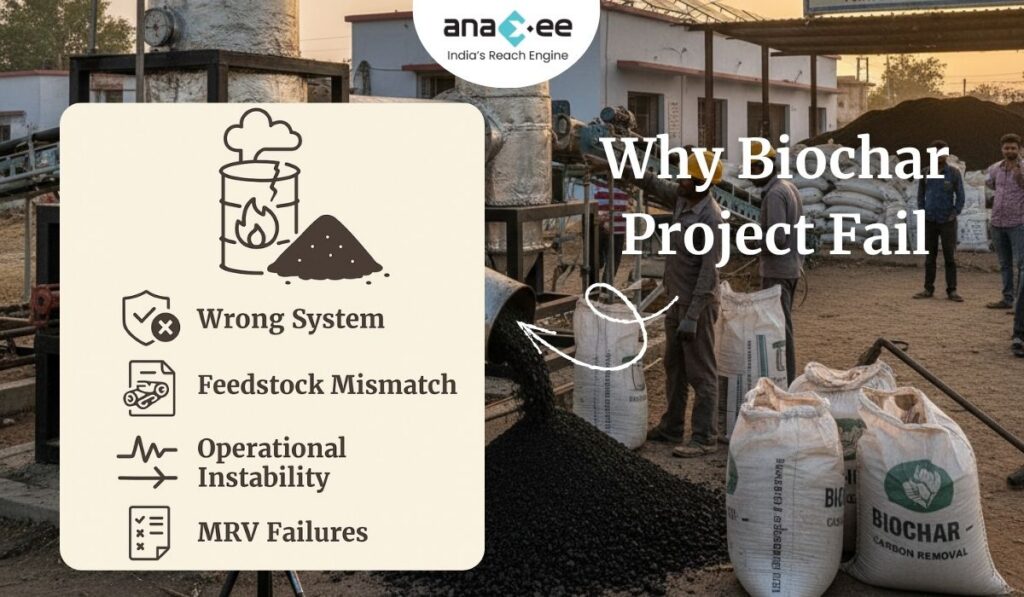

Biochar is in a remarkable position. It is one of the few climate solutions that can remove carbon, enrich soil, support rural economies, and operate at industrial scale without requiring exotic chemistry or massive energy inputs. But despite this strong foundation, many biochar projects fail long before they reach meaningful capacity. The reasons are rarely scientific, and almost never related to a lack of biomass or poor policy support.

The failures most often stem from technology risk — not in the sci-fi sense of breakthrough innovation, but in the quiet, operational sense of bad equipment decisions, unreliable systems, inconsistent production runs, and misaligned expectations between developers and financiers.

Biochar is not just “burning biomass cleanly.” It is a complex thermal process with multiple dependencies: feedstock quality, process stability, temperature profiles, emission control, char consistency, ash content, volatile release, MRV logging, and maintenance cycles. When any element goes wrong, the entire project becomes unstable. Yet developers frequently underestimate this technological fragility because biochar looks simple. And that misunderstanding has become one of the biggest hidden risks in the carbon removal space.

This blog explores why technology choices matter so much, how missteps happen, what buyers and investors look for, and what serious developers need to do differently if they want to build reliable, bankable, long-term biochar infrastructure.

Biochar Is Old — But Industrial Biochar Is New

The idea of heating biomass in low-oxygen environments has existed for thousands of years. Indigenous communities across the Amazon, India, Japan, and Africa all practiced versions of it. But industrial biochar production is relatively new. Modern projects must adhere to stringent expectations around:

- durability

- MRV

- emissions

- certification

- consistent carbon content

- regulatory compliance

- insurance requirements

- operational uptime

This shift from “traditional char” to “engineered biochar” is dramatic. It requires a level of precision that many early-stage developers underestimate. Traditional kilns can’t meet certification requirements. Low-cost reactors cannot provide stable operating profiles. And small modular units often cannot deliver the uptime or product consistency needed for long-term offtake agreements.

Biochar is ancient.

Industrial biochar is not.

Scaling industrial biochar is where technology makes or breaks the business.

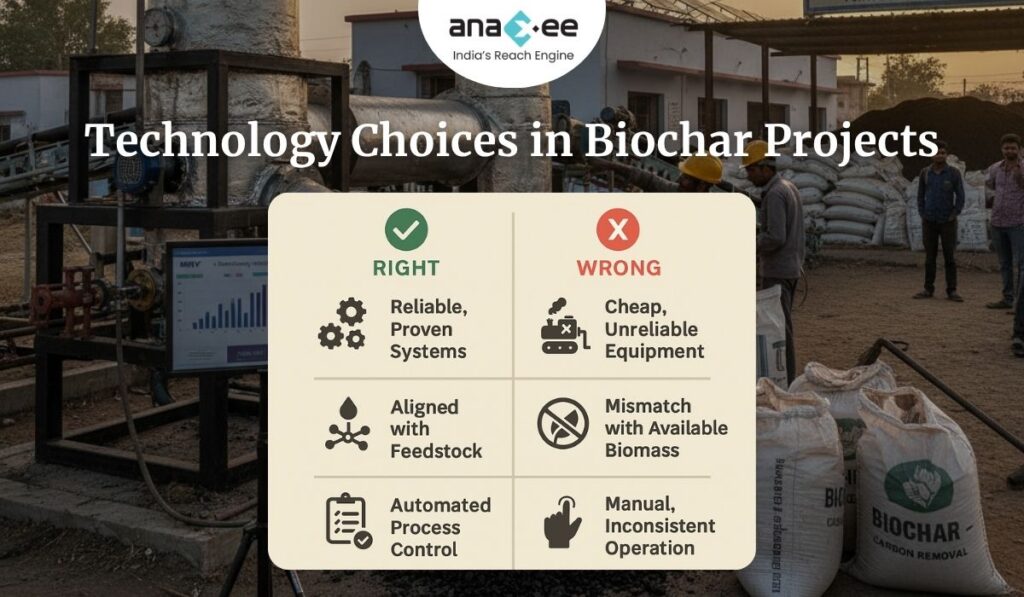

The Most Common Technology Mistake: Buying the Wrong System

Most problems in biochar start at the procurement stage. Developers often choose equipment based on:

- lowest cost

- fastest installation

- exaggerated vendor claims

- incomplete performance guarantees

- insufficient demonstration data

A “cheap” pyrolysis unit usually becomes the most expensive mistake. Breakdowns escalate quickly. Spare parts are unavailable or delayed. Temperature control is unstable. Emissions exceed permissible levels. Char quality becomes inconsistent. And the developer is left with a stranded asset — a system too expensive to replace and too unreliable to operate.

On the opposite extreme, some developers over-invest in oversized, over-engineered systems with capabilities they do not need. High-capex systems create high credit price pressures, making offtake negotiations harder. Biochar is a margin-sensitive business; an oversized system can quietly kill unit economics.

The truth lies between these extremes. The right system is not the cheapest or the most advanced — it is the most reliable, proven, and service-supported for the specific feedstock and geography.

But finding that system requires deep due diligence, and too few developers do it.

Feedstock Compatibility: The Silent Killer of Many Projects

Every biochar system behaves differently depending on feedstock:

- sugarcane trash burns unevenly

- coconut shells contain high ash

- bamboo dries slowly

- rice husk has high silica

- forestry residues vary in moisture

- sawdust requires fine control to prevent hotspots

A pyrolysis reactor optimized for forestry residues may perform poorly with agricultural waste. A system designed for pelletized biomass may clog when fed loose crop residues. Many projects collapse because developers assume “any biomass works.” In reality, the feedstock determines:

- machine throughput

- reactor stability

- char yield

- emissions

- operational cost

- maintenance cycles

- downtime

If the feedstock-reactor match is wrong, the project fails — even with perfect financing and strong buyer demand.

Operational Stability: The True Indicator of Technology Quality

Investors and credit buyers care about one thing above all: uptime.

If a project cannot run at least 85–90% of its expected operating hours, everything becomes unstable — cashflows, credit deliveries, certification cycles, feedstock logistics, and EBITDA.

Operational stability depends on:

- process automation

- temperature uniformity

- oxygen control

- continuous feeding systems

- automated safety shutoffs

- emissions management

- heat recovery systems

- documented O&M

Yet despite this, many developers still purchase systems without data logging, without SCADA integration, without clear maintenance protocols, and without long-term service agreements.

A pyrolysis unit without solid automation is like a solar plant without inverters — it might technically work, but it will never work reliably.

The Hidden Technology Risk: Data and MRV

Carbon removal buyers are not just purchasing a ton of CO₂. They’re buying verifiable permanence. That requires:

- temperature logs

- feedstock moisture data

- char carbon content

- mass balance calculations

- emissions control records

- batch documentation

- laboratory reports

- third-party verification compatibility

If a system cannot generate consistent data, the project cannot be certified. If it cannot be certified, the credits cannot be sold. If credits cannot be sold, the business collapses.

Technology that does not support MRV is not viable — even if it produces perfect biochar.

Why Investors Are Skeptical of Biochar Technology

Biochar technology vendors often provide glossy brochures but limited performance history. Many systems lack:

- multi-year operating data

- measurable uptime records

- third-party testing

- clear O&M manuals

- credible warranties

- spare part guarantees

Investors see this and hesitate. They compare biochar to renewables — sectors where technology has been derisked through millions of operational hours. Biochar is still early, so credibility matters even more.

Financiers want to see:

- proven equipment

- multiple operational references

- consistent long-format data

- MRV compatibility

- maintenance schedules

- insurance acceptance

In short: they want technology that looks like infrastructure, not a prototype.

Insurance: The New Filter for Technology Quality

Biochar insurance providers — like Kita — quietly act as technology validators. If a system is too risky, insurers either refuse to cover it or charge high premiums. This is one of the strongest indicators of technology maturity.

If insurers hesitate to underwrite:

➤ Investors will hesitate more.

➤ Buyers will demand discounts.

➤ Certification bodies will scrutinize the project.

Insurance acceptance is becoming an unofficial quality benchmark. Developers who choose unproven technology find themselves locked out of this maturing ecosystem.

Technology as a Long-Term Competitive Advantage

The developers who win in biochar are not those who plant the most machines — but those who operate the most reliable ones. High-quality technology improves:

- uptime

- char stability

- MRV flow

- certification success

- maintenance cost

- buyer confidence

- investor acceptance

- scalability

Biochar will eventually look more like solar or wind — standardized, modular, predictable. The developers who adopt high-reliability systems early will build a massive long-term advantage as the market matures.

The Future: Toward Standardized Biochar Technology

Biochar is moving in the same direction other industrial climate technologies have moved:

Phase 1 — experimentation

Phase 2 — competing vendors

Phase 3 — consolidation

Phase 4 — standardization

Right now, the industry sits between phases 2 and 3. Within the next 3–5 years, we will likely see:

- standardized equipment classes

- unified operating protocols

- measurable performance benchmarks

- shared data frameworks

- automated MRV-linked reactors

- industry-wide maintenance norms

These shifts will reduce technology risk—but for now, the burden rests with the developer.

Conclusion: Biochar Technology Isn’t Just an Input — It’s the Backbone

Biochar projects do not fail because biochar itself is flawed. They fail because technology decisions were made casually, without the discipline expected in serious infrastructure sectors. This is the quiet truth behind many disappointing project outcomes.

For biochar to scale into tens of millions of tons, developers must stop treating reactors as “equipment purchases” and start treating them as permanent core infrastructure requiring:

- rigorous vetting

- operational discipline

- reliable suppliers

- strong service support

- proven MRV alignment

- insurance acceptance

- documented performance

The projects that embrace this mindset will scale safely, win investor trust, and meet buyer expectations. The ones that don’t will continue repeating the same mistakes — stranded equipment, inconsistent output, failed credit deliveries, and broken business models.

Biochar has the potential to become one of the world’s largest climate mitigation solutions. The only real barrier now is whether technology is chosen as an afterthought — or treated as the foundation of the entire business.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations. Connect with Anaxee atsales@anaxee.com