Most automotive brands don’t fail because of weak products.

They fail because their Go-To-Market models were never designed for India’s retail reality.

On paper, the structure looks solid:

- National sales team

- Regional managers

- Distributors

- Retailers

In reality, this model collapses the moment you move beyond the top 20–30 cities.

Tyres, lubricants, and batteries feel this failure more than most categories—because these are retailer- and mechanic-controlled markets, not brand-controlled ones.

The Assumption That Breaks Everything

Traditional GTM models are built on one flawed assumption:

“If distributors are appointed and sales teams are in place, execution will follow.”

Execution does not follow.

It fragments.

And the further you go from metros, the wider that gap becomes.

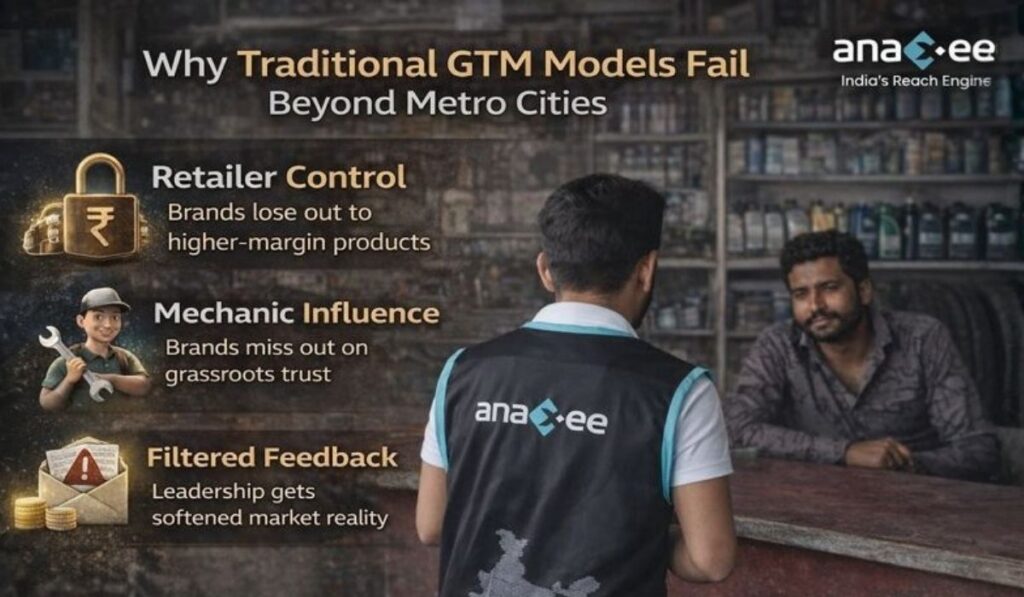

Problem 1: Retailers Don’t Owe You Loyalty

In Tier 2, 3, and 4 markets:

- Retailers are margin managers, not brand custodians

- They stock what moves, not what markets well

- They recommend what reduces friction, not what sounds premium

For tyre and battery brands especially:

- One bad claim experience kills repeat recommendation

- One supply gap pushes retailers to alternatives

Traditional GTM treats retailers as endpoints.

In reality, they are decision-makers with veto power.

Problem 2: Mechanic Influence Is Underestimated—and Poorly Managed

Lubricant and tyre consumption is heavily mechanic-led.

Yet most GTM strategies:

- Run national mechanic schemes

- Push generic loyalty programs

- Track enrollment, not behavior

What they miss:

- Mechanics don’t switch brands for points

- They switch for reliability, relationships, and trust

Without local presence, brands never learn:

- Why a scheme underperformed

- Why trial didn’t convert to habit

- Why incentives leaked

This is not a marketing failure.

It’s a feedback failure.

Problem 3: Distributors Become Information Filters

Distributors are critical—but they are also businesses with their own incentives.

Common issues:

- Ground issues are softened before reaching the brand

- Retailer resistance is framed as “market conditions”

- Scheme failures are blamed on execution, not design

As brands scale, leadership loses direct market visibility.

Reports look clean.

Reality isn’t.

Problem 4: Sales Teams Are Spread Too Thin

Area and regional sales managers are expected to:

- Drive numbers

- Handle distributor conflicts

- Support retailers

- Collect market intelligence

This is structurally impossible at scale.

So what happens?

- Visits become transactional

- Intelligence becomes anecdotal

- Follow-ups get delayed

Traditional GTM assumes human bandwidth scales linearly.

It doesn’t.

Why These Failures Multiply Beyond Metro Cities

In metros:

- Brand pull compensates for execution gaps

- Distributor density hides inefficiencies

Beyond metros:

- Retailers demand proof, not promises

- Brands compete on execution, not advertising

- One unresolved issue travels fast by word-of-mouth

This is where most GTM models quietly break.

The Real Issue: GTM Is Treated as a Structure, Not a System

Most brands think GTM means:

- Appoint distributor

- Deploy sales team

- Run schemes

But GTM is actually a system of continuous execution:

- Who shows up locally

- How often

- With what authority

- And with what verification

Without this system, scale creates blindness.

What a Modern Automotive GTM Model Needs

For tyre, lubricant, and battery brands, modern GTM requires:

1. Persistent Local Presence

Not campaigns.

Not quarterly visits.

Ongoing presence.

Someone who:

- Knows retailers by name

- Understands local objections

- Flags issues before they escalate

2. Independent Market Intelligence

Data that doesn’t pass through:

- Distributor filters

- Sales bias

Ground truth needs separate collection and verification.

3. Execution + Verification Together

If execution and reporting are separate, manipulation creeps in.

Modern GTM demands:

- Geo-tagged proof

- Time-stamped activity

- Standardized workflows

4. Scalable, Repeatable Playbooks

What works in one district must:

- Be documented

- Be measurable

- Be replicable

Otherwise growth remains accidental.

Where Anaxee Fits Into This Gap

Anaxee doesn’t replace distributors.

It doesn’t replace sales teams.

It fills the structural gap traditional GTM leaves open.

By deploying:

- Distributed local presence

- Standardized execution workflows

- Verified market intelligence

Anaxee turns GTM from a hierarchy into a system.

For automotive brands, this means:

- Fewer blind spots

- Faster correction cycles

- Better use of sales bandwidth

The Uncomfortable Truth for Leadership Teams

If your brand depends entirely on:

- Distributor reports

- Monthly sales calls

- National schemes

You don’t have GTM control.

You have GTM hope.

Hope doesn’t scale.

Closing Thought

Tyre, lubricant, and battery markets in India don’t reward ambition.

They reward execution density.

Traditional GTM models weren’t built for that reality.

New systems are.

CTA

If you’re rethinking how GTM should actually work beyond metro cities—and want to understand what’s breaking before throwing more money at schemes—

write to sales@anaxee.com.