By 2026, almost every serious carbon buyer says the same thing:

“We only buy high-integrity credits.”

The problem is not intent.

The problem is definition.

Ask five buyers what “high integrity” means, and you’ll get five different answers:

- “Credits from a reputed registry”

- “Nature-based projects”

- “Third-party verified”

- “Aligned with net-zero.”

- “Rated well by an agency”

Some of these are necessary. None of them are sufficient on their own.

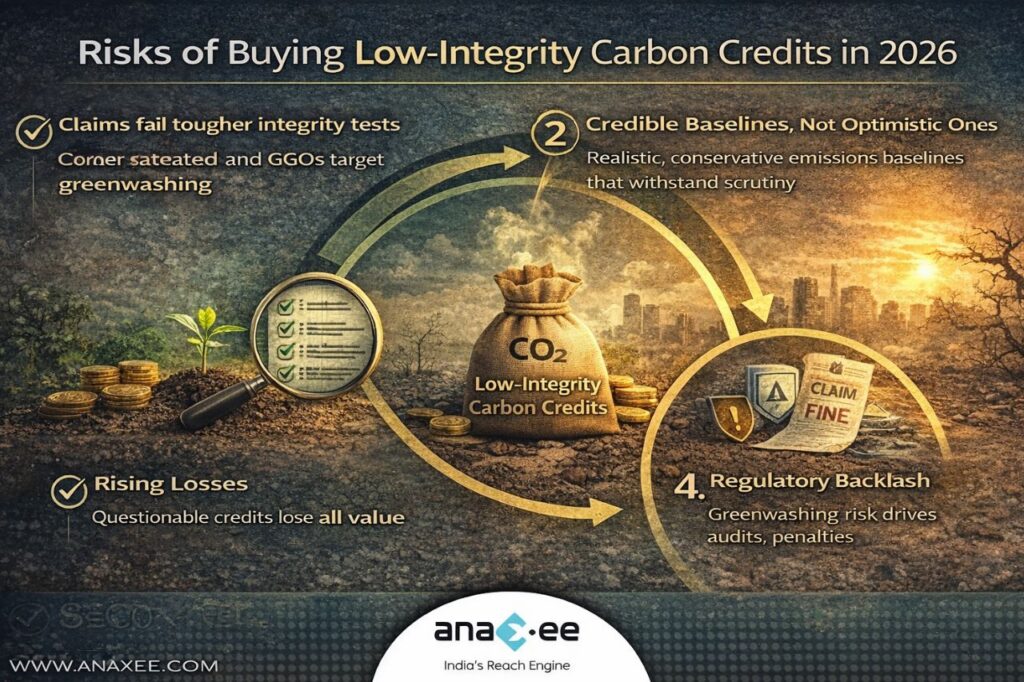

The carbon market didn’t just raise the bar on integrity — it changed how integrity is judged. Buyers who rely on old shortcuts are discovering, sometimes painfully, that credits once considered “safe” no longer stand up to scrutiny.

This blog is about cutting through the noise.

Not what integrity sounds like.

But what integrity actually requires in 2026 — and how buyers can check it without becoming carbon market specialists.

Why “high integrity” suddenly matters so much more

Five years ago, integrity failures were mostly theoretical.

Today, they’re operational, legal, and reputational.

Three things have changed:

1. Claims are now regulated, not just reputational

Sustainability claims are increasingly treated as regulated disclosures, not marketing statements. Weak credits don’t just damage reputation — they create legal exposure.

2. Ratings and labels are no longer optional

Independent ratings, labels, and assessments have become reference points for auditors, journalists, and regulators. Buyers can’t claim ignorance anymore.

3. Net-zero timelines are compressing

As companies move closer to their interim targets, the margin for “we’ll fix it later” disappears. Credits bought today must still be defensible years from now.

In short: integrity failures age badly.

The most common integrity mistake buyers still make

Many buyers still treat integrity as a checkbox exercise:

- Is it verified? ✔️

- Is it from a known registry? ✔️

- Does it have documentation? ✔️

That approach assumes integrity is static.

In reality, integrity is dynamic. A credit that clears today may not clear tomorrow if:

- Baseline assumptions are challenged

- Monitoring data is questioned

- Permanence risks materialise

- Methodologies evolve

High-integrity credits are those that survive scrutiny over time, not just at issuance.

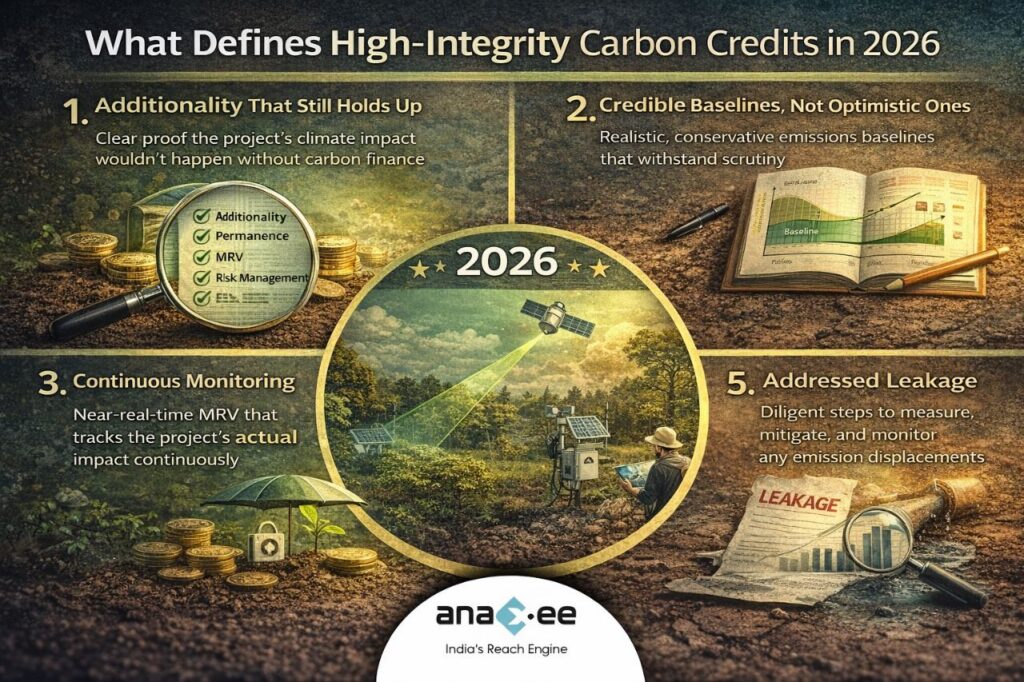

What actually defines high-integrity carbon credits in 2026

Let’s break this down into components buyers should actively assess — not passively assume.

1. Additionality that still holds up

Additionality answers a simple question:

Would this climate benefit have happened anyway?

In 2026, this question is being asked more aggressively.

What buyers must look for:

- Clear financial or regulatory barriers that justify project dependence on carbon revenue

- Evidence that the activity wasn’t already common practice

- Transparent baseline logic that can be defended years later

Red flag:

Projects that rely on generic narratives (“this helps farmers”, “this supports sustainability”) without hard evidence of dependency.

High-integrity projects show their vulnerability — and explain why carbon finance changes outcomes.

2. Credible baselines, not optimistic ones

Baselines are where many integrity issues quietly originate.

Overstated baselines inflate impact on paper while creating long-term risk for buyers. As scrutiny increases, these assumptions are often the first thing questioned.

Buyers should ask:

- How was the baseline constructed?

- What data sources were used?

- How conservative are the assumptions?

High-integrity projects:

- Use conservative baselines

- Document assumptions clearly

- Are prepared for baseline revisions without collapsing the project economics

If a project only works with perfect assumptions, it’s fragile.

3. Monitoring that happens continuously, not occasionally

In older market models, monitoring was episodic:

- Field visits

- Periodic surveys

- Annual reports

That no longer passes muster.

In 2026, integrity increasingly depends on continuous or near-continuous monitoring, especially for nature-based projects.

Buyers should look for:

- Digital MRV systems

- Ground-level data collection

- Remote sensing or geospatial validation

- Clear audit trails

The uncomfortable truth:

Many projects fail not because they don’t work — but because they can’t prove they worked consistently.

4. Permanence that’s designed, not assumed

Permanence is not just about duration. It’s about risk management.

For nature-based credits especially, buyers must understand:

- Reversal risks (fire, disease, land-use change)

- Buffer mechanisms

- Long-term stewardship plans

High-integrity projects:

- Explicitly quantify permanence risk

- Maintain buffers

- Have governance structures beyond the crediting period

Credits that assume permanence without designing for it are liabilities waiting to surface.

5. Leakage that’s actually addressed

Leakage occurs when emissions reductions in one area cause emissions elsewhere.

In 2026, generic leakage statements are no longer acceptable.

Buyers should expect:

- Clear leakage risk identification

- Mitigation strategies

- Monitoring beyond project boundaries when relevant

High-integrity projects don’t claim “no leakage”.

They explain how leakage is managed and minimised.

Ratings, labels, and what they do (and don’t) solve

Ratings and labels have become essential — but they’re often misunderstood.

What they do well:

- Provide comparative signals

- Highlight risk factors

- Improve market transparency

What they don’t do:

- Replace due diligence

- Guarantee future acceptability

- Eliminate execution risk

Smart buyers use ratings as inputs, not conclusions.

The question is no longer:

“Is this credit rated?”

But:

“Does this credit still make sense when ratings, monitoring data, and project realities are considered together?”

Avoidance vs removals: integrity is contextual

Integrity does not mean “removals only”.

In 2026, buyers are expected to:

- Use avoidance credits responsibly in the near term

- Gradually increase removal exposure

- Match credit types to their transition pathway

High-integrity portfolios are balanced, not ideological.

Problems arise when:

- Avoidance credits are used to make long-term neutralisation claims

- Removal timelines are left unplanned

- Buyers overcommit to one category without understanding supply risk

Integrity is about alignment, not purity.

The execution gap: where good credits fail buyers

Even well-designed projects can fail integrity tests due to execution gaps:

- Inconsistent field data

- Weak community engagement

- Poor documentation

- Delayed verification

From a buyer’s perspective, this matters more than methodology nuance.

High-integrity credits increasingly come from projects with:

- Strong on-ground implementation

- Transparent data systems

- Clear accountability structures

Carbon credits are only as credible as the systems that produce and monitor them.

Questions every buyer should ask before purchasing

Instead of generic checklists, buyers should ask a few hard questions:

- If this project is audited more strictly in five years, does it still stand?

- Can the project show data, not just reports?

- Who is responsible if assumptions fail?

- Is this credit aligned with our future claims, not just current needs?

- Does the project partner understand buyer risk — or only issuance?

If these questions make a seller uncomfortable, that’s a signal.

What high-integrity buying actually looks like in practice

In 2026, high-integrity buyers tend to:

- Engage earlier with projects

- Prefer long-term relationships over one-off transactions

- Invest in transparency, not just volume

- Accept slightly higher prices in exchange for lower future risk

This is not about perfection.

It’s about resilience under scrutiny.

The integrity question buyers should really be asking

Not:

“Is this credit high integrity?”

But:

“Will this credit still be defensible when standards tighten, data improves, and scrutiny increases?”

That’s the difference between buying credits — and building credibility.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations. Connect with Anaxee at sales@anaxee.com