The voluntary carbon market (VCM) has no shortage of opinions. Depending on who you ask, it is either a critical tool for accelerating climate action or a flawed system riddled with loopholes. Both views miss the point.

The real story of the voluntary carbon market in 2025 is not about ideology. It is about infrastructure maturity. The market has changed—quietly but fundamentally—and many companies are still operating with an outdated mental model.

Understanding how the VCM actually works today is essential for any organisation that wants to use carbon credits credibly, defensibly, and at scale.

First, What the Voluntary Carbon Market Is — and Is Not

At its core, the voluntary carbon market exists to direct private capital toward activities that reduce or remove greenhouse gas emissions outside a company’s own value chain. These activities are verified, quantified, and issued as carbon credits, each typically representing one tonne of CO₂ equivalent.

What the VCM is not:

- It is not a substitute for internal decarbonisation

- It is not a regulatory compliance market

- It is not a mechanism for making emissions “disappear”

Instead, it operates alongside internal reductions, addressing residual emissions and financing climate solutions that would otherwise struggle to attract capital.

This distinction matters. Much of the criticism directed at carbon markets assumes companies are using credits instead of reducing emissions. In reality, the companies most active in the VCM are often the ones investing most heavily in internal reductions and long-term transition plans Carbon_Markets_Buyers_Guide (1).

How the Market Has Evolved: From Fragmented to Demand-Led

To understand how the VCM works in 2025, it helps to understand how it used to work.

In its early years, the market was fragmented. Methodologies were basic. Monitoring was infrequent. Buyers often made ad-hoc, year-end purchases to support generic “carbon-neutral” claims, with limited governance or disclosure.

That phase is largely over.

Over the last decade, supply-side and demand-side developments have co-evolved:

- On the supply side, methodologies tightened, MRV became more data-rich, and new project types—especially removals—began to emerge.

- On the demand side, corporate buyers adopted net-zero targets, introduced internal carbon pricing, and began thinking in portfolios rather than single transactions.

By the early 2020s, these shifts started to converge into something new: a coordinated, demand-led value chain Carbon_Markets_Buyers_Guide (1).

In 2025, high-quality projects are increasingly co-designed with buyers from the outset, rather than developed in isolation and sold opportunistically.

The Core Building Blocks of the VCM in 2025

Despite its complexity, the voluntary carbon market rests on a few key components. Understanding how these fit together removes much of the confusion.

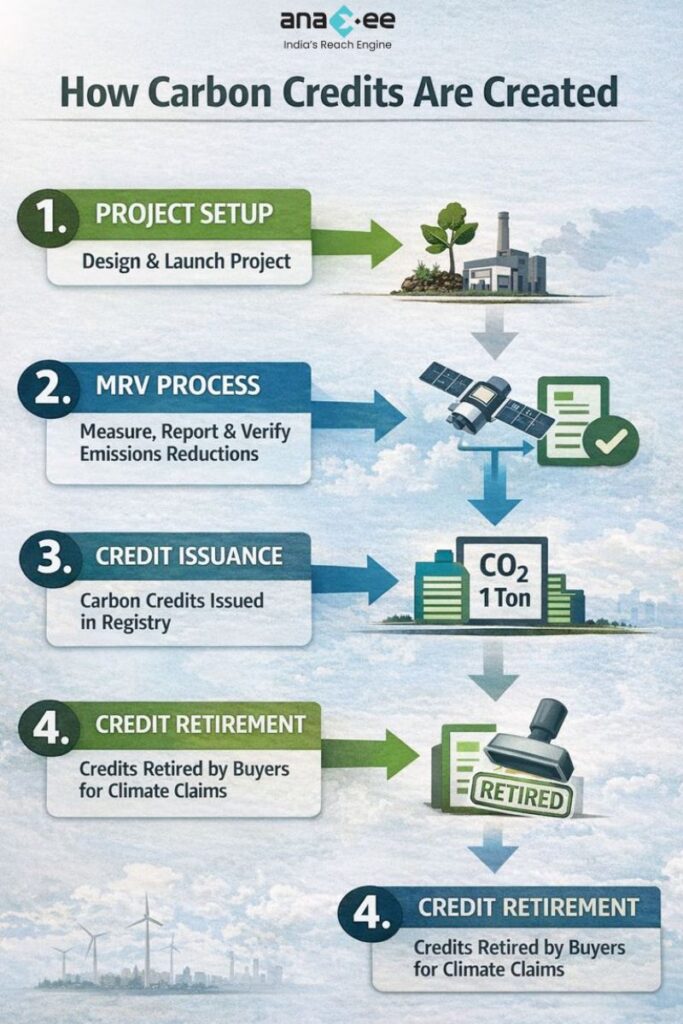

1. Project Developers

Project developers design and implement activities that reduce or remove emissions. These range from nature-based solutions—such as forest protection, restoration, and agroforestry—to engineered removals like biochar, mineralisation, and direct air capture.

In today’s market, credible developers do far more than generate carbon credits. They:

- Work with local communities and landholders

- Design long-term monitoring and safeguard systems

- Build projects to meet increasingly strict integrity thresholds

Development timelines are long, often spanning several years before credits are issued.

2. Methodologies and Crediting Standards

Carbon credits are not created arbitrarily. Projects must follow approved methodologies issued by independent standards such as Verra (VCS) or Gold Standard.

These methodologies define:

- How emissions reductions or removals are calculated

- What baselines are used

- How uncertainty and leakage are addressed

- How permanence and reversal risks are managed

Over time, these rules have become more conservative and more demanding—reflecting lessons learned from earlier market phases.

3. Monitoring, Reporting, and Verification (MRV)

MRV is the backbone of credibility. In 2025, it looks very different from a decade ago.

Modern MRV increasingly combines:

- Remote sensing and satellite data

- Field-level data collection

- Digital monitoring systems

- Independent third-party verification

Rather than infrequent, manual audits, many projects now operate with near-continuous monitoring, improving transparency and reducing the risk of over-crediting.

4. Registries and Credit Issuance

Once a project’s emission reductions or removals are verified, credits are issued into a registry. Each credit is serialized, traceable, and retired when used, preventing double counting.

Registries are no longer passive record-keepers. They are increasingly integrated with monitoring systems and disclosure frameworks, making credit data easier to audit and explain.

5. Buyers and Portfolio Governance

On the demand side, the most significant change has been how companies buy.

In 2025, credible buyers:

- Operate under written carbon-credit policies

- Use structured procurement processes

- Conduct third-party due diligence

- Build portfolios that evolve over time

This shift from spot buying to governed portfolios is one of the clearest indicators of market maturity.

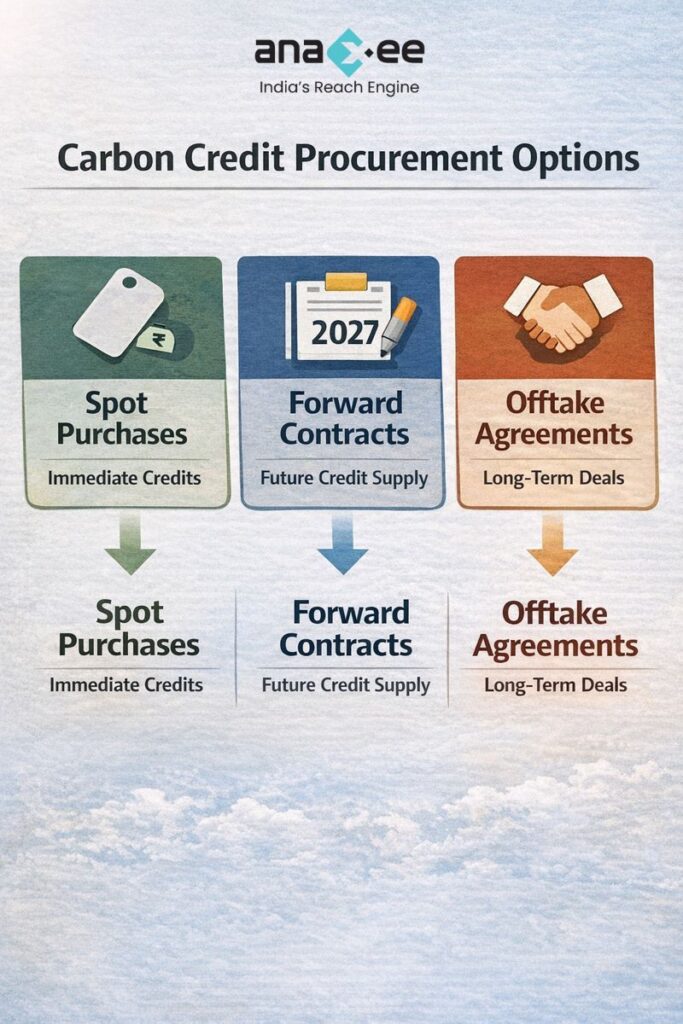

From Spot Purchases to Structured Procurement

One of the most common misconceptions about the VCM is that buying carbon credits is similar to buying a commodity. In reality, procurement structures matter as much as project quality.

Companies now use a mix of instruments:

- Spot purchases for immediate impact

- Forward contracts and offtakes to secure future supply

- Options to retain flexibility as strategies evolve

Forward agreements are particularly important for high-integrity removals, which are often capacity-constrained and capital-intensive. These agreements provide developers with revenue certainty while allowing buyers to pay only upon delivery.

In effect, procurement has become a tool not just for sourcing credits, but for shaping the future supply of carbon solutions Carbon_Markets_Buyers_Guide (1).

Why Quality Has Become a Structural Feature of the Market

The idea that the carbon market is flooded with “cheap credits” is increasingly outdated.

What has emerged instead is a tiered market:

- A lower-priced segment with weaker safeguards and limited durability

- A premium segment characterised by high-integrity nature projects and durable removals

In 2025, serious buyers are concentrating almost exclusively on the latter. This is not altruism; it is risk management.

Premium credits:

- Are easier to defend publicly

- Align with evolving claims guidance

- Attract institutional capital

- Are more likely to remain acceptable as standards tighten

As a result, quality and price are now closely linked—and likely to remain so.

The Role of Integrity Frameworks and Ratings

Another defining feature of the modern VCM is the emergence of independent integrity frameworks and ratings.

Initiatives such as the Oxford Principles and the IC-VCM’s Core Carbon Principles have brought consistency to:

- Portfolio design

- Claims language

- Disclosure expectations

At the same time, independent ratings agencies provide additional scrutiny of project quality, governance, and risk.

These layers do not replace standards or verification. They complement them—adding transparency and helping buyers compare projects on more than just volume and price.

Claims Have Changed — and That’s a Good Thing

Perhaps the most visible shift in the voluntary carbon market is the decline of simplistic “carbon-neutral” claims.

In their place, many companies are adopting:

- Contribution claims, which emphasise financing climate solutions beyond the value chain

- Hybrid approaches, combining reductions, contributions, and removals

This evolution reflects a more honest conversation about what carbon credits can and cannot do. It also reduces the incentive to overstate impact or rely on questionable accounting shortcuts.

In 2025, credibility is built not by claiming perfection, but by showing the work: methodologies used, volumes retired, vintages, and the role credits play within a broader climate strategy.

Why the Market Now Works as a Value Chain

The most important insight about the voluntary carbon market today is this: supply and demand no longer operate in isolation.

Buyers influence project design. Developers respond to clearer criteria. Investors step in earlier. Monitoring improves. Communities benefit from stronger safeguards. Each link reinforces the next.

This is what it means for the VCM to function as a value chain rather than a trading floor.

It also explains why companies that engage early and seriously tend to have better outcomes—both in terms of credit quality and strategic alignment.

Where Companies Still Struggle

Despite these advances, many organisations still misunderstand how the market works in practice.

Common pain points include:

- Underestimating project development timelines

- Expecting immediate availability of high-durability removals

- Treating procurement as a one-off exercise

- Lacking internal governance to manage portfolios over time

These challenges are not signs of market failure. They are symptoms of a system that has grown more sophisticated—and demands a corresponding increase in buyer capability.

What “Understanding the VCM” Really Means in 2025

Understanding the voluntary carbon market today does not require becoming a carbon trader or a climate scientist. It requires recognising three realities:

- The market has matured, and quality expectations are rising

- Carbon credits are part of a long-term strategy, not a short-term fix

- Execution—data, monitoring, governance—matters as much as intent

Companies that grasp these fundamentals are far better positioned to use carbon solutions as a credible extension of their climate strategy.

Those that don’t risk being left behind—not because the market is broken, but because it has moved on.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.