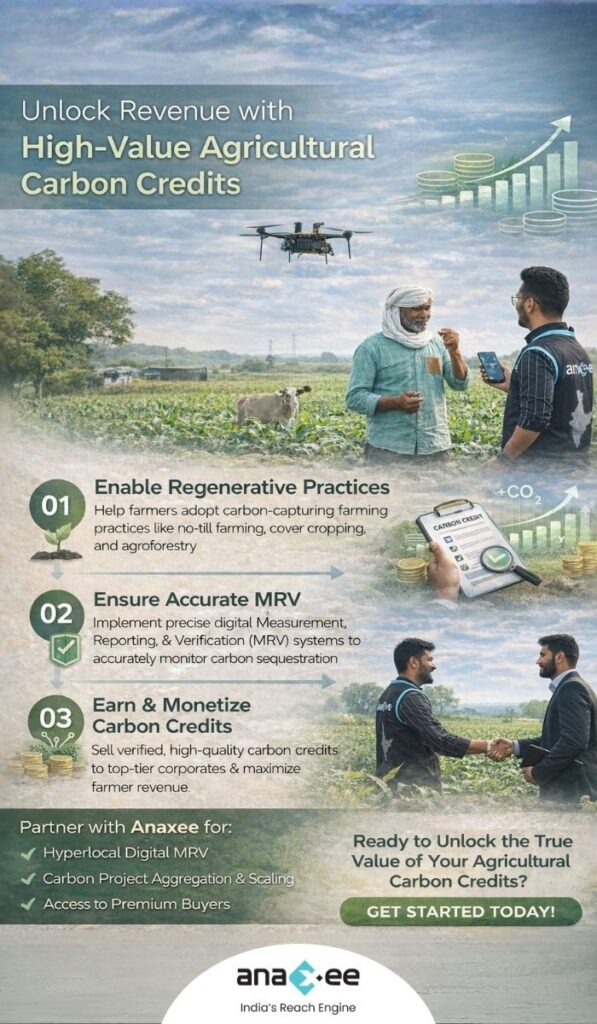

8. Where Anaxee Adds Strategic Value

At Anaxee, we position ourselves as end-to-end facilitators that bridge the gap between agricultural activities and carbon market monetization.

• MRV & Digital Integration

Anaxee deploys hyper-local data collection tools, satellite/remote sensing integration, and proven MRV workflows to ensure repeatable, transparent carbon accounting — a core differentiator in commanding high-value credits.

• Project Design & Execution

We help agribusinesses and farming communities design carbon projects that meet leading standards (Verra, Gold Standard), embed co-benefits, and align with credible carbon programs.

• Aggregation & Scaling

Smallholder fragmentation in agriculture is a major market hurdle. Anaxee’s aggregation expertise unlocks economies of scale, enabling communities to participate in high-value markets effectively.

• Market Access & Buyers Network

Through established corporate relationships and market insights, Anaxee helps farmers and project owners access premium buyers — maximizing revenue potential and long-term sustainability value.

9. Real-World Signals & Emerging Trends

India and other markets are experiencing pilot programmes that integrate science-based carbon credit models for farmers, leveraging digital MRV and partnerships with academic and government entities.

This signals growing institutionalisation of agricultural carbon markets and reinforces demand for high-quality credits.

10. Conclusion: Unlocking the Full Potential

Generating high-value carbon credits in agriculture isn’t just about revenue — it’s about:

📌 Enabling climate-smart farming

📌 Creating new income streams for farmers

📌 Building resilient food systems

📌 Helping corporates meet sustainability commitments

With strong MRV, credible standards, and strategic implementation partners like Anaxee, agriculture can become one of the most powerful sectors in the voluntary carbon economy. The rewards extend beyond carbon pricing — strengthening soil health, community livelihoods, and global climate outcomes.