Introduction: Carbon Markets Have a Measurement Problem

Carbon credits are built on a simple promise:

One credit = One tonne of verified CO₂e reduced or removed.

But agriculture complicates that promise.

Unlike industrial projects, where emissions reductions can be directly metered, agricultural carbon outcomes are:

- Distributed

- Variable

- Influenced by climate & soil conditions

- Difficult to measure consistently

This is where MRV — Measurement, Reporting & Verification — becomes decisive.

Without credible MRV, agriculture carbon credits struggle with:

❌ Buyer skepticism

❌ Verification delays

❌ Discounted pricing

❌ Integrity concerns

With robust MRV, the same projects can command premium market value.

1️⃣ What Exactly Is MRV in Carbon Projects?

MRV refers to the structured process of:

✔ Measurement – Quantifying emissions reductions or removals

✔ Reporting – Documenting methodologies & results

✔ Verification – Independent third-party validation

In agriculture carbon projects, MRV must capture:

🌱 Practice adoption

🌱 Soil carbon changes

🌱 Emission reductions

🌱 Leakage risks

🌱 Permanence safeguards

MRV is not paperwork.

It is the credibility engine of carbon finance.

2️⃣ Why Traditional MRV Struggles in Agriculture

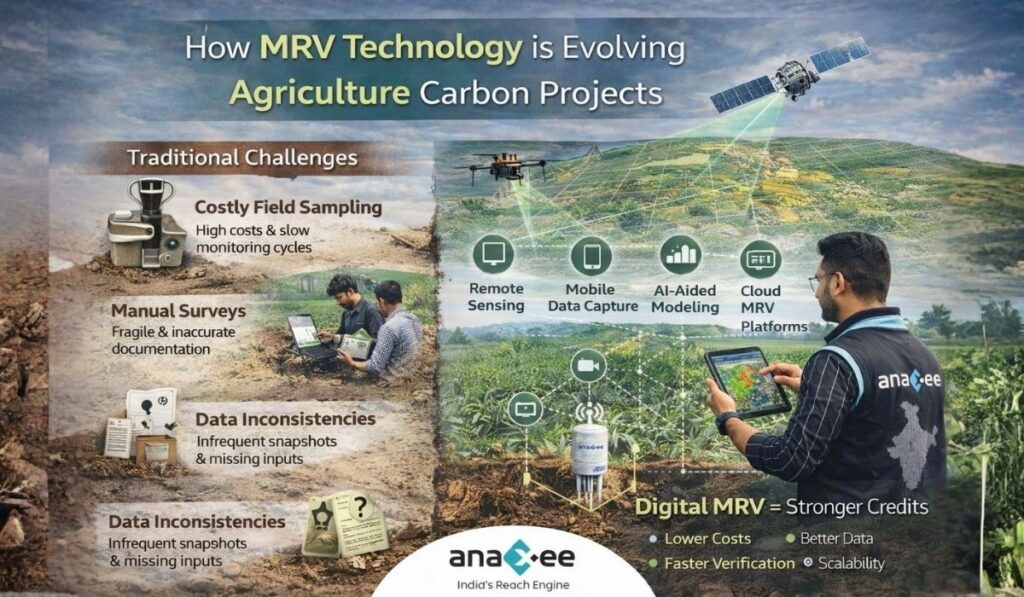

Historically, MRV relied heavily on:

📍 Field visits

📍 Manual surveys

📍 Soil sampling

📍 Static datasets

Problems quickly emerged:

⚠️ High monitoring costs

⚠️ Infrequent measurement cycles

⚠️ Sampling errors

⚠️ Data gaps

⚠️ Limited scalability

For smallholder-dominated regions like India:

- Farms are fragmented

- Practices vary widely

- Documentation is inconsistent

- Access is geographically challenging

Traditional MRV often becomes financially and operationally unsustainable.

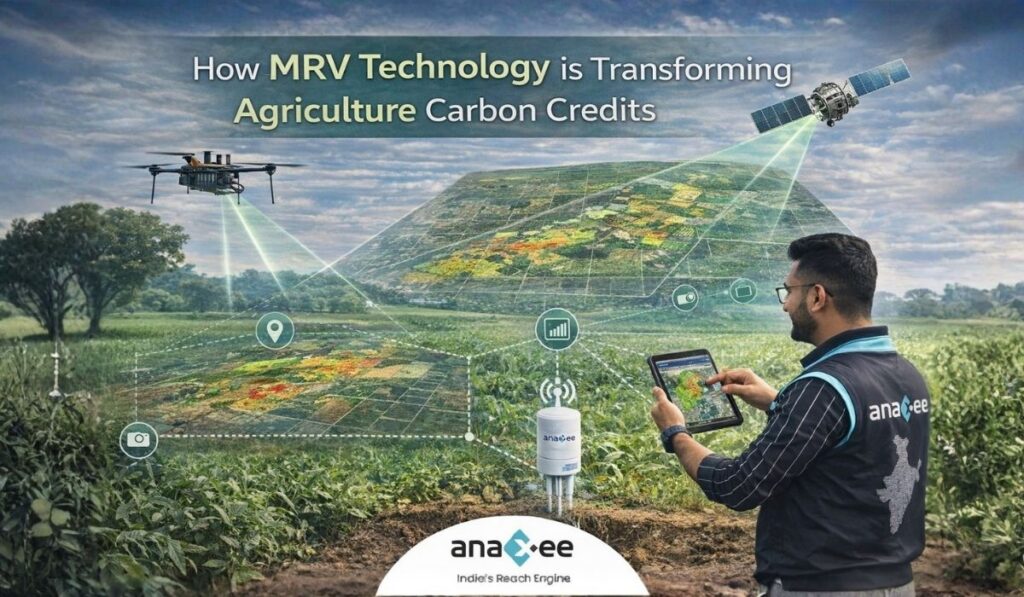

3️⃣ Enter MRV Technology: The Structural Shift

Modern agriculture carbon projects increasingly depend on technology-enabled MRV systems.

These combine:

📡 Remote Sensing & Satellite Monitoring

Enables:

✔ Land-use tracking

✔ Crop cover assessment

✔ Vegetation analysis

✔ Change detection over time

Impact:

📈 Reduced field dependency

📈 Continuous monitoring

📈 Lower verification friction

📱 Mobile-Based Field Data Collection

Allows:

✔ Geo-tagged evidence

✔ Time-stamped records

✔ Digital surveys

✔ Practice documentation

Impact:

📊 Stronger audit trails

📊 Higher data reliability

📊 Faster reporting cycles

🤖 AI & Data Modeling

Supports:

✔ Soil carbon estimation

✔ Adoption probability modeling

✔ Risk analysis

✔ Reversal forecasting

Impact:

📈 Better carbon projections

📈 Conservative crediting

📈 Reduced overestimation risk

🌐 Cloud-Integrated MRV Platforms

Deliver:

✔ Centralized data systems

✔ Real-time dashboards

✔ Evidence repositories

✔ Verification-ready reporting

Impact:

📊 Transparency

📊 Scalability

📊 Investor confidence

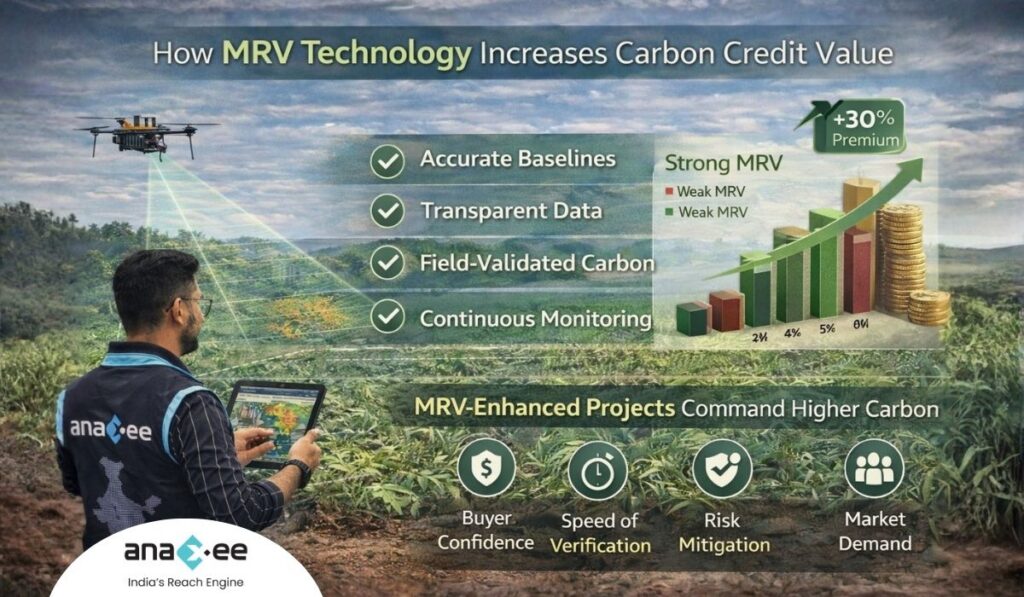

4️⃣ How MRV Technology Increases Carbon Credit Value

Carbon credit pricing increasingly reflects quality & integrity, not just volume.

Robust MRV directly improves:

✔ Credit defensibility

✔ Buyer trust

✔ Verification speed

✔ Transparency

✔ Risk mitigation

Which leads to:

💰 Higher buyer willingness to pay

💰 Lower discounting

💰 Faster issuance

💰 Stronger project economics

In short:

Better MRV → Higher-Value Credits

5️⃣ The Illusion: Technology Alone Is Not Enough

Here’s where many projects miscalculate.

Deploying tools ≠ solving MRV.

Common failures:

❌ Fancy dashboards with weak field data

❌ Satellite models without ground truthing

❌ Data collection apps without adoption discipline

❌ Fragmented tech stack

MRV technology must be supported by:

📍 Last-mile execution

📍 Structured workflows

📍 Human engagement

📍 Data validation loops

Otherwise:

👉 Garbage in → Garbage out

🚀 Where Anaxee’s Model Becomes Critical

Agriculture MRV doesn’t fail due to lack of software.

It fails at the ground interface.

Anaxee’s strength lies precisely there.

🔹 Last-Mile Data Infrastructure

Anaxee’s distributed field force enables:

✔ Geo-tagged farmer data

✔ Practice verification

✔ Photo/video evidence

✔ Continuous monitoring inputs

This solves:

📉 Data gaps

📉 Adoption uncertainty

📉 Audit inconsistencies

🔹 Human + Digital MRV Integration

Instead of “tech replacing fieldwork,” Anaxee delivers:

✔ Tech-enabled field execution

✔ Standardized data workflows

✔ Quality assurance processes

Result:

📊 Verifiable, defensible datasets

🔹 Scalable Smallholder MRV

Smallholder landscapes are the hardest MRV environment.

Anaxee enables:

✔ Farmer aggregation

✔ Cluster-level monitoring

✔ Workflow standardization

✔ Cost-efficient scaling

🔹 Verification-Ready Evidence Chains

Anaxee systems ensure:

✔ Time-stamped records

✔ Digital traceability

✔ Structured reporting outputs

Reducing:

🚫 Credit rejection risk

🚫 Verification delays

🔹 Continuous Monitoring Discipline

Carbon markets increasingly value:

📈 Ongoing performance evidence

📈 Not one-time measurement snapshots

Anaxee’s recurring field presence sustains:

✔ Monitoring cycles

✔ Data refresh reliability

6️⃣ Why This Transformation Matters for the Market

Carbon markets are evolving:

Old mindset:

❌ Estimate → Issue → Sell

Emerging reality:

✔ Measure → Validate → Defend → Monetize

Buyers now scrutinize:

- MRV robustness

- Reversal risk

- Additionality proof

- Data transparency

Agriculture credits with weak MRV face:

📉 Discounting

📉 Reputation risk

📉 Demand erosion

Credits backed by strong MRV gain:

📈 Premium pricing

📈 Long-term buyer interest

7️⃣ Strategic Implication for Project Developers

If you’re designing agriculture carbon projects:

👉 MRV is not a compliance task

👉 MRV is a pricing strategy

👉 MRV is a risk strategy

👉 MRV is an investment strategy

Ignoring MRV design early leads to:

⚠️ Delays

⚠️ Cost escalation

⚠️ Verification friction

Embedding MRV from Day 1 leads to:

📈 Predictability

📈 Credibility

📈 Market acceptance

Conclusion: Integrity Is the New Currency

Agriculture holds enormous potential for carbon removal and emissions reduction.

But markets reward:

✔ Verified outcomes

✔ Transparent data

✔ Credible MRV systems

MRV technology is not just improving efficiency.

It is redefining:

🌱 Credit integrity

🌱 Buyer trust

🌱 Pricing potential

🌱 Scalability

And when combined with Anaxee’s execution-first, last-mile delivery model, projects move from:

“Conceptually viable” → “Commercially credible.”

Because in carbon markets:

👉 Measurement builds trust

👉 Trust drives value

👉 Value sustains projects