If you lead sales or growth for a tractor, agri-input, seed, fertilizer, or farm equipment brand, you already know this reality:

Urban and Tier-1 growth is mostly done.

The real volume lies beyond.

Yet every attempt to expand deeper into Tier 2, Tier 3, and rural India feels slower, messier, and more expensive than expected.

Sales reviews start sounding familiar:

- “Rural markets are relationship-driven.”

- “Distributors don’t want to go interior.”

- “Field force productivity drops outside towns.”

- “Demand exists, but execution is hard.”

All true.

But also incomplete.

Because the real challenge is not rural demand.

It’s how tractor and agri-input brands try to execute GTM in rural India.

The Myth: Rural Growth Needs More Feet on the Ground

Most brands respond to rural ambition in one of two ways:

- Expand distributor territories

- Hire more salespeople or field officers

This works initially.

Then efficiency collapses.

Why?

Because rural India does not fail due to lack of effort.

It fails due to lack of structure and visibility.

Why Tractor & Agri-Input GTM Breaks Down Faster Than Other Categories

Unlike FMCG or electronics, tractor and agri-input sales have three structural realities:

1. Demand Is Seasonal, Not Continuous

- Sales spike during sowing, harvesting, or subsidy cycles

- Missed visits = missed seasons

- One bad cycle means a lost year

2. Retail Is Deeply Fragmented

- Agri retailers, hardware stores, mechanics, mandis

- No single “standard” outlet format

- High dependence on local influence

3. Influence > Branding

- Farmers trust:

- The retailer

- The mechanic

- The local advisor

- National brand pull is weak without local presence

These realities make random expansion dangerous.

The Real Problem: Brands Confuse Reach with Presence

Most tractor and agri-input brands proudly say:

“We are present in 400+ districts.”

But presence does not mean:

- Active retail coverage

- Product width

- Regular order-taking

- Influence at the point of decision

In most districts:

- 20–30% of retailers are active

- The rest are invisible, dormant, or competitor-locked

This is why growth looks strong in some belts and flat in others.

Why Distributors Avoid Interior Markets (And Why That’s Logical)

Rural expansion is operationally hard.

From a distributor’s lens:

- Interior retailers mean higher travel cost

- Smaller order sizes

- Slower collections

- More credit risk

So distributors naturally:

- Focus on town markets

- Serve familiar retailers

- Avoid long-tail villages

Again—this is not neglect.

It’s economic self-preservation.

Unless the brand changes the execution model, this behavior will never change.

Why Traditional Rural Sales Teams Burn Out

Many brands believe:

“Rural selling just needs tougher salespeople.”

Reality:

- Travel fatigue

- Poor visit discipline

- Inconsistent data capture

- Relationship-based reporting

Within 12–18 months:

- Attrition rises

- Coverage shrinks

- Managers lose control

You end up with high cost, low visibility, and uneven growth.

The Question Tractor & Agri-Input Leaders Should Ask

Not:

“How do we push more stock into rural markets?”

But:

“Do we actually know where rural opportunity exists?”

Most brands don’t.

They know:

- Distributor billing

- A few large dealers

- Top-performing blocks

They don’t know:

- How many agri retailers exist in a district

- Which villages are never visited

- Where competitors dominate by default

- Which outlets can be activated next season

Without this, rural GTM becomes guesswork.

What Winning Tractor & Agri-Input Brands Do Differently

The brands that scale rural India sustainably do four things differently.

1. They Start with Market Mapping—Not Sales Targets

Instead of pushing numbers, they first map:

- Every relevant agri and tractor retailer

- Every influence point (mechanics, service shops)

- Town + village coverage

This reveals:

- True market size

- Penetration gaps

- Seasonal opportunity clusters

Only then do targets make sense.

2. They Treat Retailers as Growth Units, Not Accounts

Every retailer is profiled for:

- Products sold

- Purchase source

- Farmer footfall

- Brand openness

This allows brands to:

- Identify conversion-ready outlets

- Prioritize visits

- Expand SKU width intelligently

Rural selling becomes planned, not reactive.

3. They Separate Visibility from Selling

This is the biggest shift.

Instead of asking distributors or sales teams to discover markets while selling, winning brands separate the two.

- One layer focuses on coverage, mapping, visibility

- Another focuses on selling and relationships

This reduces fatigue and increases precision.

4. They Use Execution Infrastructure, Not Just People

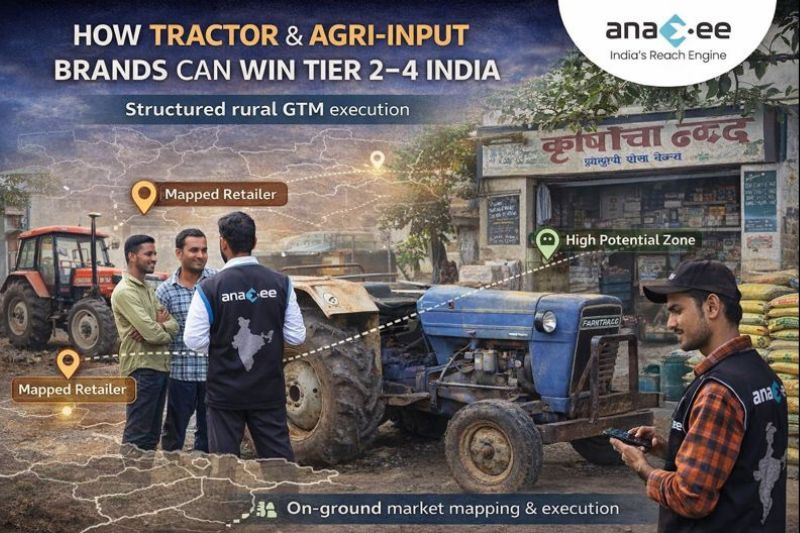

This is where Anaxee fits in.

Anaxee acts as a neutral execution layer between:

- Brand strategy

- Distributor operations

- Rural retail reality

How Anaxee Helps Tractor & Agri-Input Brands Scale Rural India

Anaxee doesn’t replace distributors.

It doesn’t compete with your sales team.

It fixes what neither can do alone: full-market visibility + disciplined execution.

Step 1: District-Level Market Mapping

Anaxee maps:

- Agri-input retailers

- Tractor dealers and sub-dealers

- Peripheral influence outlets

You finally see:

- Where demand exists

- Where competitors dominate

- Where you are absent

Step 2: Retailer Profiling & Opportunity Scoring

Each outlet is profiled for:

- Current brands

- Product categories

- Buying behavior

- Conversion potential

This turns rural chaos into prioritized action.

Step 3: Structured Field Execution via Digital Runners

Anaxee’s Digital Runners:

- Visit mapped outlets regularly

- Collect structured data

- Enable order-taking where applicable

- Reactivate dormant retailers

All activity is tracked.

No anecdotes. No guesswork.

Step 4: Distributor Enablement (Not Pressure)

Distributors receive:

- Clear coverage maps

- Identified white spaces

- Smarter visit planning

Result:

- Lower effort, higher output

- Reduced resistance

- Better rural penetration

What Brands Typically Discover

After 60–90 days, leadership usually realizes:

- “Our rural market is bigger than we thought.”

- “We were over-dependent on town retailers.”

- “Distributors weren’t lazy—we were blind.”

This is where sustainable rural growth begins.

The Bottom Line

Rural India does not reward brute force.

It rewards visibility, discipline, and structure.

Tractor and agri-input brands that win are not the ones with:

- The largest sales teams

- The loudest schemes

They are the ones that:

- See their market clearly

- Execute consistently

- Respect distributor economics

Call to Action

If you’re a tractor or agri-input brand struggling with:

- Uneven rural performance

- Distributor resistance in interior markets

- High field force cost with low visibility

It’s time to change the execution model—not the people.

Write to sales@anaxee.com

Tell us your category and priority states.

We’ll help you see rural India clearly—and scale it profitably.

🔹 FAQs:

1. Why is rural India difficult for tractor and agri-input brands?

Because demand is seasonal, retail is fragmented, and execution depends heavily on local influence rather than brand pull.

2. Do distributors limit rural expansion?

No. Distributors operate within visibility and economics. Lack of mapped opportunity is the real constraint.

3. Why do rural sales teams struggle to scale?

High travel effort, low data visibility, and relationship-based selling reduce efficiency and control.

4. How can brands improve rural penetration without hiring more people?

By using market mapping, retailer profiling, and structured execution systems instead of relying only on sales manpower.

5. How does Anaxee support rural GTM for agri brands?

Anaxee provides market visibility, disciplined field execution, and distributor enablement through technology and Digital Runners.