The Union Budget 2026–27 felt like a crossroads moment for India’s climate story: there are clear signals of industrial-scale decarbonisation — but also reminders that the transition will be politically and technically messy. Below I walk you through the parts that matter for climate and carbon markets, why they’re important, and what project developers, corporates and funders should be watching next.

Quick headline takeaways (so you don’t miss the plot)

- The Budget carves out ₹20,000 crore over the next few years specifically for carbon capture, utilisation and storage (CCUS) in heavy industries — a large, bold industrial signal.

- The government also nudges clean energy manufacturing, battery and storage capacity, and critical raw-material (rare earth) strategies — moves meant to secure supply chains for the low-carbon transition.

- Critics flag that some environment priorities look undercovered (and coal-related allocations still appear significant), prompting debate over balance between growth and green credibility.

The ₹20,000 crore CCUS push — why it matters (and why it’s controversial)

Finance Minister Nirmala Sitharaman put CCUS front-and-centre in the Budget by earmarking about ₹20,000 crore (~US$2.4 billion) to accelerate carbon capture at scale, particularly for heavy emitters such as steel and cement. This is not small change — it’s an explicit industrialisation-of-decarbonisation play.

Why this is a big deal:

- CCUS is often the only technically feasible route for deep, near-term emissions reductions in industries where process emissions (not just fuel combustion) dominate — think blast-furnace steel, clinker in cement, some chemical processes. The Budget’s money is aimed at moving projects from pilots to commercial scale, funding infrastructure, pipelines, and demonstration plants.

- It signals that India sees decarbonisation not just as a renewable-energy story but as an industrial competitiveness story. That’s important for investors and international climate finance because CCUS projects can unlock cross-border financing and technology partnerships.

Why some stakeholders worry:

- CCUS is expensive, energy-intensive and technically complex. Without a clear regulatory framework for transport, storage liability, and long-term monitoring, public money could prop up technologies that never become economically sustainable.

- NGOs and climate campaigners are cautious: focusing public resources on CCUS while coal-related measures get support raises concerns about locking in fossil infrastructure or diverting focus from cheaper renewables+efficiency options.

Bottom line: CCUS funding is a pragmatic, industrial-first choice, but its climate credibility will depend on design — how the money is disbursed, what performance conditions are attached, and whether parallel rules for storage and monitoring are rolled out.

Clean energy, batteries and supply chains — nudges, not a revolution (but meaningful)

The Budget includes stronger allocations for clean energy manufacturing, battery/energy-storage capacity and transmission upgrades. Specialist outlets covering renewables noted an increase in budgetary support to the Ministry of New & Renewable Energy (MNRE), and industry commentary framed the Budget as trying to accelerate manufacturing and storage deployment.

Two practical implications:

- Manufacturing ambitions now have match-funding: expect accelerated incentive windows for domestic cell manufacturing, battery gigafactories, and potential tax or soft-loan support for upstream assembly.

- Transmission and storage get attention: more renewables require more grid flexibility. If the Budget’s money reaches T&D upgrades and storage projects quickly, it will make renewable integration smoother.

This is a continuation of a policy arc — from production-linked incentives to capacity building — but it’s not an overnight fix for supply-chain bottlenecks (cell chemicals, processed cathode materials, etc.). The rare-earth corridors announced in the Budget are another attempt at domestic security for critical inputs to EVs and renewables manufacturing.

Electric vehicles (EVs), mobility and freight: modest wins, big expectations

The Budget contains measures relevant to vehicle manufacturing and supporting industries (tyres, batteries, EV components). Automotive analysts are reading the Budget as constructive for EV manufacturing and localization, though direct large-scale consumer subsidies weren’t the highlight. Instead, the focus is on making domestic industry competitive — local value chains, battery production, and charging infrastructure improvements.

For corporates and project developers:

- Expect procurement opportunities around charging infrastructure, grid upgrades, battery repurposing and recycling.

- Fleet electrification incentives may come through state-level policy and public procurement nudges rather than direct central cashbacks.

Carbon markets, credits and regulation — what the Budget says (and what it doesn’t)

Surprisingly, the Budget itself doesn’t launch a detailed roadmap for an organised domestic carbon trading market (CCTS or otherwise) in a way that ties the ₹20,000 crore CCUS roadmap into a price signal for avoided/removed CO₂. The Budget’s industrial decarbonisation focus will, however, change market dynamics:

- More CCUS spend could create a future supply of verified carbon removals if projects are paired with robust MRV (measurement, reporting, verification) and long-term storage guarantees.

- But absent a clear domestic carbon price or lifecycle rules for credits, most early project economics will still depend on voluntary demand or exportable credits, and on project developers demonstrating permanence and additionality to international buyers.

So: money is being allocated to technology, but carbon market architecture still needs rulebooks: registry rules, permanence protocols, co-benefit tracking, and legal clarity on storage rights.

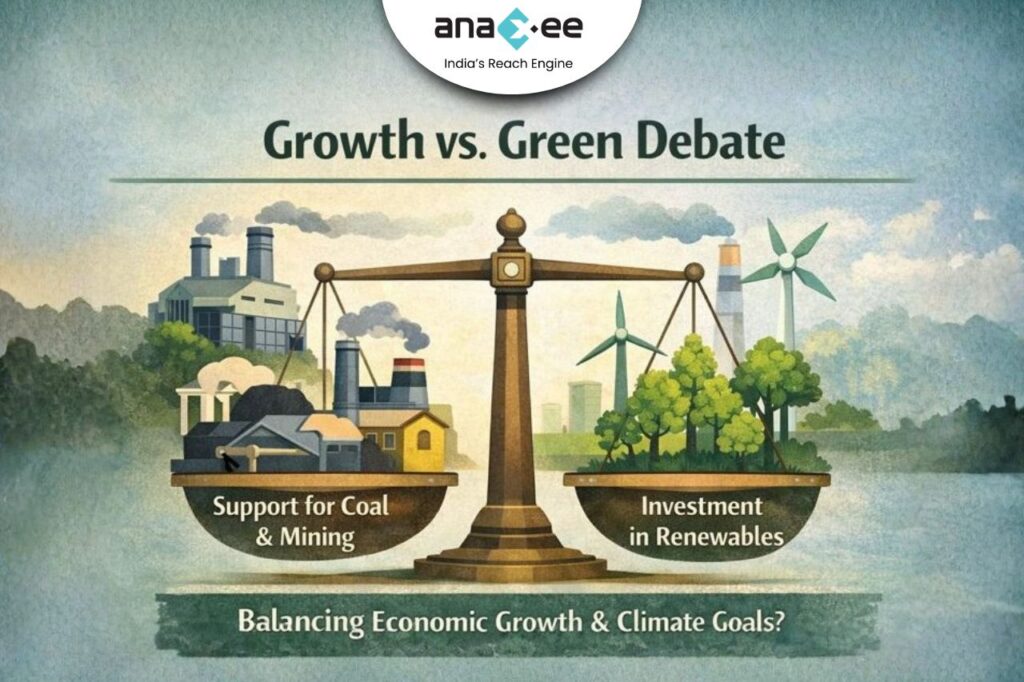

Green vs growth: the political economy angle

Several commentators (policy think-tanks and civil-society media) pointed out an uneasy balance: the Budget signals green tech and energy security, and continues to support fossil-fuel adjacent pathways (coal gasification pockets, large allocations to mining/coal ministries). That tension is political reality: India wants growth and jobs while keeping climate commitments on track.

For funders and climate strategists, this means:

- Private capital will be essential to convert Budgetary signals into emission cuts — public funds can de-risk early stage or first-of-a-kind deployments, but scaling needs bankable revenue streams.

- Projects that can show job creation, local manufacturing benefits, and near-term emission reduction are likeliest to attract blended public-private finance.

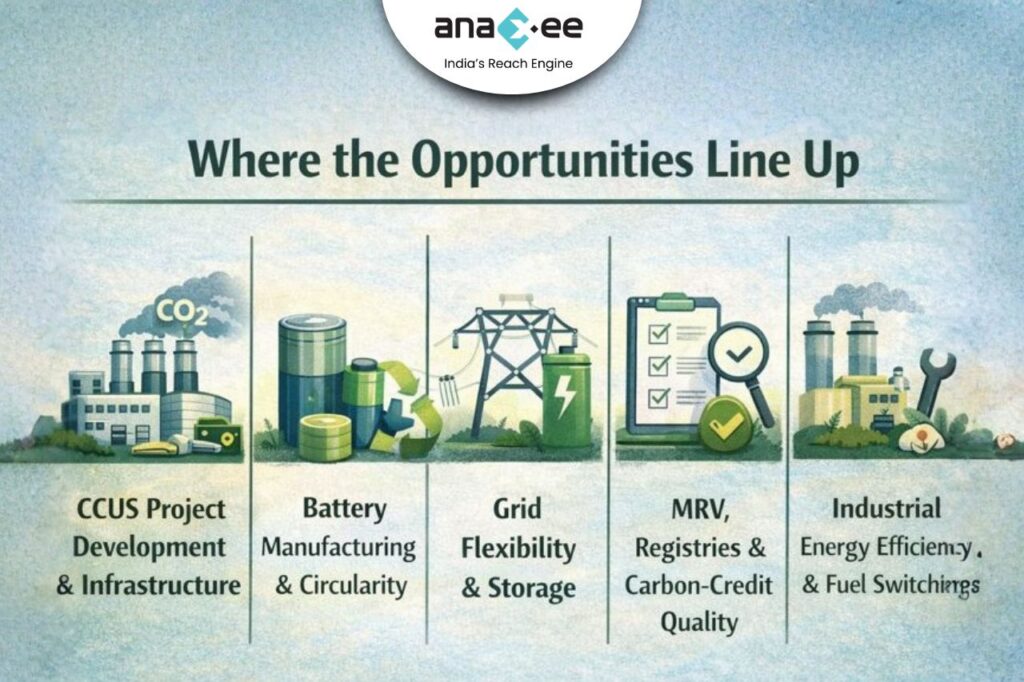

Where the opportunities line up

If you’re building projects, pitching investors, or advising corporates, consider these priority plays:

- CCUS project development & infrastructure: supply chain for capture units, CO₂ transport and pipeline planning, storage-site characterisation, and long-term monitoring services. The Budget makes this a priority area.

- Battery manufacturing and circularity: upstream cell manufacturing, second-life battery business models and recycling — policy support is being signalled.

- Grid flexibility and storage: grid-scale and behind-the-meter storage, virtual power plants (VPPs), and T&D upgrades to accommodate more renewables.

- Industrial energy efficiency & fuel switching: energy audits, electrification of process heat where possible, and hybrid solutions that pair renewables with industrial loads.

- MRV, registries and carbon-credit quality: services that can credibly measure and verify removals (especially for CCUS) will be valuable if India wants exports or a domestic market of trustable credits.

Risks and what could trip projects up

- Policy detail lag: allocations are announcements; the rules that unlock funds (eligibility, co-funding, procurement rules) will determine who benefits. Watch PIB and ministry notifications.

- Technical & financial risk: CCUS projects need long-term offtake or revenue stacking — without carbon prices or durable subsidies they’re risky.

- Environmental justice & social license: large industrial projects need early stakeholder engagement to avoid delays and reputational risks.

A few practical recommendations (for developers and corporate procurement teams)

- Map the Budget announcements onto project timelines: identify which parts of your pipeline could qualify for CCUS or manufacturing support and prepare technical dossiers now.

- Partner across the value chain: steel/cement firms, logistics owners, storage-right holders and financiers must co-design bids.

- Invest in MRV capacity now: credible monitoring, permanence guarantees and measurement tech are de-risking assets for buyers.

- Build blended finance cases: combine public de-risking with concessional debt and commercial equity to make first-of-a-kind projects bankable.

- Follow the rulemaking: Ministry-level notifications (MNRE, MoEFCC, Ministry of Petroleum & Natural Gas, and PIB releases) will contain the eligibility criteria — those details decide winners.

Final read: is the Budget pro-climate?

It’s a mixed verdict. The Budget is pragmatic: it funds industrial decarbonisation tools (CCUS, battery and manufacturing pushes) and strengthens supply-chain security. But it’s not a full-throated green pivot — coal-linked support and a lack of immediate carbon-pricing detail mean the outcome depends on rule design and implementation. In other words: the Budget opens the door, but the next 6–12 months of policy design, tender rules and financing decisions will determine whether India’s climate ambitions translate into emissions cuts or simply into technological experiments.

About Anaxee:

Anaxee is building the Climate infrastructure platform that helps Carbon Project developers and Climate investors maintain continuity of their project over its lifetime. From field data to verified credits. They believe the future of carbon projects lies in trust, transparency, and technology working together.

Anaxee Digital Runners helps in implementation of large-scale, country-wide, climate and Carbon Credit projects across India. Anaxee focuses on Nature-Based Solutions (NbS) and community-driven interventions, including agroforestry, regenerative agriculture, improved cookstoves, solar devices, and clean water systems.

Anaxee’s “Tech for Climate” infrastructure integrates a tech-enabled, feet-on-street network with digital MRV (Measurement, Reporting, and Verification) systems to ensure transparency and real-time validation for every carbon project. By combining data intelligence with local execution, Anaxee enables corporates, investors, and verifiers to trust the integrity, additionality, and traceability of each carbon credit. This approach bridges the gap between communities and global carbon markets, advancing scalable and verifiable climate action across India.