India needs nearly $170 billion per year in climate finance through 2030. Yet current flows hover around $44 billion, with much of that concentrated in large renewables, EVs, and urban infrastructure.

The people who produce the most granular, field-level climate outcomes — farmers, rural communities, land stewards, supply-chain MSMEs — receive the smallest share.

Why?

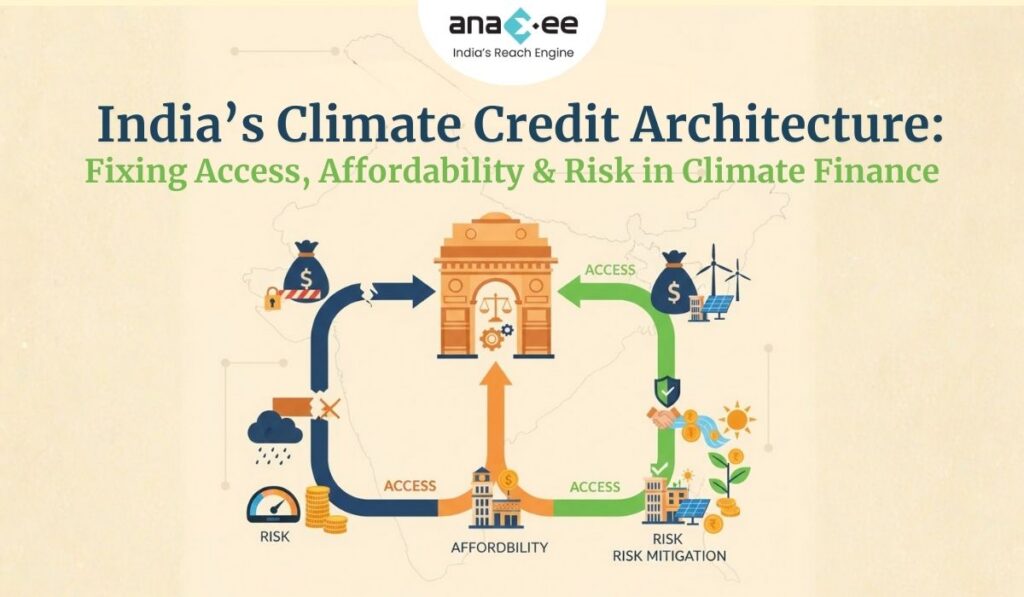

Because India’s climate finance bottlenecks fall into three structural buckets:

1. Access

Most climate-positive actors are simply outside the formal credit system.

2. Affordability

Even when credit is available, the interest rates make climate projects financially unviable.

3. Risk Allocation

The institutions that should take risk don’t, and the institutions that can’t take risk are expected to.

These three constraints showed up repeatedly in the panel conversation — whether it was about textile circularity, climate-smart agriculture, NBFC cost structures, or the unrealistic expectation that commercial lenders will magically take climate risks without a risk-mitigation backstop.

India’s climate architecture cannot scale unless these three barriers are dismantled.

2. Access: The First Big Barrier — “Climate Finance Does Not Reach the Last Mile”

Despite endless talk about financial inclusion, the truth is blunt:

Most smallholder farmers, FPOs, rural women’s collectives, and climate-MSMEs do not qualify for mainstream bank credit.

Banks lend overwhelmingly to:

- Large corporates

- Infrastructure projects

- Urban MSMEs

- Renewable energy developers

- Enterprises with strong collateral

Meanwhile, climate-positive actors in rural and semi-urban areas get trapped in:

- Informal credit

- Short-tenor loans

- High-cost NBFC debt

- Post-harvest distress borrowing

- Input-credit from middlemen with 24–30%+ effective interest rates

Even innovative climate-aligned models — sustainable rice, regenerative cotton, residue aggregation, agroforestry, biomass, community solar — hit the same wall:

No credit access, because lenders see them as “too small”, “too risky”, or “non-bankable.”

This is a structural failure, not a market failure.

Why does access not translate to climate impact?

Because the most climate-positive actors are:

- Small

- Distributed

- Informal

- Fragmented

- Geographically dispersed

- Hard to underwrite

- Hard to monitor

- Hard to measure

Traditional lending is not built for this.

How do you fix “access”?

You don’t push banks to lend harder.

You redesign the architecture so that:

- last-mile actors have verifiable credit profiles

- climate outcomes are measurable

- repayment is de-risked

- intermediaries (FPOs, cooperatives, aggregators) can borrow at scale

- NBFCs can access lower-cost wholesale capital

- blended finance de-risks first movers

This requires — and the panel emphasized this — digital MRV + field verification as the backbone.

Without verifiable on-ground climate impact data, lenders simply won’t come down-market.

3. Affordability: The Unsolved Problem — “High Interest Rates Kill Climate Projects Before They Begin”

This part of the discussion was striking.

NBFCs and SFBs borrow at 12–16%.

They lend at 20–28% to rural borrowers.

Climate projects — especially agriculture, biomass, recycling, and distributed renewables — simply cannot survive at these rates.

A panelist put it sharply:

“If the cost of credit for the wholesale lender itself is high, how do you expect climate borrowers to pay less?”

Exactly.

Why does affordability matter so much?

Because climate projects:

- have long payback periods

- often involve behavior change

- require up-front training

- have variable cashflows

- are exposed to weather and market shocks

To make climate projects work, you need:

- longer-tenor loans

- flexible repayment structures

- interest subvention (temporary or conditional)

- concessional capital at the wholesale level

- risk-sharing mechanisms

This is why blended finance is essential — not optional.

India’s climate-credit architecture simply cannot scale with commercial-rate debt.

Fixing affordability requires three moves:

1. Lower wholesale cost of capital

NBFCs need access to:

- concessional credit

- guarantees

- first-loss capital

- long-term low-interest credit lines

2. Reduce interest rates for end borrowers

Either through:

- risk-sharing

- interest rate buy-downs

- performance-linked reductions

3. Tie affordability to verifiable outcomes

Interest rates can drop when:

- carbon is measured

- soil improves

- methane falls

- residue is diverted

- market linkages mature

This aligns incentives and turns climate impact into an economic driver.

4. Risk Allocation: The System Is Asking the Wrong Players to Carry the Risk

The third barrier — risk — is the most complex.

Current situation:

- Banks want zero risk.

- NBFCs are forced to take all the risk.

- Farmers carry downstream risk of weather, price volatility, and tech adoption.

- Innovators carry the risk of market failure.

- Mills carry the risk of technology uncertainty.

- Brands carry the risk of reputation.

This is dysfunctional.

As the panelist said:

“Guarantees are often used on borrowers who were not creditworthy in the first place.”

Meaning: we misuse the tool, then complain it doesn’t work.

A functioning climate-credit architecture requires:

1. Risk to sit where it belongs

Philanthropic capital should take early-stage risk.

DFIs should take intermediate risk.

Commercial capital should take scalable, predictable risk.

2. Outcome-based guarantees

Not blanket credit guarantees that distort incentives.

3. Data-driven de-risking

Verified MRV data reduces perceived risk and improves underwriting.

4. Portfolio-level risk pooling

No NBFC should be forced to take 100% of the risk.

5. Regulatory clarity

India needs explicit rules for:

- performance-linked financing

- outcome-based financing

- tranching

- blended structures

- risk-sharing pools

- foreign philanthropic participation

Until then, India will remain “blended finance curious” but not “blended finance ready.”

5. The Missing Piece: India Needs a Unified Climate Credit Architecture

Here is the core problem:

India’s climate credit landscape is not a system.

It is a patchwork of pilots, schemes, and isolated innovations.

What India needs is a unified architecture built on four pillars:

Pillar 1: A National Climate Registry (Farmer → Enterprise → Market)

A digital backbone that captures:

- farm-level climate data

- enterprise-level climate actions

- supply-chain footprints

- GHG emissions

- MRV data

- audit trails

Anaxee, with its field-force + MRV tools, is perfectly positioned here.

Pillar 2: TRUST — A Transparent Reporting Framework

The TRUST platform (referenced in your infographics) is the right direction:

- central reporting

- secure workspaces

- GHG inventory integration

- structured data submission

- standardized templates

This improves lender confidence.

Pillar 3: Blended Finance Frameworks for Affordability

Regulators must explicitly enable:

- interest-rate buy-downs

- outcome-based grants

- first-loss facilities

- philanthropic participation

- sector-specific credit norms

- climate-aligned guarantee funds

Without this, the cost of capital will remain insurmountable.

Pillar 4: MRV + Traceability + Compliance Infrastructure

This is where most pilots fail.

Climate finance needs:

- real-time monitoring

- farmer-level verification

- digital proof of action

- automated climate calculations

- remote-sensing validation

- field audits

- tamper-proof records

This is where Anaxee’s Digital Runners, Climate Command Centre, and MRV stack play a transformational role.

Data is the bridge between climate outcomes and finance.

Without data, money will not move.

6. Where Anaxee Fits in India’s Climate Credit Architecture

Anaxee is not a financial institution.

But its infrastructure is exactly what financial institutions lack.

Here’s what Anaxee brings to the table:

1. Access → Digital Farmer Registry + Field Verification

Hard-to-reach actors become visible, verifiable, and credit-worthy.

2. Affordability → MRV for outcome-based financing

When climate outcomes can be measured, lenders unlock:

- lower interest rates

- performance-based pricing

- climate-aligned loan products

This structurally reduces borrowing costs.

3. Risk → Better data = reduced underwriting uncertainty

Lenders can price risk correctly.

This unlocks finance for:

- regenerative agriculture

- residue collection

- agroforestry

- climate-smart inputs

- green MSMEs

- community renewable projects

4. Scalability → Nationwide field execution

Anaxee’s vast runner network allows:

- decentralized monitoring

- high-frequency verification

- scalable reporting

- consistent QA/QC

This turns climate projects from “pilotable” to “scalable.”

7. What India Must Do Next — A Clear 5-Step Roadmap

Step 1: Formalize climate-credit product categories

Sectors like:

- agroforestry

- regenerative rice

- circular textiles

- green MSMEs

- alternative cellulose

- bioenergy

- water efficiency

- sustainable mobility

…should have clear credit standards.

Step 2: Standardize MRV and verification norms

This is essential for trust and transparency.

Step 3: Reduce cost of capital with blended finance

NBFCs cannot scale climate lending at 16–18% borrowing costs.

Step 4: Create national and state-level guarantee pools

This is the missing piece that banks will respond to immediately.

Step 5: Incentivize climate outcomes, not just borrowers

If farmers cut methane, their interest rate should drop.

If MSMEs reduce emissions, their credit line should expand.

This is real climate finance, not box-checking.

Conclusion: India Can Build the World’s Most Scalable Climate Credit Market — If It Fixes These Three Bottlenecks

The panel discussion made one thing clear:

Climate finance is not limited by money. It is limited by architecture.

Fix architecture → flows accelerate → impact scales.

India has:

- the ambition

- the climate commitments

- the digital public infrastructure

- the financial institutions

- the entrepreneurship ecosystem

- the necessary market demand

What India lacks is:

- structural de-risking

- affordable credit pathways

- unified data infrastructure

- regulation that enables blended finance

This is solvable.

If India builds a robust climate-credit architecture around access, affordability, and risk, it can unlock finance for millions of climate-positive actors — and become the world’s most scalable climate marketplace.

This is the moment to build it.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.